Asset managers have flagged a number of concerns around the anti-greenwashing rule that is due to be implemented tomorrow (31 May) including how to apply the requirements to all communications and assessing greenwashing risk when there is no single definition of ‘sustainability’.

In the report UK SDR and Investment Labels by the UK Sustainable Investment and Finance Association (UKSIF) and PwC, UKSIF members were interviewed around the implementation of the Financial Conduct Authority (FCA)’s Sustainable Disclosure Requirements (SDR), with the first implementation deadline imminent for the anti-greenwashing rule, and the fund labelling being adopted from 31 July 2024.

Firms flagged challenges around applying the anti-greenwashing rule in a short space of time – the finalised guidance was only published on 23 April 2024 – and increasing regulatory divergence around fund labelling and definitions of ‘sustainability’.

See also: UKSIF and IA publish guidance for SDR consumer-facing disclosures

Anti-greenwashing

Even though the anti-greenwashing rule is viewed as an extension of existing practices at most asset manager firms, concerns remain around how to apply this to all communications.

“Communications is a very broad term covering a wide range of areas, including statements, strategies, targets, policies, annual reports, marketing and images,” the report said. “Some firms will not have processes in place for examining such a wide range of mediums and ensuring ongoing compliance, which could require oversight across several different parts of the business.”

The report encouraged firms to look at how products’ sustainability approaches are communicated internally to relevant teams, especially marketing and sales teams, and ensure colleagues are aware of the FCA’s expectations under the new rule. Similarly, they must be prepared to continue to examine the language used across a wide range of areas and mediums.

“During the interviews conducted, several firms noted work they are undertaking to develop guidelines on how to prepare communications and training on this to be rolled out to relevant teams, including sales teams, within the firm. Developing guidelines and training could help foster a consistent and compliant approach throughout the firm, helping to mitigate the risk of greenwashing.”

Further, asset managers said they were grappling with the FCA’s decision to not to provide a specific list of terms covered by the rule and, even though the regulator acknowledges in its anti-greenwashing guidance, there is no single definition of ‘sustainability’ or broader international consensus on how ‘sustainability’ should be defined.

The report said: “The principles-based approach adopted by the FCA, combined with the lack of broader consensus on defining greenwashing, may pose a challenge for firms. As a result, firms may have to revisit or create and apply their own frameworks and definitions to identify potential greenwashing risks. Firms will also face the ongoing challenge of potentially having to update the framework to reflect evolving industry and regulator consensus in this area, and shifting client views.”

UKSIF and PwC said firms should develop a taxonomy of terms and guidance on how terms should be used that is applied internally to identify potential greenwashing. These should link to product classification frameworks to ensure the taxonomy is consistent with the sustainability labelling criteria and new naming and marketing rules.

Increasing regional divergence

Firms flagged the interoperability challenges amid “international regulatory divergence” on labels and anti-greenwashing given that in addition to the UK’s SDR, asset managers are responding to Sustainable Finance Disclosure Regulation (SFDR) and potential changes to EU rules.

For example, the proposed naming guidelines recently released by the European Securities and Markets Authority (ESMA) suggest an 80% threshold for sustainable assets within sustainably marketed funds compared to the 70% threshold requirement in the UK. Further, the classification system in the EU’s SFDR does not map onto the UK sustainability labels, eg EU SFDR Article 8 products with only sustainability characteristics would not necessarily qualify for a SDR label. Also, UK rules allow unlabelled products to use certain sustainability-related terms in their name and/or marketing if they meet specified conditions, whereas this is not the case in the EU.

“This means that some products straddling both regimes and UK funds with European mirror funds that are currently marketed as sustainable will not qualify, requiring significant changes to either their marketing or investment strategy,” the report said.

The report suggested asset managers create a firm-wide product classiticaion framework to manage the complexity within the SDR package as well as international regulatory fragmentation, while also upskilling distribution teams to communicate labels and stepping up engagement with product distributors on this topic.

Selecting the right label

In terms of fund labelling, the report found some concerns around how unlabelled funds will be interpreted by clients, and flagged there will also be cases where more than one label will apply, adding additional complexity to internal assessments.

For example, the ‘Sustainability Mixed Goals’ label was introduced in response to consultation feedback to capture funds that invest across different sustainability objectives and strategies. For example there potential for label to be used for a fund holding a mix of ‘Sustainability Focus’ and ‘Sustainability Improver’ assets.

SDR fund labels

“Firms should consider these issues when determining what labels to apply, though this will be difficult in the first year without further clarity from the FCA and industry practice.”

Interviewees also flagged concerns the ‘Improvers’ label poses potentially heightened greenwashing risks as the net of investable assets is wide and ‘improvements’ may not be realised for a number of years.

Firms will also need to decide to do with the label once targeted improvements have been realised. The report said they could sell the assets, meaning that investors would not benefit from the improvements, introduce fresh targets and continue to improve assets in line with these or re-label the fund as either ‘Focus’ or ‘Mixed Goals.’

“While a number of asset managers we spoke to indicated they would prefer the third option, it is not clear what the regulator intended or expects as the FCA has not issued any specific guidance on this issue,” the report said.

