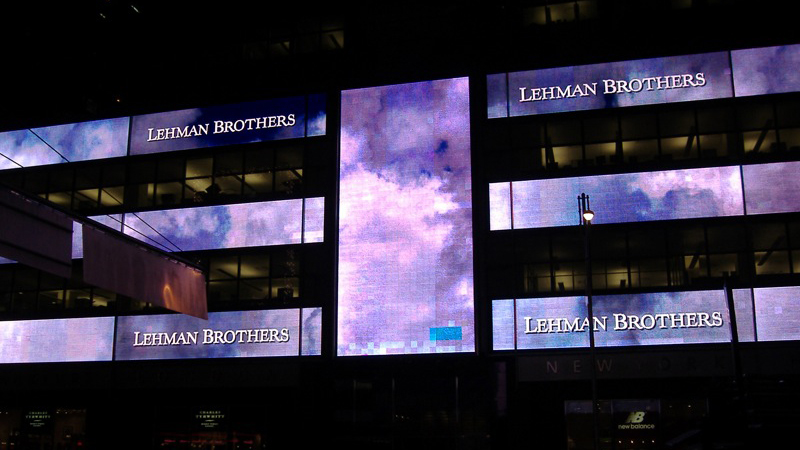

Last week marked the 15th anniversary of the Lehman Brothers bankruptcy, the flashpoint moment of the global financial crisis. It ushered in an era of super-low interest rates and reshaped the economic landscape. Interest rates were 5% going into the crisis and have just hit 5% now, having dipped to near-zero in between. Is this the end of the post-Lehman era?

Lehman Brothers filed for Chapter 11 bankruptcy protection in the US on 15 September 2008. It was a seminal moment, demonstrating that governments and central banks would not prop up the banking sector indefinitely. It prompted a slump in banking shares across the world. To avoid a full-scale financial crisis, the UK central bank dropped rates from 5% to 0.5% over the next six months, along with the majority of other central banks around the world.

See also: Is an equity-bond market correlation ‘the new normal’?

The consequences of this drop in rates were significant. For equity markets, it led to the dominance of growth stocks. With interest rates and government bond yields are at or near zero, a company’s future potential profits became highly valued. Analysis by Schroders shows that the “Super-7” US stocks now make up more of the global equity index (MSCI ACWI) than the whole stockmarkets of Japan, the UK, China and France combined.

Other assets also benefitted. Schroders research also shows the impact of cheap debt on property prices. The average house in the UK now costs around eight times average earnings: “Looking at 178 years of data, we can see that – before recently – the last time house prices were this expensive relative to average earnings was in the year 1883, 140 years ago.”

Another consequence has been the rise of private equity. The declining popularity of stockmarkets as a way for companies to raise capital is a global trend, but it is particularly notable in the UK. “In 1996 there were over 2,700 companies on the main market of the London Stock Exchange. By the end of 2022 this had collapsed to 1,100 – a 60% reduction,” says Schroders. Private equity has grown from a $500-600bn industry in the early 2000s to be worth more than $7.5trn in 2022.

At the same time, the risks in the financial system have changed profoundly. Doug Abbott, head of UK wealth, client group at Schroders, says: “Governments have also supported economies and markets through quantitative easing, which was unheard of. The scale of that even when it was introduced; even then, they would never have imaged how that would go. Those have been the drivers that have affected a lot of things around asset classes and markets. It’s driven up wealth for people who have owned assets.”

Government leverage

Leverage has moved from the corporate sector to global governments. Government debt-to-GDP ratio for the Advanced G20 nations reached more than 130% in 2020, according to the IMF, an increase of over 20 percentage points when compared to pre-pandemic levels in 2019. Individuals have come to rely on governments to do more and more.

It is tempting to believe that this will simply reverse as interest rates rise. Abbott says: “If we’re back at 5%, what does it mean for companies, markets, people’s money in their pockets? Think about everything that’s happened in the last fifteen years, think about the total opposite happening and what that might mean.” Will technology fall, private equity collapse, governments pull in their horns and pay down debt?

See also: Soft landing or soft economy – what do rising bond yields signal?

The reality is more nuanced. Certainly, yields on government debt have already started to rise, making higher levels of government borrowing unsustainable. The findings of Robeco’s research ‘Expected Returns 2024-2028: ‘Triple Power Play’ suggests yields may have further to go to reach ‘normal’ levels. Laurens Swinkels, head of quant strategy, sustainable multi-asset solutions at Robeco says: “Yields on German government bonds should be in equilibrium at 4%. They have increased a lot, but are still not at 4%. They may be well ahead of the 10-year average, but could go higher.” Yield curves are still inverted, suggesting, he says, “government bonds are cheaper but not cheap”.

Equally, it is difficult to see a reversal in high government debt levels. Abbott says: “Global government debt sits there as a headwind. Governments are more hamstrung and it’s harder for them to invest, it’s harder to support people, particularly in the developed world. How do you address this? You can either focus on growth, aim to bring down that debt ratio, and improve your fiscal position, or you have to soldier on – do you raise taxes, try to become more efficient? You’re likely to see a combination of these things, including the use of technology, taxation versus growth. If the cost of debt is going up, that will be a challenge for governments too.” However, it will be a slow process.

In equity markets, however, it is possible that the next period will mirror to the previous period. Robeco has looked at the implied equity premium in markets – how much equities will perform over bonds. Looking at developed markets, it found that the expected return on equities relative to bonds has decreased significantly and is now below its long-term average. The real culprit is US markets, where valuations have moved higher and higher.

In contrast, emerging markets look compelling value compared to their long-run equity premium after a difficult decade. Swinkels says: “For emerging markets, the implied equity premium is still quite high. Emerging markets are now at a 30% discount to developed markets.”

Any outperformance from emerging markets may be exacerbated by their lower debt burdens and improving productivity. In contrast, high debt is likely to hold back developed market economies, particularly as interest rates rise. Swinkels says: “We see the end of monetary leniency – central banks will have a laser-like focus on containing inflation. They could lock horns with fiscal authorities that want to pursue a more expansionary policy.”

There are other factors that are likely to influence markets this time round. Environmental, social and governance factors are not yet priced in fully into markets, says Swinkels, but they will be over the next few years. Artificial intelligence could also play a role, with companies that build efficiencies through the early adoption of natural language processing likely to build productivity ahead of their peers. There are also geopolitical risks that are likely to weigh on markets, which may accelerate deglobalisation.

Abbott says: “Looking forward, you’re going to have a different type of regime. We think it’s going to be shaped by big themes such as demographics, deglobalisation, decarbonisation – all of which point to a more deflationary environment. People need to be thinking about their portfolios in a way that help them navigate that.”

It is the end of the post-Lehman Brothers era, but the new regime will not simply be a reversal, but something new altogether.