In March, the Prime Minister Keir Starmer announced plans to scrap NHS England, the public body that oversees the National Health Service. The move is intended to cut costs and reduce bureaucracy in a system which is struggling to meet the needs of an ageing population.

In September last year, Lord Darzi published a report into the state of the NHS in England, deeming it “in serious trouble”.

“Beyond the familiar issues of poor access to GPs, ballooning waiting lists, and the dire state of A&E, [the report] underscores how insufficient capital investment has left much of the NHS property estate unfit for purpose,” said Alan Dobbie, co-manager of the Rathbone Income fund.

He explained the new Secretary of State for Health Wes Streeting has prioritised moving more primary care into community settings, given that a hospital visit typically costs 10 times as much as a trip to the GP. This spring, the government is due to unveil its 10-year health plan to modernise the NHS, which should reveal new details of how this will be done.

Dobbie said the plan will aim to bring doctors, district nurses, care workers, physiotherapists, and mental health specialists under one roof in neighbourhood health centres. This could benefit businesses that manage primary care properties, such as Assura and Primary Health Properties. “These healthcare REITs specialise in owning and developing purpose-built GP surgeries in the UK and Ireland,” he said.

“Although their model of utilising private capital to enhance the NHS estate may be contentious, it offers a viable solution to a government long on ambition but short on cash. High interest rates have caused REIT valuations to decline significantly in recent years, meaning the shares of these businesses trade below net asset value, despite their substantial growth potential.

“Coupled with high single-digit dividend yields, we believe these REITs present a compelling option for income-seeking investors. While the companies’ relatively high leverage poses a risk if interest rates rise further, the investment case remains strong. A recent private equity bid for Assura indicates that others in the market are recognising this opportunity as well.”

Will performance bounce back?

Investment trust managers surveyed by the Association of Investment Companies (AIC) tipped healthcare as their top sector for 2025, but performance has been lacklustre for a while, in the UK at least.

Alex Hunter (pictured), global equity analyst at Sarasin & Partners, said innovation to improve the health span for ageing populations has been one of Sarasin’s core investment themes.

He noted that, over the past 12 months, the MSCI Healthcare Index has underperformed the wider MSCI index by about 10% on concerns over uncertain political healthcare policies. However, he thinks the stage is set for performance to bounce back. “I would expect healthcare to resume outperformance, driven by relentless innovation within the sector, once policy uncertainties have subsided,” he said.

Performance of the healthcare sector has been pretty average over five years, according to Dobbie.

However, he highlighted the unique composition of the sector, which is heavily concentrated in two large stocks. “Although the healthcare sector constitutes 11.5% of the FTSE All Share, just two stocks – AstraZeneca and GlaxoSmithKline – dominate, with a combined weight of 9.3%. AstraZeneca alone accounts for 6.9% of the index, while GSK makes up 2.4%. Consequently, these two stocks significantly influence the sector’s overall performance. Our fund holds positions in both.”

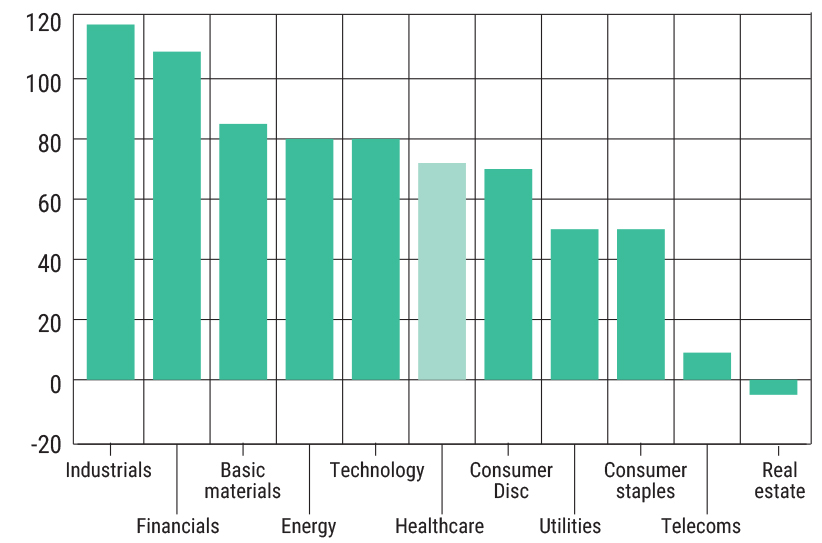

FTSE All Share total return (%)

Blockbuster GLP-1 weight loss drugs have shaken up the pharmaceutical world and driven enormous profits for European drugmakers.

US firm Eli Lilly and Novo Nordisk have led the way, seeing incredible success with their anti-obesity drugs, and AstraZeneca is working on developing its own therapies in this area, with both oral and injectable drugs currently in trials. Both GlaxoSmithKline and AstraZeneca have the cashflow to buy up smaller drugmakers and get into the highly competitive GLP-1 space faster if they see the right opportunities.

See also: Troy’s Harries: GLP-1’s impact on drinks stocks

AI speeds up drug development

AI has infiltrated every sector and industry, but it could have incredible efficiency and cost-saving benefits in healthcare. Certainly, the prime minister has made it clear he wants to leverage technology to much better effect in the NHS. There is also a lot of potential for AI in drug development, Hunter suggested.

“AI has a clear application in speeding up drug development, improving diagnostic accuracy, as well as enhancing general healthcare administration,” said Hunter. “The adoption of AI should benefit all market participants fairly equally since all have access to the technology. However, a key differentiator in this area will be the quality and quantity of the underlying medical data used for machine learning.”

Stockpicks for the ‘AI in healthcare’ theme

Ken Wotton, manager of the Baronsmead VCTs at Gresham House, highlighted two stocks which are benefiting from the AI theme which is transforming diagnostics and treatment efficiency. One is Diaceutics, which uses AI and machine learning to process and standardise around 500 million patient data points from medical insurers, laboratories, and healthcare providers on its diagnostic platform.

This enables pharmaceutical companies to optimise patient journeys and improve drug commercialisation, Wotton explained. “As precision medicine moves from a niche focus to a mainstream healthcare strategy, Diaceutics stands to benefit from significant structural tailwinds, making it a compelling long-term growth opportunity.”

Another AIM-listed company using AI to drive efficiency in the UK health system is Netcall. Wotton described the company as a leader in customer engagement and business process automation.

“Netcall is transforming industries including healthcare, local government, and financial services. Its flagship NHS solution, Patient Hub, enables patients to confirm or reschedule appointments digitally, reducing missed slots and allowing healthcare staff to reallocate time more effectively. With NHS waiting lists near record highs, this kind of efficiency is increasingly valuable,” he argued.

See also: ARK Invest: Is AI the wonder cure for the broken healthcare sector?