Artemis has topped a list ranking asset managers for the readability of their investment content, while Allianz has come bottom.

A report compiled by strategic consultancy Communications and Content found award-winning asset managers are producing investment content for clients that is complex, too long and misjudged, based on a readability score and a reading age.

It found a third of all investment content is less readable than the UK Internal Market Bill, the public bill published on 9 September currently before parliament that sets up the trading arrangements among the UK’s four countries after the Brexit transition period ends.

An industry talking to itself

It also found “an industry talking to itself”, with two articles in three failing to reference the reader or client, and that the average article takes six minutes to read – 2.5 times longer than typical media articles – which fits poorly into the average 25 minutes people spend reading each day.

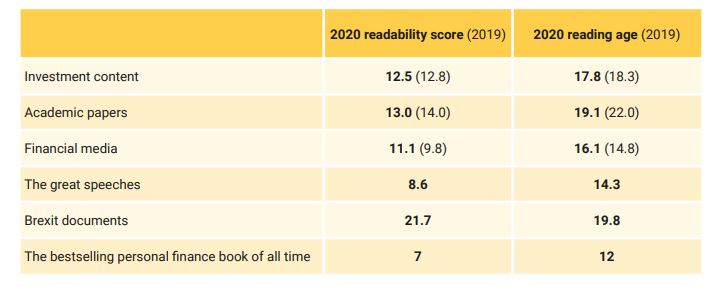

To obtain the results, Communications and Content put a selection of written materials into the Automatic Readability Checker to assess their readability and reading ages.

The sample included 72 items of written content from 24 asset managers that won accolades at a 2020 industry awards; 22 articles from the personal finance media, including the BBC website and the Economist; eight famous historical speeches; three academic papers from the EDHEC Business School; and Robert Kiyosaki’s Rich Dad Poor Dad, the best-selling personal finance book in history.

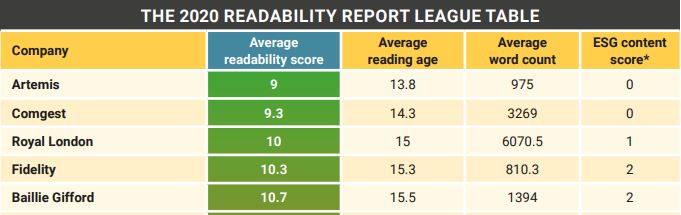

To judge asset management firms, the study put three pieces of content – the most prominent or promoted – from each company’s website into the readability checker and ranked them based on the average scores.

Investment content is closer to academic levels of readability than articles found in the financial media, the report concluded.

Investment content readability score against comparable literature the intended audience might

reasonably want to read

Source: Communications and Content

At the top end, Artemis obtained a readability score of 9 and a reading age of 13.8 years, followed by Comgest with 9.3 and 14.3 years, and Royal London with 10 and 15 years, respectively.

Top five from the report

At the bottom end, Allianz, Aberdeen Standard Investments and Kames were ranked as the worst in terms of the readability of their investment content.

Bottom five from the report

‘People desperately need bite-sized and understandable materials’

Communications and Content managing director David Butcher said investment content is far too complex and too long for the time people have available to read it.

“Whether you’re a consumer or a professional, you’re probably bombarded, stressed, worried and tired – and you just don’t have the time to wade through lengthy, old-fashioned style documents that save their conclusions to the very end,” he said.

“What’s pretty shocking, especially for consumers, is the mis-labelling of content. We found anything marked for consumers tended to be more complex than material aimed at professionals – the people who get paid to invest.

“People desperately need bite-sized and understandable materials as they make important decisions. But the industry delivers lengthy tomes aimed at itself.”