AJ Bell has become the latest provider to axe VAT from its MPS range, a move it claims has made its services one of the cheapest available.

The change, which has been retroactively applied from 1 October 2020, will see the annual management charge on AJ Bell’s model portfolios drop from 0.18% to 0.15%.

According to the FTSE 100 platform group this makes it “one of the cheapest offerings on the market”.

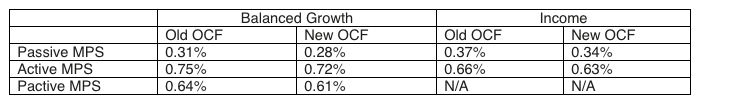

Its Passive Balanced Growth MPS is now priced at below 0.50%, including the annual platform charge, with an updated ongoing charges figure of 0.28% from the previous 0.31%.

The Active Growth range will see charges fall from 0.75% to 0.72%, while its Pactive Growth portfolios will see the OCF cut from 0.64% to 0.61%.

Income versions of the Passive and Active portfolios will also enjoy a 0.03% reduction in OCF to 0.34% and 0.63% respectively.

Summary of total charges before and after VAT removal

AJ Bell’s annual platform charge for Sipp, ISA and General Account holders remains fixed at 0.20%, reducing on assets over £1m. AJ Bell Retirement Investment Account holders with assets below £500,000 are charged 0.25% and 0.20% on pots above that level.

“These changes take all our Passive Growth MPS options below the 0.30% mark which means with our platform charge of 0.20% for our SIPP, ISA or General Investment Account, advisers now have access to a suite of risk-managed portfolios, on platform, at less than 0.50% per annum,” CIO Kevin Doran said.

“That’s exceptional value in a highly competitive market, consistent with our commitment on costs.”

Alongside the reduction in charges Doran said AJ Bell announced is prepping to launch a responsible investment MPS range imminently.

“We are always looking at how we can evolve the MPS in line with the needs of advisers and are working towards launching a responsible investment option within the MPS over the coming months.”

Brooks Macdonald announced last week it would be scrapping VAT from its 10-strong managed portfolios range after Tilney Smith & Williamson, Brewin Dolphin and Investec Wealth & Investment did the same last year.

See also: Brooks Macdonald becomes latest DFM to scrap VAT on MPS range