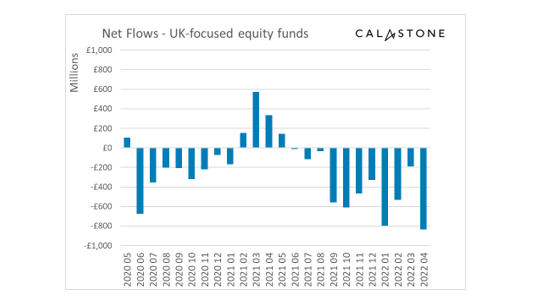

Investors sold UK equity funds at a record pace in April, according to Calastone’s latest Fund Flow Index, with risk-off sentiments outweighing a pick-up in performance.

UK-focused equity strategies lost £836m to outflows last month, beating the previous record set in January when funds leaked £795m.

Calastone noted outflows were “broadly-based”, with two thirds of UK equity funds ending the period with net redemptions.

However, it added those focused on mid and small-caps bore the brunt of the selling, accounting for two fifths of the net outflow from UK equities overall.

Calastone claims that out of £49bn invested in equity funds since 2015, no net new money has flowed into funds with a UK bent.

UK funds rise to top in poor month for performance

Investor pessimism around UK equities comes despite funds in the sector having outperformed their global, US and European peers, on average.

Whereas the S&P 500 lost 8.7% last month, the FTSE 100 was up just shy of 1%, buoyed by share price rises from energy companies, pharma giants and financials.

Similarly, the IA UK All Companies sector sustained much lower losses of 0.96% in April, while funds in the IA Global Emerging Markets, Global and North America sectors were down 2.9%, 3% and 3.6%, respectively, according to FE Fundinfo.

Funds in the IA Europe ex-UK sector were down 2.3%, slightly better than the IA UK Smaller Companies sector which fell 2.6%.

“Outflows from UK-focused funds make sense at present given the weak economic outlook, but we were surprised at just how negative sentiment was,” Edward Glyn, head of global markets at Calastone, said.

Glyn thinks the UK’s spiralling cost of living crisis could be to blame. “The flow of news on the UK economy has been relentlessly bad over the last few weeks as investors have absorbed the limited and heavily criticised set of measures announced by the chancellor to protect households from soaring inflation, while tax increases and an economic slowdown will only add to the pressure on household finances.”

See also: Henry Dixon ‘perplexed’ by UK outflows despite swell in investor sentiment

Risk-off trades dominating

Investors also shunned North American equity and European equity funds in April, Calastone said, albeit to a lesser degree.

US-focused funds shed £285m, their second highest outflow on record, while peers in Europe saw redemptions climb, month-on-month, to £168m.

The only geographic region to buck this trend was the global category, which took in £1.6bn during the month.

However, Calastone noted this was partially a bounce back from “excess negativity” in March, in which £977m was pulled, and driven by demand for ESG funds, which comprised two thirds of fund flows.

“Investors are wary. Everywhere we look, risk-off trades are dominating the picture,” Glyn said.

Equity income funds see first positive monthly flows in two years

Equity income funds had a surprisingly good month, attracting £200m of net inflows. This was the first time the category has attracted positive monthly flows in two years.

Glyn said the energy crisis, sharp falls in tech share prices and rising expectations of recession in the UK, Europe and even the US have prompted investors to re-evaluate the beleaguered asset class.

“Against this backdrop, income funds offer something of a safe haven – both those with a global and those with a UK focus – so the patterns of trading suggest there is a switch taking place from growth to income. That makes sense in the current climate.”

See also: UK equity income outlook brightens but tread carefully

Elsewhere, in another flight to caution, bond funds enjoyed inflows of £610m last month. Here, Calastone said the preference for lower risk options was also evident, with short-dated bond and inflation-linked bond funds emerging as the best sellers.

On the flip side, high yield bond funds saw almost no net new money and many suffered net outflows.

See also: Rising yields prompt investors to re-think bond allocations