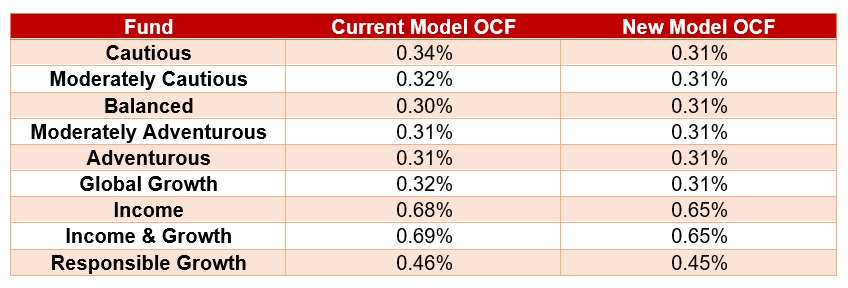

Eight of AJ Bell’s nine multi-asset funds have become marginally cheaper after the investment platform undertook a simplification of its charging structure.

It has set a single 0.31% ongoing charges figure for all six of its multi-asset growth funds. That move reduced the cost of all but one. The ‘Balanced’ fund became slightly more expensive having previously been 0.3%.

AJ Bell’s two income funds will both charge 0.65%, while the responsible growth fund will have an OCF of 0.45%.

The changes came into effect last month and will be reviewed annually.

Chief investment officer Kevin Doran (pictured) said the OCF changes would give “greater clarity and certainty to customers and advisers”.

“The new model ultimately means cost cuts for most customers and fixes our pricing extremely competitively versus peers.

“Over time, we expect that with continued fund asset growth, we will be able to take advantage of economies of scale and decrease the level of the fixed OCF, further delivering value to customers,” Doran added.

35% jump in direct customers

In January, AJ Bell re-emphasised its commitment to becoming a bigger player in the D2C space.

According to its annual results, advised client numbers rose 17% last year to hit 131,610, while D2C customers ended 2021 at 251,661 reflecting a 35% jump.

In November, AJ Bell launched an investing app at a third of the price of rival Hargreaves Lansdown giving opportunity for further client acquisition moving into 2022.

You might also like:

Vanguard launches sustainable range but fails to match lowest-cost competitor

Quilter Cheviot creates ‘building block’ funds to shrink MPS costs