Threshold clarity

To qualify for any of the labels, 70% of the gross value of a product’s assets must be invested in accordance with the sustainability objective, and those assets must be selected with reference to a “robust, evidence-based” standard that has been independently assessed

However, firms are grappling with what qualifies as being sufficiently “robust and evidence-based”. They also query how the threshold should apply to certain types of funds and asset classes, particularly for funds-of-funds – those interviewed were still unclear on whether the 70% threshold should be applied to investee funds’ holdings

Offering its advice, UKSIF and PwC said asset managers should, where possible, take advantage of the flexibility afforded by the FCA around the 70% threshold guidance to ensure alignment with their product’s sustainability objectives. It recommended investment processes should be adapted so that investments can be tracked against the standard selected for the fund, and then monitored against robust KPIs, and encouraged active engagement with their data provider.

Roadmap

UKSIF and PwC issued 10 recommendations for firms to prepare for the SDR rules including a roadmap to structure their efforts. As well as the guidance issued above specific to anti-greenwashing, fund labelling and the threshold, the recommendations including aligning reporting cycles with TCFD reporting, streamlining data collection and focusing sustainability reporting on what is more relevant and material to the business and clients.

James Alexander, CEO at UKSIF, commented: “We are committed to supporting our members to take full advantage of the opportunities of the FCA’s SDR and help guide them through this first crucial year of implementation. This regulation can empower our members to better demonstrate and evidence their sustainable investment approaches and strategies in an environment where consumers are increasingly looking to put their money into funds that more closely align with their values. Working with our members, we want to ensure that consumers can access clear and consistent information on the sustainability characteristics of financial products.

“While the SDR fund labels are not mandatory, they aim to encourage more consistent disclosure between firms, improve product comparability for retail investors and, in turn, allow consumers to make more informed choices when it comes to sustainable investments.”

David Croker, partner at PwC UK, added: “The FCA’s SDR package represents a significant development in the UK’s sustainable finance regulatory framework, bringing with it wide-ranging impacts on the asset management sector. It will shape how UK asset managers develop sustainable investment products, ensure that sustainability- related claims stand up to scrutiny, and report on the sustainability credentials of their investments.

“As asset managers continue to grapple with evolving sustainable finance regulation globally, it will be important for them to take a strategic view of the SDR package to help manage challenges around interoperability. This means implementing changes to their product governance and sustainability reporting in a way that reflects their broader firm-wide strategy on sustainability, helping to preserve and create value for their organisation alongside regulatory compliance.”

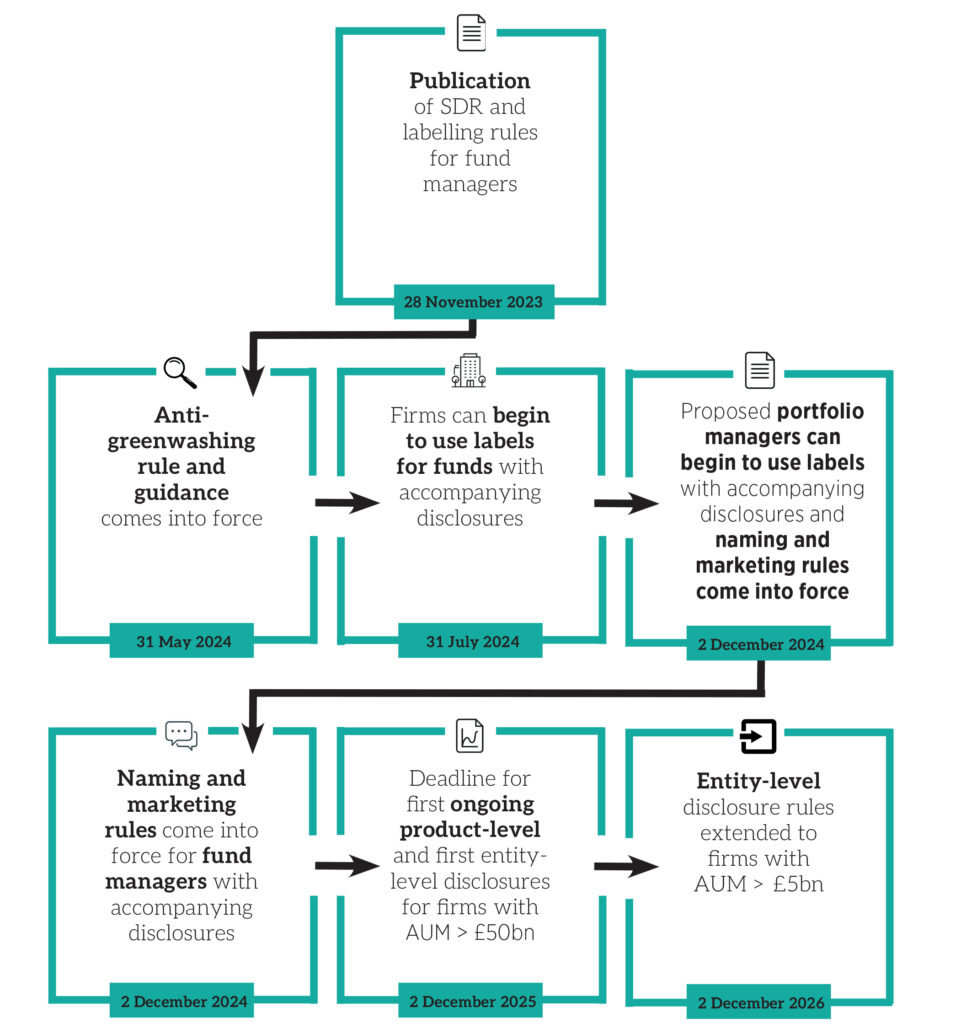

SDR implementation timeline

This story originated on our sister title, PA Future.