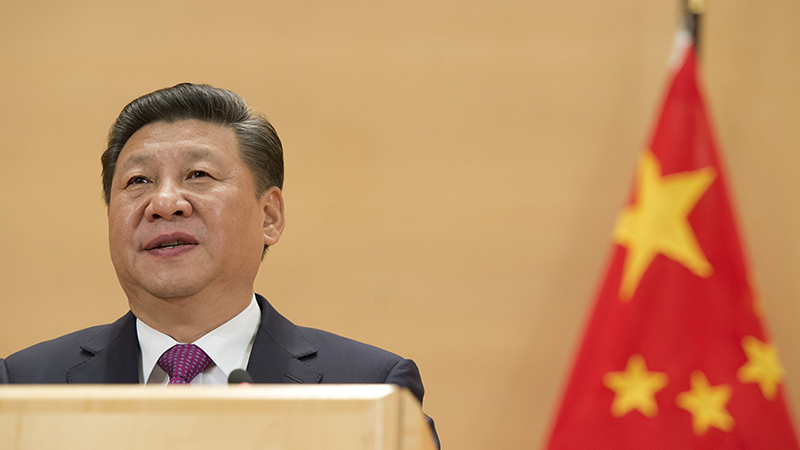

Many might have seen the public chastisement of China’s former president Hu Jintao by incumbent Xi Jinping during the 20th Party Congress last month as simply a political spat, but the move may have ramifications for investing in China.

The physical removal of Xi’s predecessor from the congress on 27 October suggested a power shift, with control moving from the Chinese Communist Party as a whole to a more concentrated dictatorial regime.

A record sell-off in Chinese stocks by foreign investors was prompted by Xi’s tightened grip on power, which included the president excluding any pro-market voices from his seven-man Politburo Standing Committee leadership team.

With fears rising that China might not be able to dodge the widely predicted global economic slowdown, investors must carefully scrutinise their exposure to the world’s second-largest economy.

Eggs all in one basket

“The uncertainty factor in China just increased,” says Ben Kumar, investment strategist at asset manager 7IM. “The pragmatic policymaking of the past few decades has gone and been replaced with the ideas fizzing around in the brain of one man.

“That creates all sorts of problems. The ideas could be bad, the man himself could be bad at implementing them, and of course, the man could fall ill or die, creating a succession problem. More volatility is guaranteed.”

Other investors agree that the move by Xi could be a potential warning flag given the huge task the country faces in mitigating a combination of pressures.

“China’s economic problems, created in part by the need for reforms, have to be addressed now,” says Florian Ielpo, head of macro and multi-asset at Lombard Odier Investment Managers. “With five quarters of an economic slowdown, the Chinese economy is faced with hardship like never before in the past 30 years of it opening up to world trade.

“The sell-off by investors indicates that the continuation of reforms is seen as a negative by markets, but with the adequate consumption stimulation measures, China’s prospects could improve – and with it, its asset valuations.”

Less reform moving forward

But there are undoubtedly headwinds that could get in the way of Chinese asset prices rising, according to some. These are largely down to the content of the speech Xi made having secured his third consecutive five-year term.

“What markets liked even less than Xi filling his politburo with supporters and ejecting former president Hu, was that the word ‘security’ was mentioned more frequently than the last congress five years ago, while the word ‘reform’ was mentioned significantly less,” adds Lorenza La Posta, portfolio manager at MGIM.

“This raises fears that this new regime in China might actually follow the recent past – zero-Covid policy, common prosperity, and the mostly-grim economic consequences of the two.”

La Posta expects the public sector in China to continue strengthening more than the private sector, and that the Communist Party’s social reforms should continue to lead to a growing middle class.

“While the former may not necessarily be a positive from an international investor’s perspective, the latter should benefit the country and, ultimately, the growth of a broader investible universe,” he says. “Moreover, technological growth is still heavily incentivised, and we expect economic growth to come back to being a priority in the coming months as that is a key element to common prosperity and social stability.”

As 7IM’s Kumar notes, identifying winners in the Chinese equity market can be particularly tricky, especially given that “dictators can change their mind very quickly”.

“Take a look at the educational companies in China in 2020/21, which overnight went from being high-growth market darlings to state-owned businesses ‘forbidden’ from making a profit,” he says.

He acknowledges there would be sectors that the government wanted to incentivise. But that if they got too powerful, “they’ll be chopped down to size”.

Stimulus needed to reverse the slowdown

However, some fund managers believe there could be investment opportunities as a result of Xi’s focus on common prosperity and domestic growth.

“The Chinese government should now offer unprecedented support to domestic market leaders who are committed to growing their companies to fill gaps that used to be plugged by foreign demand or exports,” Jasmine Kang, manager of the Comgest Growth China fund, says.

“Many sectors stand to benefit from this, including consumption, healthcare, clean energy, software, and semiconductors.”

MGIM’s La Posta thinks the investment opportunity within Chinese equities is “still strong”, but advocates using experienced stock selectors, while Comgest’s Kang believes that the common prosperity measures and commitment to enhancing the green economy, coupled with historically low valuations created by the recent sell-off, means Chinese equities are “an attractive opportunity”.

But Lombard Odier’s Ielpo feels for equities to rise again across all sectors, the Chinese government needs to “come up with effective stimulation measures” given that China had been experiencing a slowdown for the more than a year.

“The longer the wait, the larger the fiscal spending that will be needed to see the economy recover,” he adds.