Over the past two years investors will have no doubt become all too familiar with the impacts of the Covid-19 pandemic on the markets. It became apparent, just weeks into 2022, that it will continue to affect investor thinking through much of the year ahead.

Many of the pandemic’s ‘winners’, for instance, are already struggling in the wake of loosening restrictions and towards the end of January indices, such as the S&P 500, have seen falls of more than 10% as technology stocks have led a sell-off.

But this is not a new trend; indeed, as Covid restrictions have tightened and loosened, and rising inflation and an increase in interest rates have been growing over the past six months, investors understandably are evaluating strategies for the year ahead.

New entrants and new strategies

Towards the end of January, FE Investments published the latest rebalance of its Crown ratings, which evaluate the performance of thousands of investment funds across different territories, asset classes and investment styles.

The Crown ratings operate on a 1-5 scale (with 5 being the best) and are calculated by building up a ‘Crown Score’. Three years of history is required to carry out these scores, so any fund with less history than this do not qualify for a rating. Therefore, they provide an invaluable resource to the investment community.

The latest rebalance was particularly revealing in that it showed a demonstrative move away from the technology stocks that had largely been ‘winners’ during the pandemic. Additionally, over the last three years, the markets have been through a full market cycle with many rotations between growth and value funds, large and small cap focus and Covid winners and losers, so this rebalance gives a good assessment of how a fund performs through very different conditions.

This time around, a variety of strategies can be found among the seven funds which gained the highest rating at the very first time of asking.

Those funds were:

- – EFG Asset Management’s New Capital Global Balanced fund,

- – Legal & General’s L&G Future World Sustainable Opportunities,

- – Ninety One’s UK Sustainable Equity fund,

- – Octopus Investments’ FP Octopus UK Multi Cap Income fund,

- – Omnis Investments’ Asia Pacific ex-Japan Equity fund,

- – PGIM Funds’ European Corporate ESG Bond fund

- – S&W Samphire fund, managed by authorised corporate director (ACD) S&W Fund Administration.

For simplicity’s sake, if we are to look at the Octopus fund which has been operating in the relatively successful IA UK Equity Income sector, we can see how it has outperformed its sector benchmark throughout the course of 2021:

For much of the year, the fund was generating alpha returns primarily because in its strategy it has no particular bias towards any industrial or economic sector, which has stood it in good stead as the markets have rotated. The fund aims to provide predictable, attractive dividends alongside long term capital growth. It invests in companies across the entire UK equity market, with a bias toward small and mid-cap equities which they believe will provide above average income and capital growth.

The fund may also invest in large cap and international equities including FTSE 100 constituents where it is believed to be in the interest of investors, so again a broad outlook in its approach.

Market rotations

One of the standout sectors throughout the pandemic was the IA North American Smaller Companies sector, which grew by almost 66% from the beginning of April 2020 (when the markets were starting to recover from the initial Covid-19 sell-off) to the end of the year. This was largely due to a huge growth in technology-based companies whose services were in huge demand as much of the developed world switched to remote working.

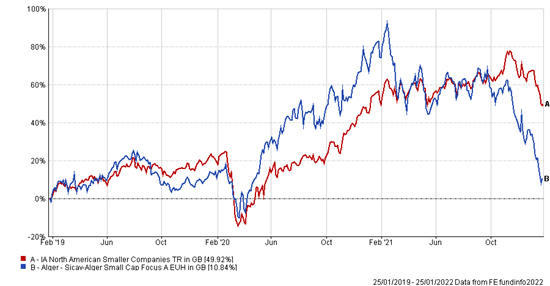

However, as the chart below shows, the performance of Alger Management’s Sicav-Alger Small Cap Focus fund, which saw its Crown rating fall significantly from 4-Crowns to 1-Crown is indicative of the difficulties that funds that specialise in high-growth stocks have been facing over the past six months after extended periods of alpha returns:

What next?

Rising interest rates and high inflation are set to continue well into 2022 and, even if a new variant of the Covid virus emerges, it is unlikely that governments will enact the same policies which fostered the conditions that enabled technology-focused funds to soar.

However, although these market rotations are more than likely to continue, there is still opportunity to be found among previous pandemic ‘winners’.

Baillie Gifford for instance, one of the most successful fund groups throughout 2020 due to the technology bias amongst its funds, has generated headlines in recent weeks for a prolonged period of underperformance. However, this is largely due to these aforementioned market shifts, rather than any structural changes within the group. A lot of the companies they invest in still have huge potential for growth, so a case could be made that there is still value to be found in the right places.

When we come to rebalance the Crowns again in July this year, we will no doubt see which funds and groups have been able to navigate these changing markets.

Charles Younes is a research manager at FE Investments