In September last year, Abrdn announced one of its longest-serving and highest-profile fund managers was due to retire. Smaller companies veteran Harry Nimmo had been with the firm for 37 years and was the architect of the ‘quality, growth, momentum’ process employed across the group’s small-cap mandates.

It was a significant moment, but the succession of Abby Glennie – the fund manager charged with filling those big shoes – had been meticulously planned. She had worked alongside Nimmo for more than seven years and had been co-manager on the funds since November 2020. She was already steeped in the group’s process and an experienced small-cap analyst, having started her career at Kames Capital.

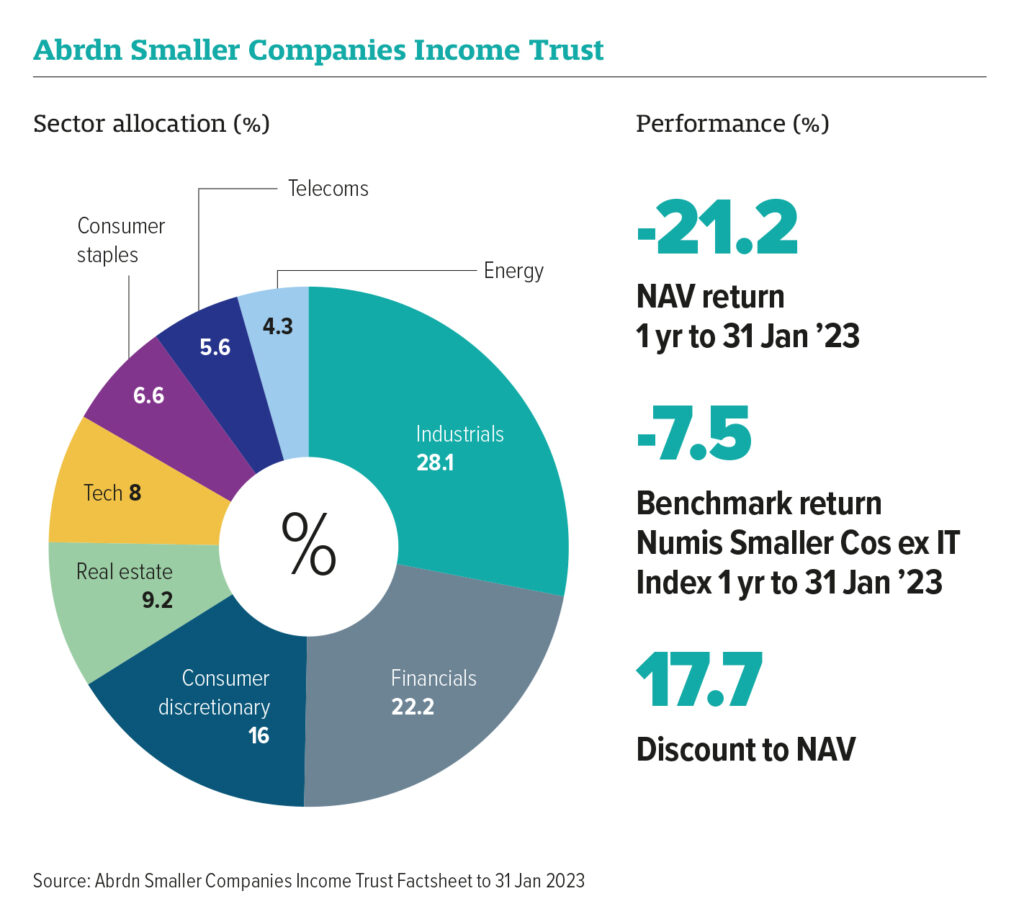

Nevertheless, it was a tough time to take the reins. It was a dismal year for small-cap stocks and for higher-quality small caps – Abrdn’s natural stomping ground – in particular. The funds shed the strong outperformance accumulated in 2021 and 2019 as markets switched to a more ‘value’ focus.

Glennie says having a clear process helped them with asset retention over the year: “Clients know when they should be challenging us. They can always ask why a particular stock fits our process. Last year, clients generally understood why we didn’t do well as they knew why they’d bought our funds and what to expect. It’s important not to flip the portfolio about at different times in the market cycle.”

She believes the signals for the year ahead look a lot more positive. There has been a shift in sentiment from the gloom in late 2022. “In December, there were far more questions about the length and depth of a recession. That seems to have eased significantly. Even the Bank of England has a different outlook since it gave its last updates in November.”

It is an environment that has historically suited small caps. Glennie points to the correlation between improving PMI data and small-cap performance. PMI data is just starting to tick higher. She says valuation is also on their side: “Small caps look cheap relative to large caps. In the UK, there has been significant disparity with the FTSE 100. A lot of that has been driven by sectors, with the large-cap universe heavily weighted in financials, staples and utilities. We see an appetite to move to small and mid cap, but investors are cautious on timing.”

