By Darius McDermott, managing director of FundCalibre

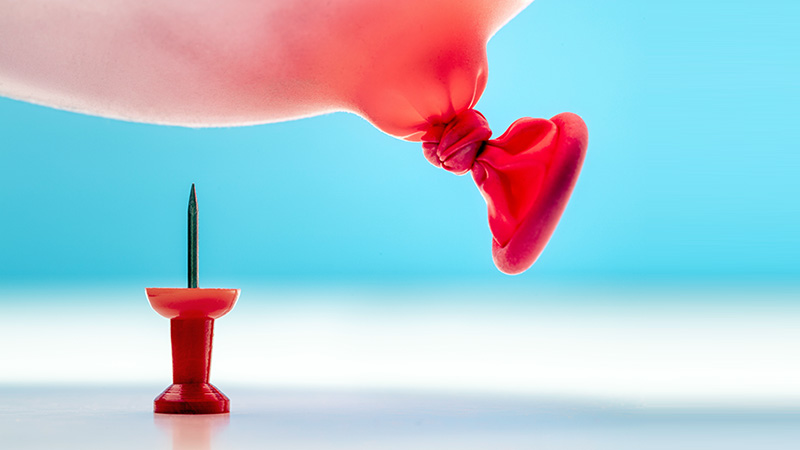

Former Fidelity veteran fund manager Anthony Bolton warned that “all the red lights are flashing” over US stocks at a recent conference, suggesting there would be a day of reckoning for the US mega caps and the passive funds that track them.

Bolton rarely raises his head above the parapet, but one of his last interventions was prior to the Global Financial Crisis when he warned of the dangers of Collateralised Loan Obligations. With that in mind, it is worth taking notice of his warnings when he gives them.

Certainly, there are factors that should give investors pause for thought. The US market is as concentrated as it has been in its history, with 35% in the top 10 stocks. The previous peak was 30% in 1963.

The concentration is even more acute in indices such as the Russell 3000 Growth, which has 58% in technology, but also applies to ostensibly global indices such as the MSCI World, which has 74% in the US.

These companies also look increasingly expensive. Although earnings have been strong, the price to earnings ratio for Nvidia has moved from 51x to 55x since the start of the year. In companies where earnings haven’t been as strong, the P/E expansion has been even wider. Apple, for example, has seen its P/E ratio rise from 30x to 40x over the course of 2024.

Even growth-focused investors have been paring back their weighting. Gary Robinson, manager of the Baillie Gifford American fund, has been reducing the fund’s weighting in Nvidia.

See also: PwC: ‘The pressure is on’ for AI to start delivering results

He said the inferencing market, which allows AI models to analyse data and draw conclusions, will become more important. While Nvidia is important in this market, it has more competition. Robinson has also pared back Tesla after its recent strong run.

David Eiswert, manager of the T. Rowe Price Global Focused Growth Equity fund, said market leadership is diversifying already, partly in response to broadening economic strength across the US.

“The US economy is growing, and US gasoline prices are down 40% year over year, which has materially benefited consumers,” he explained. “Consumer and business balance sheets are in relatively good shape.

“Meanwhile, inflation has fallen to near target ranges, allowing the Federal Reserve to cut interest rates by 50 basis points in September — with indications of more to come. All this provides a relatively strong backdrop for equity markets.”

Eiswert also said the broadening of market returns from the concentration of the magnificent seven since the summer should make 2025 a better environment for stock selection. He expects looser monetary policy, while Chinese stimulus, and strong consumer and corporate balance sheets, should support a broader range of sectors in the year ahead.

Nevertheless, there are reasons not to write off the mega caps just yet. Ben Leyland, manager of the JOHCM Global Opportunities fund, pointed out that there are good reasons for Nvidia’s strong performance.

See also: Analysis: Is the end of the magnificent seven nigh?

Unlike some of the stocks in the internet boom, Nvidia has strong revenues and cash generation.

“That’s not to say it’s not too expensive,” Leyland said. “But it is difficult for me to say that it will fall over on a 10-year view.”

However, he believes it may be more vulnerable on an 18-month view, stating: “The tech sector is exponential on the way up and on the way down. It’s naturally volatile and there probably will be a very painful time to own US tech.”

Leyland anticipates better opportunities in areas disrupted by Covid, but with the capacity to recover – industrial and automotive semiconductors, for example, or life sciences.

It is also possible that the mega caps could have an increasing role for dividend investors. Michael Rossi, co-manager on the JPM Global Equity Income fund, pointed out: “In 2024, Meta Platforms’ CFO unexpectedly announced the company’s first ever dividend payout and talked about the importance of returning capital to shareholders and dividends serving as a strong complement to share buybacks.

“Subsequently, Alphabet also initiated its first ever dividend, making it the fourth company in the now historic magnificent seven to reward shareholders with income. The world’s biggest AI CRM giant, Salesforce, joined the bandwagon and declared a quarterly cash dividend in the second quarter of 2024.

See also: Active vs passive: What can investors expect as confidence wanes in magnificent seven?

“While dividend yields from tech stocks are initially modest, the absolute expenditure is significant at a whopping $17bn from these three companies alone over the next one year. Moreover, the signal provided by these actions is profound.”

This would bring the mega caps to a new audience and could help support demand.

The other factor to consider is fund flows and the balance of active and passive. Flows into passive strategies have undoubtedly helped support the dominance of the mega caps.

There has been a virtuous circle of investors moving to passive because of good performance, which has supported share prices for the index heavyweights, which has brought more investors. This may not last indefinitely, but there are relatively few signs of it changing in the short term.

The mega caps are, for the most part, good companies, supported by long-term trends, such as AI, with strong revenues and cash generation.

However, history suggests that investors will tire of high valuations eventually and there are signs that market leadership is already starting to diversify. Investors need to make sure they are adequately diversified just in case the mega caps have a wobble.