By Michael Nelson

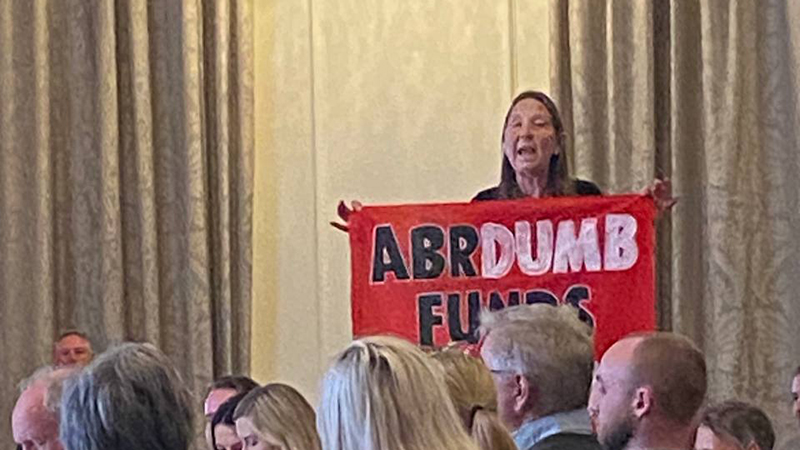

Climate activists from the protest group Tipping Point UK interrupted Abrdn’s annual general meeting (AGM) to demand the asset manager end investment in coal, oil and gas, with around a dozen protesters standing to condemn the company during chairman Sir Douglas Flint’s opening remarks.

Meanwhile, several shareholders also pressed CEO Stephen Bird to rule out investments in coal, oil and gas. Protesters condemned Abrdn’s investments in Ithaca Energy, a developer of the controversial Rosebank oilfield, whose Israeli parent company, Delek, is on a UN blacklist for operating on occupied Palestinian territory.

The meeting was delayed as security took steps to remove the protesters.

Max Miller, a retired Army officer from Roslin who was part of the inside disruption, said: “I find it staggering that, in a year that has seen carbon emissions reach record levels, bringing record heat in each of the last 10 months, delivering devastating floods that threaten UK food supplies, and driving wildfires and drought to destroy large parts of the planet, Abrdn still thinks it is appropriate to invest in fossil fuels. This once proud leader of the investment industry must move with the times and cut all links with those polluters that are destroying our planet.”

Cathy Allen, a retired teacher who also took part in the action, added: “Abrdn’s investment in coal, oil and gas is a one-way ticket to environmental and financial ruin. If they persist in financing fossil expansion, they’re steering their company straight into disaster. It’s time for Abrdn to wake up and smell the carbon emissions before it’s too late.”

Tipping Point UK highlighted in the last year Abrdn dropped from the FTSE 100, saw a major fall in share price, cut 10% of its staff and lost major shareholders such as Harris Associates.

The asset manager has also come under fire for being one of a handful of European investors without a coal exclusion policy, despite promising to introduce one. Additionally, according to a Reclaim Finance report, Abrdn ranked alongside BlackRock, Invesco and Vanguard as financiers of the worst fossil fuel bonds in 2023, with investments in BP, Conoco Philips and Eni totalling $7.1bn.

An Abrdn spokesperson said: “We respect people’s right to express their point of view. Abrdn fully supports constructive engagement on climate change, and we’re committed to continuing our work to support a responsible transition.

“As we have previously stated, we believe that engagement is more powerful for an effective energy transition than an absolutist approach to fossil-fuel divestment.

“We fully acknowledge the role of fossil fuels in causing and exacerbating climate change and fully support the goals of the Paris Agreement. This is why consideration of climate-change risks is an integral part of our investment process across all asset classes and sectors.”

This article was first seen in our sister publication, PA Future