UK regulated financial firms could be required to link management teams’ remuneration to their firm’s diversity targets, under new proposals from the Financial Conduct Authority and Bank of England.

On Wednesday, the FCA, Prudential Regulation Authority (PRA) and BoE released a discussion paper setting out policy options to improve diversity and inclusion in financial services.

Options include the use of targets for representation, measures to make senior leaders directly accountable for diversity and inclusion in their firms, and linking remuneration to diversity and inclusion metrics.

A statement said the trio of regulators believe increased diversity and inclusion (D&I) results in “improved governance, decision-making and risk management within firms, a more innovative industry, and products and services better suited to the diverse needs of consumers”.

Sir Jon Cunliffe, deputy governor for financial stability at the Bank of England, said: “Diversity and inclusion is beneficial for financial stability. Groupthink and overconfidence are often at the root of financial crises. Enabling a diversity of thought and allowing for an array of perspectives to coexist supports a resilient, safe and effective financial system.

“The paper we have published invites a discussion on our thinking on how the industry, including Financial Market Infrastructure firms (FMIs), can develop its approach to diversity and inclusion, in line with our objective to ensure sound, robust financial markets.”

Progress

The discussion paper looked at progress made within financial firms on D&I and recognised the sector had “taken steps forward” but the “rate of change has been slow”. For example, the proportion of women working in authorised positions in the UK banking sector rose from 9% in 2001 to 20% at the end of 2020. For CEOs, the proportion of women rose from 1.7% in 2001 to 9.7% by the end of 2020.

It also noted that McKinsey data showed that financial services was the fastest growing sector in terms of female representation at the executive level in 2020, but pointed out that overall figures are still low. In 2020, only 5% of the CEOs in the FTSE 350 were women.

Furthermore, it said the situation for ethnic minorities is showing signs of going into reverse: “Early findings from the Green Park Business Leaders Index (2021) show a decline in the number of black leaders and the ‘black pipeline’ to senior management for FTSE 100 companies,” the paper said.

There is also limited progress on social mobility with a City of London Corporation study showing 89% of financial firms’ senior roles are held by people from higher socio‑economic backgrounds.

Sam Woods, deputy governor for prudential regulation and CEO of the PRA, said: “While some progress has been made to improve diversity and inclusion in parts of the financial services sector over the last decade, the discussion is still in its early stages, and more needs to be done to speed up progress.

“Regulators and industry need to work together to increase diversity at senior levels and ensure that the UK’s financial services firms are best equipped to serve the economy. A lack of diversity of thought can lead to a lack of challenge to accepted views and ways of working, which risks compromising firms’ safety and soundness.”

Outcomes

The paper is hoped to be a starting point in discussion between the regulators and the industry on setting higher standards for D&I. They want firms to “think about how they can advance D&I through improving their policies, governance arrangements, accountability, remuneration arrangements and disclosure”.

Diversity data

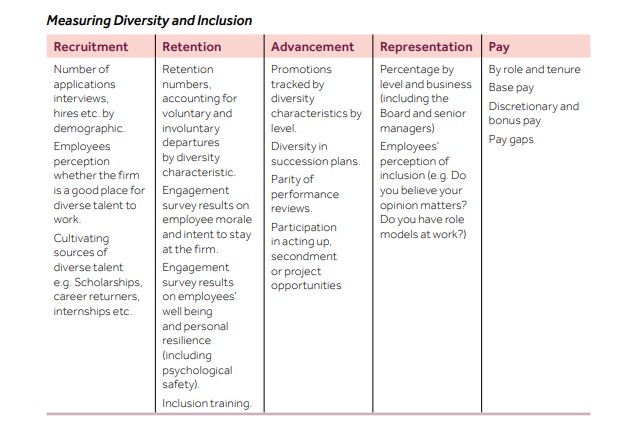

There is also a focus on data collection and monitoring within the discussion paper and one of the potential expectations of firms is to develop metrics that enable monitoring of their D&I policies and initiatives. It acknowledged that most groups collect data on gender but said they should also be collecting data on “any of the protected characteristics and nationality, educational attainment, age, disability, sexual orientation, family status, carer and parental status, employment status (full time, part-time, flexible working), for example.”

It also suggested the following table as a guide to monitoring D&I:

Reporting in this way, the paper added, could become a regulatory requirement, but added: “We recognise that developing a new data collection would take time, and firms would need to build systems and collect the data from employees, where they do not already do so. Based on feedback on this DP, and the evidence received in the pilot data collection, including consultation with the UK data protection supervisory authority (the Information Commissioner’s Office), we will develop more detailed proposals on potential reporting requirements which we will consult on in due course.”

See also: The dos and don’ts of diversity data

Leadership

In terms of leadership and culture, the paper said D&I should be linked to those at the top.

“We know that diversity and inclusion has become a priority for many leaders in the financial services industry but it has been difficult to sustain effective change. We believe that it requires deep cultural change in many firms. Leaders need to set a compelling strategy and empower their teams to develop and implement initiatives that deliver cultural change at all levels within their institutions. They will have to set goals, monitor the effectiveness of change programmes, identify barriers and make changes where necessary. Senior managers will have a key role to play but, as with any culture issue, diversity and inclusion should be a concern for leaders at all levels.”

It added boards should monitor and challenge diversity progress and be satisfied that decision makers are “reaping the benefits of diversity of thought” and that establishing inclusive cultures is a “critical part of making this work”.

Succession planning was also addressed with firms encouraged to give thought to how upcoming appointments are considered in terms of diverse representation and invited views on how diversity is best achieved at the board level.

Remuneration

It also said linking progress on D&I to remuneration could be a key tool for driving accountability in firms and incentivise progress. In a 2021 annual review by carried out by the FCA, only 5% of signatories reported that they believe the link to remuneration not to be effective. The regulators asked for guidance on how metrics on D&I advances could be used as part of non‑financial criteria when setting variable remuneration awards.

D&I policies should also be a “central consideration for all firms”, the paper said, rather than a sideline with clear documents setting out expectations for staff and management.

The paper also invites views on setting D&I targets for senior management and also customer-facing roles.

See also: Number of women on FTSE boards jumps but ‘more to be done’ at executive level

“We would also like to gather views on the merits of setting any requirements or expectations for firms to set targets for underrepresented groups for entry into the wider senior management population, either quantitative or qualitative. We would want to avoid this becoming a ‘tick box’ compliance exercise. Any such target‑setting would need to take account of the wider cultural context of the firm and firms would need to be able to explain the actions taken to meet any targets.”

The discussion paper is open to feedback until 30 September 2021.

The PRA’s Woods said: “The paper we have published today is intended to start a new conversation with firms about how we can best move forward across the sector, while we also take steps to improve diversity and inclusion within our own organisations. I encourage firms and other interested stakeholders to give us their views on our proposals.”

Nikhil Rathi, chief executive of the FCA, added: “We are concerned that lack of diversity and inclusion within firms can weaken the quality of decision-making. We look forward to an open discussion on how we should use our powers to further diversity and inclusion within financial services, to the mutual benefit of firms and their customers.”

Reaction

ESG Clarity editorial panellist and CEO of City Hive, the network for change in the asset management industry, Bev Shah said: “Our leading financial institutions openly discussing diversity and inclusion makes this an issue firms can no longer ignore or sideline. Diversity data will show who is acting and who is greenwashing. Diversity is something that goes hand in hand with TCF.”

For more on ESG investing, please visit esgclarity.com