Being a value investor has not been easy over the past decade, not least of all a contrarian value investor like Fidelity Special Situations’ Alex Wright.

He has witnessed all the highs and lows – and the low lows – for the investment style at Fidelity, where he began his career as a graduate trainee in 2001. Now eight years on from taking the reins of Anthony Bolton’s former fund, Wright finds himself in the sweet spot, as unloved UK stocks enjoy a long overdue bounce-back.

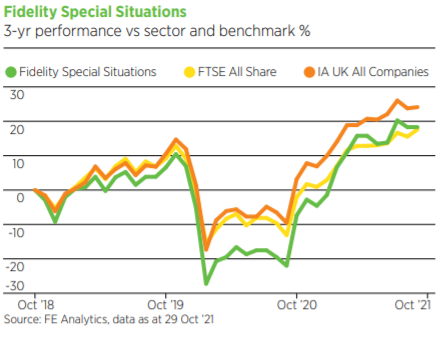

His £3.1bn Special Situations fund, which he runs alongside Jonathan Winton, is now in the top quartile of the IA UK All Companies sector over one year, returning 29% versus peers’ 20.8%.

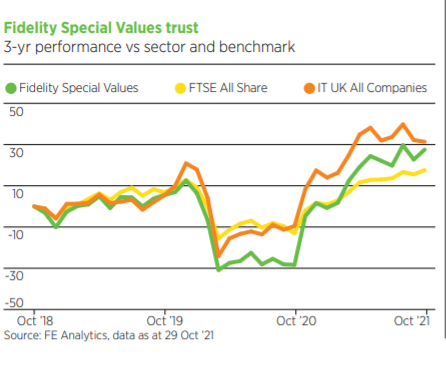

Wright’s Fidelity Special Values trust, which he has managed since 2012, has just delivered its best annual performance, with shares up a staggering 73.8% and net asset value increasing by 56.2% compared with the FTSE All Share’s 26.9%. It is now within touching distance of a £1bn market cap for the first time in its 27-year history.

Against the current backdrop, Wright believes value’s recent winning streak could continue. If inflationary pressures persist, this will prove a major challenge to current market levels, particularly in the richly valued US.

“While inflation is clearly a risk, on a relative basis, it is a real opportunity for this strategy,” Wright says.

“One of the few places you can actually shield yourself is in value equities. Obviously, they have seen a huge headwind to performance over the past 10 years because discount rates have been so low. But in a world where valuation levels compress, if you start at the lowest valuation, your downside is much smaller.”

Turnaround cases

Wright’s two funds are remarkably similar, with 90% crossover between their portfolio holdings, though Special Values has around 10 micro-cap names not found in Special Situations. It is also more heavily geared, running about 12-13% leverage compared with the open-ended fund’s 6-7% leverage.

They also have a small and mid-cap bias, which has become more aggressive during the pandemic. Only 45% of Special Situations and 40% of Special Values are invested in companies with a market cap above £5bn, significantly lower than rival peers in the sector.

“When the whole market trades off, there ends up being a particular opportunity in the more mid- and small-cap names because the baby gets thrown out with the bathwater,” Wright explains.

By Wright’s definition, being a value contrarian means buying companies where the three to five-year prospects are not appropriately priced by the market.

Typically, these businesses are suffering from some short-term issues, which the market interprets as a structural problem that will persist, but that Wright believes can be turned around.

“Sometimes, that leads me to buy some companies that aren’t particularly cheaply valued today where I think the returns can go up further in future. But that is rare,” he admits.

Sage is currently his priciest holding. Trading on a forward price-to-earnings (P/E) ratio of about 28x, the UK tech stock is much dearer than Wright’s largest position Legal & General (8x), which is why he keeps his holding small at just 75 basis points.

The company has seen its margins squeezed as it transitions from an on-premise model, selling a licence or copy of its software, to a cloud-based model, where customers pay for products on a subscription basis. Many companies have made the switch, most famously Microsoft, and Wright says it will be more profitable for Sage overall as subscribed customers are stickier and easier to market to.

