Monday 25 July

- -First-quarter results from Vodafone

- -German Ifo business climate index

- -Belgian Courbe Synthetique business sentiment index

- -In Europe, quarterly results from Philips

- -In the US, quarterly results from NXP Semiconductor, Newmont Mining and Whirlpool

Tuesday 26 July

- -Full-year results from insolvencies specialist Games Workshop

- -First-half results from Unilever and Sabre Insurance

- -Trading statements from Compass, Easyjet, Wickes, Mitie and Greencore

Amid staff shortages, air traffic control delays and increased flight turnarounds, Easyjet is expected to announce further capacity downgrades on top of the lowered 87% guidance in its Q3 update.

“Easyjet operates a low-cost business model with small margin for error. Its reliance on one of the worst impacted airports in Europe, Gatwick, has added additional pressure to operations not as widely seen by its competitors based out of less constrained airports,” said Hargreaves Lansdown equity research assistant Charlie Williams.

Although it remains well covered against rising fuel costs, with around 71% hedged in the second half, Williams points out passenger fares will be unable to offset rising costs heading into the winter months.

- -US Case-Shiller house price index

- -US Conference Board consumer confidence index

- -In Europe, quarterly results from LVMH, UBS, Deutsche Boerse and Puma

- -In the US, quarterly results from Microsoft, Alphabet, Visa, Coca-Cola, McDonald’s, UPS, Texas Instruments, Mondelez, 3M, General Electric and General

Wednesday 27 July

- -First-half results from Lloyds

“Analysts may keep banging on about how higher interest rates and a steeper yield curve are both good for the net interest margins and profits of the big banks, but their share prices are not budging,” said AJ Bell investment director Russ Mould and financial analyst Danni Hewson, who point out Lloyds’ shares have lost a third of their value in the past 12 months. Even £2.1bn in share buybacks and £11.8bn in dividends have failed to sweeten the deal.

Concerns over the fragile state of the UK economy, a slowdown in the housing market and an increase in bad loan losses are likely contributors to shareholder pessimism.

Lloyds is expected to generate a pre-tax profit of £3.2bn in the first half of 2022, down from £3.9bn a year ago. Though the FTSE 100 bank wrote back some of its loan provisions during the pandemic in 2020, analysts are forecasting a £388m loss for H1 2022.

But it is expected to raise its first half dividend from 0.65p to 0.73p, bringing the full year dividend to 2.33p a share or £1.6bn.

- -First-half results from Lloyds, British American Tobacco, GSK, Smurfit Kappa, Rio Tinto, Reckitt Benckiser, Unite and Ibstock

- -Trading statements from Fresnillo and Wizz Air

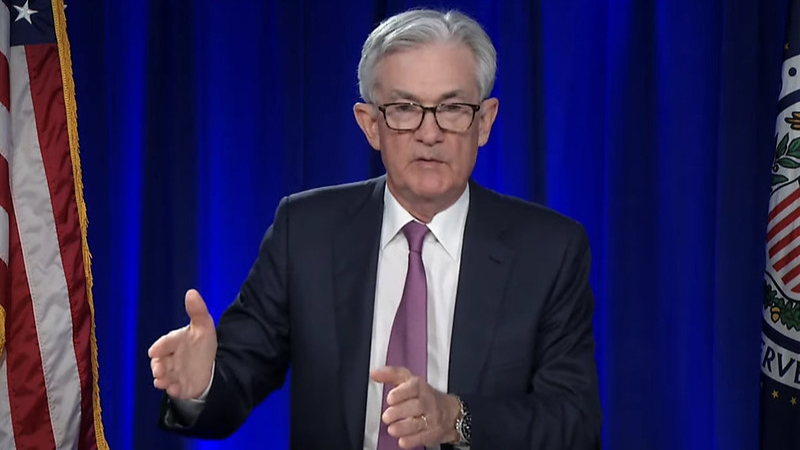

- -US Federal Reserve interest rate decision

With inflation steadily on the rise, markets are pricing in more aggressive action from the Federal Reserve. According to the CME Fedwatch service, there is a 70% chance of a 75 basis points increase to 2.50% at its July meeting and a 30% of a full one-point hike. By the end of 2022 the market is putting a 90% probability on the Fed Funds rate reaching at least 3.50%.

