Investment grade is being touted as the safe haven asset for 2020 as government bonds continue to deliver negative yields, but fund selectors still see sovereigns as playing a key security role in portfolios.

Columbia Threadneedle deputy global head of fixed income Gene Tannuzzo describes government bonds as a “central bank policy tool” yielding next to nothing, which has left investors scrabbling to find assets with stable, high-quality cashflows.

Speaking at a 2020 outlook event, Tannuzzo said: “A critical piece of what we’re looking for in 2020 is the asset where the cashflow is stable enough that we have confidence it will be there through a cyclical downturn. That may not be a government bond anymore, that may now be an investment grade bond and may even be a less cyclical triple-B rated security that can provide that safe haven.”

Tannuzzo believes the answer lies in less cyclical areas of the investment grade space particularly in Europe, including some of the large telecom companies and even UK utilities.

“If we look at the regulated issuers there, we feel very good about the stability of those cashflows. Particularly in an environment where eurozone corporate bonds are being purchased by the ECB directly.”

Improving high yield outlook

Tanuzzo says aggregate credit risk has dropped for the Columbia Threadneedle Credit Opportunities fund, but while cautious on high yield, he is not overlooking the asset class altogether. This is because an increasing number of double-B rated companies have started to make improvements to their balance sheet.

“If they can get that triple-B minus rating from S&P or Moody’s, all of a sudden the ECB can start buying those bonds,” he says. “Those ‘rising stars’ from high yield to investment grade are still outpacing the downgrades into high yield from investment grade, and we try to be positioned for that to.”

The Columbia Strategic Income fund has 24% exposure to triple-B credit and 13.8% to double-B.

Columbia Threadneedle multi-asset fund manager Maya Bhandari says the team is using credit as a protection or “anchoring” asset for the multi-asset portfolios.

“I suppose the nice thing about a bond is you’re showing what you’re being paid, but with yields as low as they are, you’re not being paid a huge amount for diversification. So, in the UK for example, in short dated corporate bonds are something that we use to diversify.”

Fixed income demand wanes

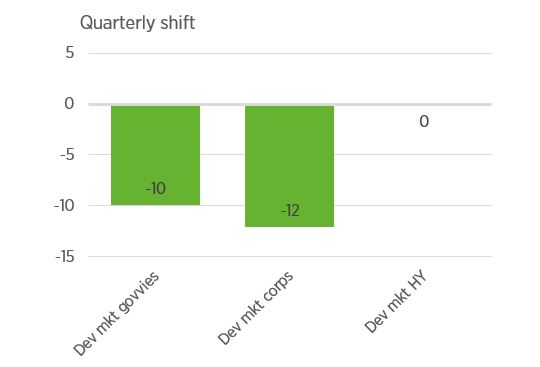

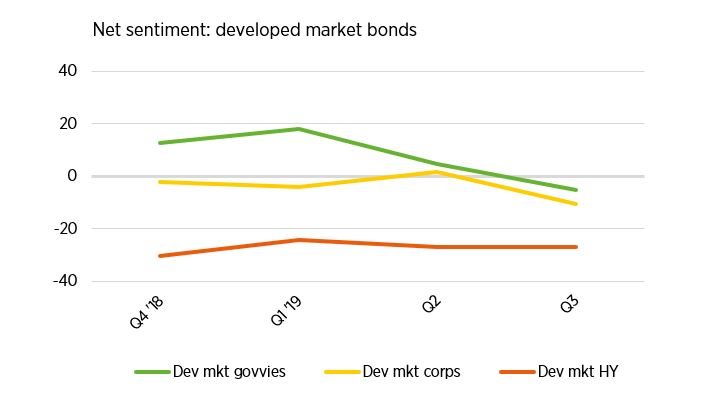

Last Word Research has found demand among UK fund selectors for fixed interest assets waning between Q2 and Q3 this year. For government bonds, net demand – buyers minus sellers – dropped 10 percentage points between the two quarters, from a net 5% to -5%. Developed market corporate bonds meanwhile suffered a 13 percentage point drop, from 2% to -11%.