However, she says the value on offer is difficult to ignore, particularly in their ‘quality growth’ part of the market, adding: “This valuation consideration will come into focus. Earnings strength and company resilience should come to the fore in the year ahead.” However, she admits there is still earnings risk in the market and vulnerable companies may have a tough time, so caution is warranted.

Durability counts

It may have been a tough year, but Glennie has no doubts about the long-term durability of the process Nimmo established. It has been in place for around 25 years, tested through a variety of market conditions. While it has been reshaped at the edges, it has not fundamentally changed over that time. It is used across the group’s global small-cap mandates.

Through continuous back testing, the team has devised a matrix of quality, growth, momentum and valuation factors that have been shown to drive share price performance. This helps manage the near-8,000-strong universe of small caps to a manageable list of companies on which Abrdn’s analysts will do fundamental research.

That includes meeting with senior management, financial analysis, assessing ESG risks and conducting a peer review process. The aim is to build a high-conviction portfolio of companies they know and understand in depth.

Glennie says that while the process doesn’t change, it can lead them to different types of stocks. “We consider ourselves generalists – we don’t screen out any stock or sector. Different factors become important over time,” she says.

“For example, on earnings momentum, certain sectors may go through a period when they are having a lot of downgrades. They would score badly at that point. Then in a recovery, those same companies may see the strongest momentum. We find that the quality aspects are more stable, while valuation aspects may change considerably.”

There will also be good and bad times for the group’s style. Glennie says the most difficult environment is when everyone is buying cyclical value stocks. It was the market’s focus on value that hurt particularly in 2022, along with its focus on macroeconomic factors – notably interest rates – over company fundamentals.

The process is the engine behind all the group’s small-cap mandates, which includes open and closed-ended funds, plus segregated mandates. Liquidity and risk metrics are managed firm-wide and the commonality between the portfolios is high.

Glennie and her team operate as portfolio managers and analysts. The eight-member global small-cap team works closely, holding daily team meetings and routinely sharing information. They will also share information with the UK large-cap teams and there is some crossover on mid-cap analysis.

She says: “We are really involved in the companies in which we invest. We know what’s happening. That also positions us well in terms of client discussions. It means they can ask us about any stock and have us answer knowledgeably.”

‘Best in class’

Glennie has been seeking out ‘best in class’ companies that are outpacing their individual sectors, but also those companies with significant visibility on revenues in a tough environment. She says: “This is companies such as JTC, the fund administration business; Telecom Plus, the consumer multi-utility provider; Gamma Communications, which is a telecoms provider to enterprises; or Keywords Studios.”

There are increasingly opportunities in previously ‘difficult’ sectors, she adds, as there is more visibility on the economic environment. They hold games developer Team 17, for example, which has seen its position strengthen more recently. They also have Hollywood Bowl, which has outpaced the wider leisure sector: “Their model is so much more robust and it’s very well run.”

She is also seeing better sentiment towards the retail sector. “Some of the retail stocks people were particularly worried about last year have been doing better. We hold some quality retail stocks such as Greggs, JD Sports or Dunelm. They’re trading well, and the market is slowly changing its view on them.” She has also just bought back Jet2.com for the mid-cap fund.

Some of these areas are benefitting from consolidation, but in general, she says the corporate environment hasn’t been as bad as expected. “Fewer companies have gone bust because of government support, and companies weren’t as badly levered. Nevertheless, we find that stronger companies have been able to invest in their own businesses, while their peers are more constrained.”

However, the economy has yet to feel the effect of higher interest rates. Glennie admits this is a concern but won’t necessarily affect small caps directly. “Companies in our portfolio have quite low leverage and may even be net cash. Many small-cap companies have learned from the global financial crisis not to run with high leverage. As such, we’re less worried about the interest rate impact on the market,” she says.

The biggest worry is if interest rates tip the economy into recession. The UK narrowly avoided a recession in the final quarter of 2022, but the economy shrank 0.5% in December alone and there is still considerable uncertainty on the ultimate impact of higher rates. As such, while the moment for smaller companies may be approaching, there are still some deterrents for investors.

Glennie says they are starting to see money flowing into small caps again, suggesting there is tentative confidence returning. She points out that while large caps tend to outperform in the early part of a recession, small companies historically start to outperform large caps soon after a recession starts, often as early as three to six months after it begins. This is intuitive because markets often start to price in a recession long before it happens. This is particularly true this time round, when the recession has been widely flagged.

Either way, Glennie has learned from someone who saw a cycle or two in his time at the helm and isn’t fazed by tough conditions. After a bruising year in 2022, the signals are notably better for 2023, with valuations looking more compelling and corporate and economic performance more optimistic.

BIOGRAPHY

Abby Glennie is deputy head of smaller companies at Abrdn. She is lead manager on the UK mid-cap strategies and co-manager on the UK smaller companies funds. Glennie joined the company in February 2013 as a member of the UK equity team, initially working on the UK large cap desk, before moving to smaller companies in January 2016. She was appointed deputy head of the team in early 2020, and as part of her role, she helps lead the Equities Charity Group.

This article first appeared in the March edition of Portfolio Adviser Magazine