Plans for the Fed to accelerate its balance sheet reduction from $47.5bn a month to $95bn a month, come September, also appear set in stone.

But markets are starting to price in interest rate cuts for 2023, following predictions the US will enter a technical recession in the second quarter of this year, said Mould and Hewson.

“The day after the Fed’s decision, the US Bureau for Economic Analysis will release its first estimate for Q2 GDP and, according to the Atlanta Fed’s GDP Now survey, this could show an annualised rate of decline of 1.6%, mirroring the 1.6% fall in Q1,” they said.

- -US durable goods orders

- -US pending homes sales

- -US oil inventories

- -In Asia, quarterly results from SK Hynix and UMC

- -In Europe, quarterly results from Airbus, Kering, Daimler, BASF, Universal Music, Danone, Deutsche Bank and Credit Suisse

- -In the US, quarterly results from Meta Platforms, Qualcomm, Bristol Myers-Squibb, Boeing, LAM Research, Ford, Kraft Heinz, Spotify and United Rentals

Thursday 28 July

- -First-half results from Anglo American

Since peaking at £41.70 in April, Anglo American’s shares have reversed all their gains, as the prices of key commodities – such as nickel, copper and iron – have come crashing back to earth amid fears of an impending recession.

“Anglo’s exposure to a diverse range of metals hasn’t been able to help, such is the widespread nature of the commodity decline,” said Matt Britzman, equity analyst at Hargreaves Lansdown.

“There have, however, been some Anglo-specific issues too. In April, it was reported that production over the first quarter was 10% lower than last year, impacted by staff sickness and high rainfall.”

In addition to the production guidance downgrade, costs are also expected to be 9% higher.

Britzman added: “On a positive note, after four years of hard work the Quellaveco project in Peru produced its first copper concentrate. Commentary is awaited on when commercial operations are likely to begin, with a few regulatory hurdles still to overcome.”

- -First-half results from Shell, Smith & Nephew, Segro, Barclays, Centrica, ITV, Metro Bank, National Express, Foxtons, RELX, Rentokil Initial and Robert Walters

- -Trading statements from BT, Aveva, Sage and CVS Group

- -German inflation figures

- -US Q2 GDP growth (first estimate)

- -US weekly unemployment claims

- -In Asia, quarterly results from Samsung Electronics, Prada, Baidu

- -In Europe, quarterly results from Nestle, L’Oreal, TotalEnergies, Sanofi, ABInBev, Volkswagen, Schneider, Banco Santander, STMicroelectronics, Stellantis and Arcelor Mittal

- -In the US, quarterly results from Apple, Amazon.com, Mastercard, Pfizer, Comcast, Intel, Caterpillar, Hershey, Warner Brothers Discovery, Pinterest and KLA-Tencor

Apple posted its best quarterly revenue growth in the three months to 25 December, with sales climbing 11% to $123.9bn. But the macro picture has darkened since then, with a recession on the horizon.

Hargreaves’ Williams said: “Apple previously said it expects a $4bn-$8bn hit to sales as supply chain disruption and weaker demand in China weigh on performance. While we are cautiously optimistic that headwind figure will sit at the lower end, continuing disruptions can quickly alter that.”

Analysts will be watching to see if consumer demand for Apple’s products, including the new iPhone scheduled to launch later this year, will hold up amid higher inflation and the cost-of-living squeeze.

“Apple aren’t immune to rising costs,” said Williams. “With factory closures and transport costs increasing, we will be keeping an eye on how this has impacted operating profits.”

Friday 29 July

- -First-half results from Astrazeneca, Natwest, Standard Chartered, Rightmove, Croda, Intertek, International Consolidated Airlines and Drax

- Preliminary full-year results from Diageo

- -German unemployment

- -UK mortgage approvals

- -EU inflation

- -US PCE index

- -In Europe, quarterly results from Hermes, BNP Paribas, ENI, Swedish Match and Renault

- -In the US, quarterly results from ExxonMobil, Procter & Gamble, Chevron and ConocoPhillips