Appetite for developed market high yield among UK fund selectors has been low for some time. In Q3 a net -27% of investors were looking to increase exposure to high yield, which remained unchanged from Q2.

Fundamental bond mechanics still apply

Octopus Investments senior investment analyst Tom Buffham believes government bonds remain a safe haven despite the negative headline yield. He notes investment grade and high yield while thought of as delivering a risk premium, can be vulnerable to falling yields in times of stress – in both cyclical and non-cyclical sectors.

“In a crisis, investors will perceive risk to have risen and demand a greater yield premium,” he says. “Companies operating in cyclical sectors are likely to be more effected in a slowdown, but history has shown investors make similar demands of companies operating in non-cyclical sectors, and often by enough to deliver negative total returns in those periods.”

He says the defensive component of these bonds remains the duration component which can be accessed more purely through a government bond. “Negative yields haven’t changed these fundamental bond mechanics,” he adds.

Buffham says it’s important to note that from a hedging sterling investor’s perspective, there are no negative yields.

“For example, currency hedging from euros into sterling boosts the yield on the 10-year German bund from -0.36% to 0.89%, higher than that of the equivalent UK gilt which yields 0.67%,” he adds. “This positive carry, combined with a negative correlation with equity risk, keeps government bonds as the attractive portfolio hedge in our eyes.”

Aggregate exposure covers all eventualities

Canaccord Genuity Wealth Management head of model portfolio service and passives Jordan Sriharan (pictured) says over the short term, looking to 2020 for example, government bonds are under pressure given low yields, but over a longer horizon they are still a safe haven.

“In the longer term, five years, 10 years, I still think high-credit-quality government bonds from developed markets with a double-A, triple-A rating will act as a safe haven,” he says. “Sovereign cashflows are backed by taxation and tax paid by the electorate in that particular country and in the US, Europe, Japan and UK it’s still stable.”

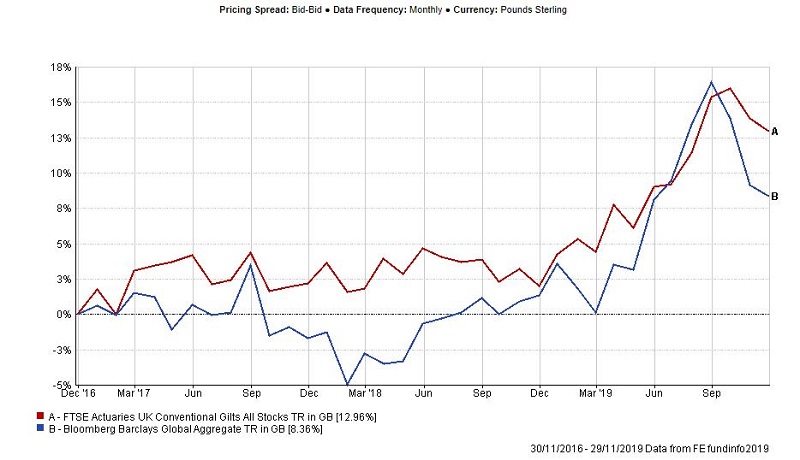

Sriharan says Canaccord Genuity has been weighing up exposure to government bonds and credit given both have performed well in 2019 and decided to trim corporate exposure but not necessarily add to government bonds. It is subsequently looking at global aggregate managers who can tilt exposure to government and corporate bonds as they see fit, something Sriharan suggests is more difficult for private wealth managers to do.

The Bloomberg Barclays Global Aggregate index has returned 8.36% in sterling terms over the past three years compared with 12.96% for the FTSE Actuaries UK Conventional Gilts All Stocks index in sterling terms.

Aggregate bonds versus gilts

“Because the Barclays Global Aggregate index has a meaningful allocation to government bonds, if you’re finding active managers in that space then there’s actually a way of protecting the downside but also getting some of the upside in credit if spreads compress a bit or stay where they are. If 2020 is the year where this great run of form for risk assets comes to an end, you’ve got a bit of protection there.”

But this is not a case of simply outsourcing bond selection to a strategic bond fund manager, he adds. “They [strategic bonds] have done very well but have they used more on the credit side than the government bond protection side?”