Albert Einstein is supposed to have observed: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” And, if he did say it, he had a point. Generate a 7% return per year and the investment’s value will double roughly every 10 years – not bad if you can find attractive risk-adjusted investments with such a yield.

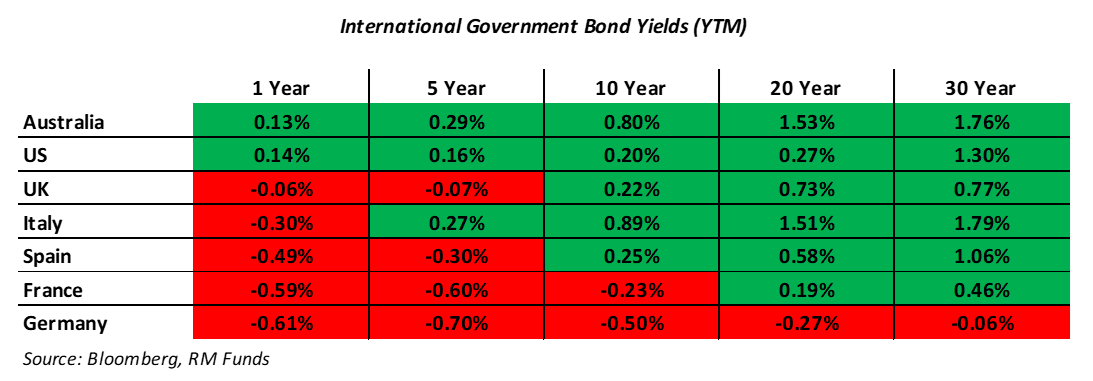

The global economy has lurched from one crisis to another over the last two decades. The monetary support from central banks, while undoubtedly essential, has also reduced yields to multi-decade lows. Conduct a review of a handful of G20 economies and the reality is laid bare in the table below. Government bond yields are fast turning negative or nearing 0%, and in most circumstances are below inflation, eroding investors purchasing power.

Take a quick look at corporate bonds and the Bloomberg Barclays Euro Corp IG index, which tracks more than €1.25 trillion (£860bn) of bonds, yields a grand total of 0.55%. And if we stray into ‘junk’ bonds, we are greeted with a yield of just 3.8%. Not very rewarding when one considers the wave of defaults, restructurings and bankruptcies on the horizon.

Dwindling Aristocrats

Up next, we have equities, where the S&P UK Dividend Aristocrats index now numbers only 35 constituents among its ranks. With around 47% of the FTSE 100 suspending or cancelling dividends, there is not much hope there either.

Finally, that leaves us with the third segment of any respectable allocator’s portfolio – alternative assets. Full disclosure: I am a fund manager of an alternatives fund, so I clearly have a vested interest – and yet I believe it is easy to be objectively bullish about the asset class.

Why? Because there are some great assets to uncover. Why buy Tesco equity or Tesco bonds, for example, when you can buy a real estate investment trust that has the same counterparty exposure but without the operational complexity? You can benefit from a wider spread and also generate a consistent ‘Covid-secure’ yield.

Bankable counterparties

Renewables are an area that boasted an unblemished record until January and the concerns about power prices. When reviewed in context and compared with largescale utility companies that bring with them a multitude of issues from government politicking to regulatory concerns, however, renewables seem a reasonably safe bet. Much like the Tesco example, the counterparties are highly bankable, including government subsidies or the very same utility companies.

These are just two simple examples of relative value trades – accessing similar counterparty risk in an alternative format, in these instances via energy generation or real estate, is a great way of capturing a ‘simplicity premium’.

As we move into the final quarter of what has been a pretty horrendous year for many, the outlook is a persistent low-yield environment, spattered with health, inflationary and macroeconomic concerns. While alternatives are not a magic bullet, the ability to quickly and accurately assess their performance, and generate potentially inflation-linked distributions seems far more attractive than betting on high-beta stocks that can swing 10% or 20% in a single week.

Pietro Nicholls is the lead portfolio manager of the VT RM Alternative Income Fund and co-manager of the listed investment trust RM Secured Direct Lending