Kris Atkinson, portfolio manager, Fidelity Short Dated Corporate Bond Fund

It might be an exaggeration to roll out the often-misattributed quote that “There are decades where nothing happens; and there are weeks where decades happen”. However, on the back of the last few weeks in the US and Germany it certainly feels that way and it should be regarded as an opportunity to reassess and rethink portfolio positioning. Below I outline my latest views on interest rates and credit. In short, we continue to play for lower yields and steeper curves, while we de-risk the credit side of the portfolios.

Rates decision-making just got more difficult, we play for lower yields and steeper curves

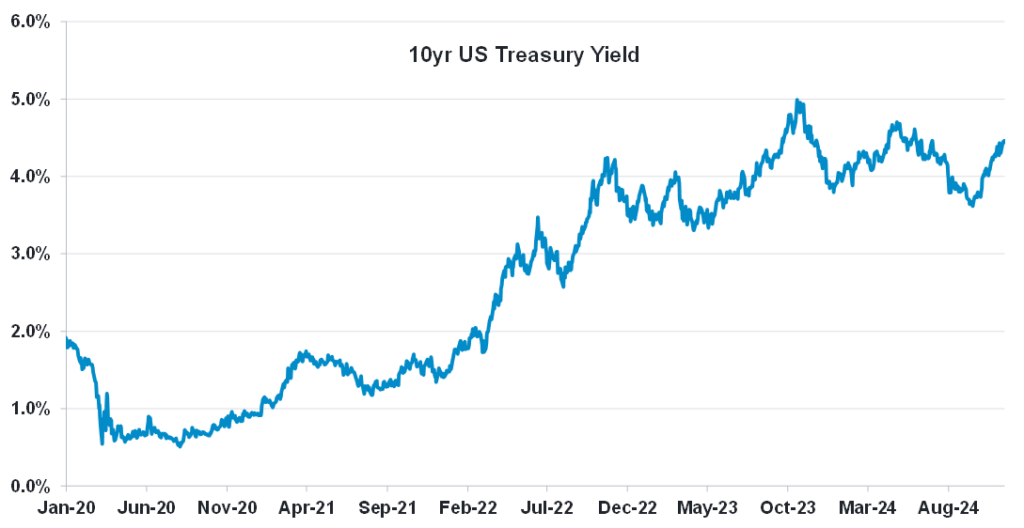

On interest rates, I do think that managing duration just got a lot harder. Despite the bounce off the recent highs, US Treasury yields remain near their highest levels since the summer, while overnight index swaps (OIS) forwards also now price in a less dovish path for Federal Reserve policy relative to consensus forecasts.

Trump’s ‘governance by tweet’ approach had a statistically significant impact on rates volatility during his first term, since Leopards don’t change their spots, it would be foolish to discount this as an outcome this time round. This is, of course, in an environment where rates volatility and uncertainty is already significantly higher than it was in 2016.

Figure 1: 10yr US Treasury Yields

Source: Fidelity International, Bloomberg, 15 November 2024.

But 10-year and 30-year yields remain in range and I will attempt to draw a line in the sand that 4.5% should be the upper bound of that range, making anything greater than 4.4%+ a buying opportunity. Record Treasury selling in the run up to the election suggests a buyers strike in advance of a clearly anticipated event risk but the snap back from 4.5% and the strength of the coupon auctions in an election week is suggestive of a market with appetite to own Treasuries at current levels. Put another way, I am not clear what pushes 10-year US Treasuries to 5% from here. Rather, I see the bias to lower yields and steeper curves.

A Trump win does not change the course for the Fed much

Since it is not the Fed’s job to anticipate the impact of potential policies that won’t be enacted until the back end of 2025, ongoing normalisation remains appropriate and the Fed will continue cutting and the red sweep is not going to change that. We can debate whether a ‘Trumpian’ terminal rate should be higher than a ‘Harrisian’ one but unless animal spirits visibly and measurably reignite the US economy that is not going to change the Fed’s calculus versus pre-election.

Further the reduced chance of a contentious debt ceiling debate reduces the risk of delayed payment or a downgrade by agencies putting us in a much cleaner place to respond to data. On a longer view, tariffs are net negative for growth. Yes, they will lead to pockets of inflation but insofar as it is measurable in PCE it will be looked through as one-time by the Fed and rightly viewed as a growth negative tax on consumption, and thus supportive of lower yields. So, even if auction sizes grow later next year there is more than enough demand, yes, they are large and, yes, the US fiscal path appears totally unsustainable longer term but US Treasuries are obviously USD-denominated conferring a big advantage.

