It’s been a year since Aberdeen Standard Investments UK equity income duo Tom Moore and Charles Luke replaced fallen star fund manager Neil Woodford on the Income Focus Fund.

When Woodford’s youngest fund suspended on 16 October 2019 its future was far from certain. The day before, authorised corporate director Link confirmed it would be winding up the Woodford Equity Income Fund, and Woodford himself announced he would be shutting his Henley on-Thames funds empire for good.

After a competitive bidding process, with Blackrock, Schroders and Jupiter rumoured to be in the running, Moore and Luke emerged victorious.

When the pair first laid eyes on the portfolio in January 2020 what they found was a far cry from a traditional UK equity income fund. Among the portfolio’s biggest issues was its over-exposure to British housebuilders, with Woodford ploughing 30% into the sector. It was also filled with highly illiquid holdings. “There were companies we wouldn’t have owned, certainly,” says Luke (pictured), “and it wasn’t a diversified portfolio”.

Income focus and risk management are now ‘front and centre’

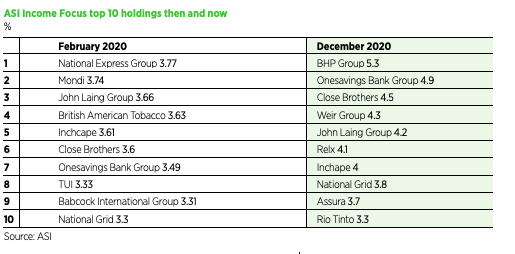

By the time the fund re-opened on 13 February 2020, almost all the existing holdings had been kicked to the curb. Gone were sub-prime lenders Provident Financial and Morses Club, and housebuilders Barratt Developments and Taylor Wimpey that dominated the top 10 holdings, replaced by Mondi, John Laing Group and National Grid.

Luke and Moore kept six legacy Woodford holdings, including defence contractor Babcock, British American Tobacco and housebuilders Bellway and Vistry. Two illiquid holdings – Purplebricks and Safe Harbour Holdings – were also kept due to the fact they could not be sold at an appropriate price but have since been divested.

The pair would not reveal the total cost of selling down the existing holdings. “We didn’t want to go into this feeling we’d inherited positions in which we didn’t have any strong conviction,” Moore (pictured left) explains.

Under Income Focus’s new guise, Moore and Luke have tried to distance themselves from Woodford by bringing liquidity and risk management to the forefront. Their concentrated portfolio of 30 holdings is entirely made up of highly liquid names in the FTSE 350 and they do not own more than 5% in any one stock.

They have also shunned the ‘star manager’ approach in favour of one that is team-based, drawing on ASI’s sizeable desk of analysts to help generate their ‘best ideas’.

See also: ASI duo throws shade at Woodford as revamped holdings revealed

“Income focus is now front and centre, the risk management is front and centre, but also the idea generation is coming, thick and fast,” Moore says. The portfolio is also much better diversified. Three-quarters of Woodford’s portfolio was held in housebuilders, financials (35.7%) and industrials (10.2%), with slivers of exposure in consumer services, healthcare and telecoms.

By contrast Moore and Luke have 4.5% in oil and gas, 10.5% in basic materials, 16% in industrials, 12% in consumer goods, 9% in healthcare, 4% in consumer services, 8% in utilities and 1% in telecom stocks. Around 32% is held in financials, but this exposure is also more diversified than Woodford’s, with 6.3% in banks, 4% in insurance, 5.3% in real estate and 16% in the “eclectic” financial services sector.

“Those are heavy weightings,” Moore admits, “but we are aware of the risk characteristics of the individual stocks and how that plays within the aggregate portfolio.”

And then the coronavirus hit

Weeks after officially taking the reins the duo’s best laid plans went awry as the coronavirus crisis took hold and sent financial markets into a tailspin.

“When we were setting up the portfolio, we were not expecting the worst global pandemic in living memory,” says Moore. “We had selected stocks we felt were well positioned in a more normal environment.”

Bets on travel and leisure companies such as Tui and National Express proved punishing, with the latter plummeting an eye-watering 80% in the month-long selloff , while holdings in Babcock and Cineworld also hurt performance.

See also: ASI Income Focus sheds 30% of its assets a year on from Woodford after Covid beat down

But in the final quarter, as markets grew hopeful off the back of global vaccine rollouts, the pair were able to turn performance around. Their financial plays in Onesavings, Close Brothers and Standard Chartered bounced back strongly, benefiting from rising bond yield expectations and low level of impairments. Miners Rio Tinto and BHP were also strong performers, as were industrial holdings Weir Group, DS Smith and Bodycote as PMI indices climbed.

Ironically, two housebuilding stocks inherited from Woodford, Vistry and Bellway, were among the pair’s strongest-performing stocks in the final quarter, with the former up 65% and the latter 25%.

Despite this, returns for the year remain negative, with the fund losing 20.4%, double the IA UK Equity Income sector’s 10.7% losses.

“We’re very aware clients have experienced significant underperformance under the previous manager, and the first year under our tenure was affected by Covid-19,” says Moore. “But you can see from the past three months that things are turning.”

Positioning for a cyclical recovery

Though 2020 has been one of the most taxing years on record for the UK Equity Income sector, with UK dividends plunging 44% to £61.9bn, Moore and Luke are hopeful for the year ahead.

Most of Income Focus’s holdings that suspended their dividends have reinstated them, including Close Brothers, Mondi and Bodycote. “The ones that haven’t we expect to do so in the next six months or so,” says Luke.

Link cut the yield target on Income Focus from 7.5% before handing the fund off to the ASI duo. The fund now targets a yield higher than the FTSE All-Share average over a three-year rolling period.

“Clearly, we want to deliver a high level of income,” Moore says. “The indicated dividend yield is currently over 4.5%, which is attractive. On top of that we would seek to be growing the dividends in the single digits. It may be that if the environment is benign, we grow faster.”

Moore believes the UK’s relative cheapness, clarity on Brexit and the speed of the vaccine rollout could transform the region’s economic prospects.

This optimism is reflected within the fund’s current top 10 holdings, which Moore says contains a “nice balance” of cyclical stocks that will benefit from an improving economy, as well as “resilient income stocks” such as National Grid, which could see their “dividend yields compressed quite meaningfully”.

“There’s a feeling that what was a very tough year last year, both for UK equities and the broader sector, could turn into something very different in 2021,” Moore muses. “By mid-February, the elderly will have received at least one dose of the vaccine. It’s quite possible that lockdowns will ease and there will be quite a lot of pent-up demand at that point.”

This article first appeared in the February 2021 issue of Portfolio Adviser magazine. Read more here.