“It’s a much better model that should be more highly rated and higher margin, and the market is giving them some but not all of the benefits.”

Playing the field

Wright also likes to buy into areas of the market where competition is thinning out.

Last March he bought more shares in Allied Irish Banks when its share price was in the doldrums. The Irish lender emerged from the pandemic with minimal loan losses, thanks to government stimulus measures. But more importantly, it has seen its market share increase, thanks to two rival banks folding during the Covid crisis.

“Going from five to three players is a dramatic improvement in the competitive position of the remaining Irish banks,” Wright says.

Ryanair is benefiting from a similar trend as Europe’s major airlines like Lufthansa, Air France and British Airways have been forced to drastically cut capacity to lower costs. Wright added the stock to the portfolio in late 2020 and early this year, participating in its rights issue. He waited longer to pull the trigger because unlike the life insurers and banks, Ryanair was making huge cash losses.

Around the same time, he also purchased several leisure names, including bowling operator Ten Entertainment, ex-TGI Friday’s owner Hostmore and pub chain Wetherspoons. All three positions are less than 1% because although Covid restrictions have been removed, Wright says there is still a great amount of uncertainty plaguing these businesses.

Takeover takeoff

Playing in the mid and small-cap space, Wright has been a big beneficiary of the explosion of M&A activity this year.

Out of Special Values’ 100 stocks, 10 have attracted takeover bids. Aerospace equipment supplier Meggitt was purchased for £6.3bn, a 70% premium to its closing share price, while infrastructure group John Laing was snapped up by US private equity giant KKR for £2bn. They are 2% and 2.5% of the fund, respectively.

Many UK investors have bemoaned the number of great British businesses falling into the hands of American and private equity buyers, but Wright says this will continue unless the market re-rates. UK stocks are still only trading on 12x earnings versus their US counterparts, which are on 21x earnings.

“There’s no point moaning about the UK being taken out,” he says. “What you need to do is buy UK companies to drive up the price.”

However, shareholders should be vocal if offers are not up to scratch. Fidelity International and Toscafund opposed Spire Healthcare’s £1bn takeover by Australian rival Ramsay Health Care on the basis it significantly undervalued the business. The deal failed to garner enough shareholder support and did not pass.

Bullish on life insurers and housebuilders

Life insurance companies remain Wright’s biggest absolute position at 12% of Special Situations. He owns four out of six UK-listed insurers, with Legal &General his largest position at 5.5% followed by Aviva (3.8%) and consolidator Phoenix Group (3.2%), and his trust has similarly sized positions.

Legal & General was the third-biggest contributor to performance in the past 12 months, while Aviva is the 10th. Though both have seen their share prices bumped up in the last year, with Aviva up 18%, Wright still thinks they look cheap.

Compared with Legal & General and Phoenix, Aviva endured a bumpier ride during the pandemic. It scrapped its final 2019 dividend, a move Wright believes was “a mistake” and “a political decision” on the part of ex-CEO Maurice Tulloch. But under new boss Amanda Blanc, Wright feels the company is back on track.

“They’ve done what they really should have been doing for the past five years, restructured the business and they’re now back to paying dividends. They paid a catch-up dividend, and they’re doing a share buyback, so the cash generation and the solidity of their business is also coming through.”

Another sector he remains bullish on is UK housebuilders. Wright owns Irish housebuilders Glenveagh and Cairn and FTSE 250 companies Redrow and Vistry. He also has several positions in companies that supply goods to housebuilders like Norcross, which makes showers, tiles and bathroom accessories, as well as building material manufacturers Brickability and Forterra, and B&Q owner Kingfisher.

The trend toward hybrid working, lower rate mortgages and an expected pick-up in the build-to-rent market should be supportive of the housing market moving forward, he says.

This article first appeared in the December 2021 issue of Portfolio Adviser. Read more here.