So, the bottom line, 2 months ago OIS was pricing in 3% by mid-2025, we are now back to 4%, but it seems to me that little has changed to impact the Fed’s pathway over that time. Indeed, JP Morgan show that relative to fundamentals, Treasuries are two standard deviations cheap and that in previous instances (e.g. November 2023 and during the Gilt-LDI crisis), they snapped back to fundamentals. We are therefore inclined to position for lower yields and steeper curves but I will hold my hands up and say that this is not a very high conviction view.

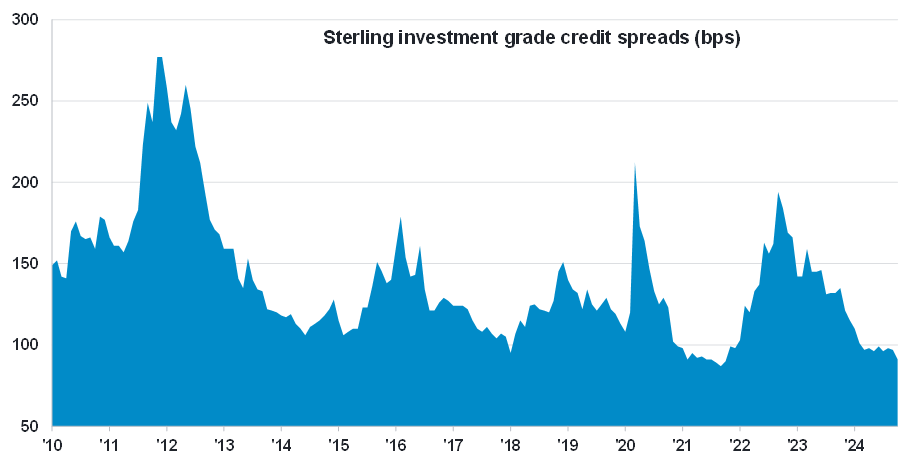

Credit markets are easier to call, valuations are tight

Credit is easier to call, US investment grade (IG) credit is back to the tights, US high yield (HY) credit is within a few basis point (bps) of the tights, GBP IG is within a few bps of the tights, HY relative to IG is at the tights, hybrids are at the tights, and CoCo’s are at the tights. Even the pocket of “value” that is EUR IG spends 80% of its time trading wider than today, this cheapness seems warranted in light of weaker fundamentals and election risks. Of course, new tights in spreads can be made but the rubber band is stretched pretty tight making the asymmetry of risk reward pretty extreme.

What can shake it from its relentless march tighter? Well, a pick-up in M&A seems to be one obvious and consensual outcome of Trump’s election. M&A activity has been running below trend for some years leaving some pent up spending, in combination with low spreads this could and should be funded by a decent chunk of debt. There should be an increase in dispersion as a result of his preferences for polluters at the expense of clean-tech and as discussed above, tariffs will cause margin, supply chain and substitution impacts that are challenging to predict at this juncture. Throw into the mix Trump’s sometimes unpredictable nature, ever-present geopolitical risks and the freshly announced German election and there are plenty of risk events to point a finger at. Of course, until one of these materialises the technical will win out and the steam roller will rumble on.

As a result, in terms of portfolio activity we have taken a hatchet to our credit risk and are reducing aggressively.

Figure 2: Credit spreads are tight

Source: Fidelity International, Bloomberg, 31 October 2024. Sterling Investment Grade Credit = ICE BofA Euro Sterling Index.

IMPORTANT INFORMATION

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates rise and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuers ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between government issuers as well as between different corporate issuers. Due to the greater possibility of default, an investment in a corporate bond is generally less secure than an investment in government bonds. Fidelity’s range of fixed income funds can use financial derivative instruments for investment purposes, which may expose them to a higher degree of risk and can cause investments to experience larger than average price fluctuations. Reference to specific securities should not be interpreted as a recommendation to buy or sell these securities and is only included for illustration purposes. Investments should be made on the basis of the current prospectus, which is available along with the Key Investor Information Document (Key Information Document for Investment Trusts), current annual and semi-annual reports free of charge on request by calling 0800 368 1732. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. FIPM: 862