Fidelity has grabbed headlines with its launch into restricted financial advice organised as Fidelity Wealth Management.

It joins a number of big asset management players, such as Schroders, M&G and Quilter, which have made the decision to offer financial advice to their investors, clients and customers.

The development may give independent advisers food for thought, where they recommend a fund or utilise a platform which is, at least in theory, also competing with them by offering advice services too.

That said, many experts Portfolio Adviser spoke to believe the firm can maintain distinct channels.

Closing the advice gap

The move also begs questions about the size of the advice pie and indeed whether such services will contribute to closing the advice gap. Fidelity is explicit about wanting to do so.

At launch, Stuart Welch, global head of personal investing and advisory at Fidelity International said: “The FCA has noted the progress made in closing the UK’s advice gap in recent years. However it has stressed there is still significant work needed to ensure those who require help in managing their finances have access to services which can help them with the decisions they face.”

The firm says Fidelity Wealth Management will build upon its existing wealth and retirement services, bringing them together in a centralised offering.

It also has plans to expand upon these in the future with the addition of estate planning, what it describes as tax optimisation and broader financial planning services.

Interestingly, given recent pandemic challenges and shifts in communications, Fidelity says customers can select the services which are most relevant to their needs, as well as how frequently they speak with an adviser. It says advice can be arranged as a single meeting or reviewed annually, and through several channels depending on a customer’s preference – including telephone or video conferencing.

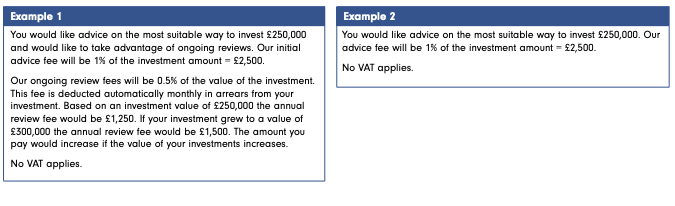

Two examples of its advice fee were included in a brochure accompanying the launch announcement:

Fidelity says it is ‘fully committed’ to supporting IFAs

Portfolio Adviser asked Fidelity to address the potential concerns that advisers might begin to view it as a rival emphasising strict protocols across the business.

It said: “We are fully committed to supporting independent financial advice firms and have continued to invest heavily in the Fundsnetwork platform as evidenced by our delivery of API-enabled services, DFM functionality, transfer tracking, client reporting capabilities and support for Covid-19 working arrangements. We fully respect the relationships between advisers and their clients and have strict protocols in place to ensure they are excluded from marketing campaigns being run for our Personal Investing and Wealth Management offerings.

“Fidelity Wealth Management will complement the existing services we offer to support the growing need for financial advice in the UK – allowing us to support a range of investment, wealth and retirement options. This includes both the services we offer directly to clients, such as our Personal Investing platform and Fidelity Wealth Management, and the service we offer to intermediaries supporting their own clients, such as Fundsnetwork.”

Their high net worth D2C clients have been clamouring for advice for a long time

Addressing the issue of just how much the service competes with advisers, Fundscape CEO Bella Caridade-Ferreira (pictured) says: “The launch of the Fidelity Wealth Management arm is not an adviser platform development and it won’t compete with Fidelity adviser users. It’s an expansion of the Fidelity Personal Investing service for D2C customers.

“Advice is something that their high net worth D2C customers, in particular, have been clamouring for, for a long time. Over the years, Fidelity has probably lost high net worth clients to other D2C platforms that have an advice proposition too, so Fidelity is addressing the issue with this new service.”

Lang Cat consultant Mike Barrett adds: “Any provider developing these type of services needs to ensure two things. Firstly, that individual client suitability is always achieved. For example, this could mean handing off the client to a full advice service if their needs are too complex or advising them to go elsewhere if investing is not the best course of action for them.

“Secondly, the provider needs to ensure they don’t tread on the toes of advisers. If the client already has an adviser, the focus should be on supporting and enhancing that relationship. If they do not, then offering them an advised service as opposed to letting them DIY is a positive move.”

Will Fidelity Wealth Management resonate?

CWC Research’s director Clive Waller says that the UK market may hold particular challenges, in contrast to the US where Fidelity has long-established advisory and more recently robo and hybrid advice services.

He says: “My gut view is, and always has been, that in the UK we like brokers. So, for example Hargreaves Lansdown or Interactive Investor. This is unlike the US, where investors are much happier to deal with providers. We just do not seem to want to. Everyone calls Hargreaves D2C, but they are not. They are a broker.

“For Fidelity to succeed, they must create what in effect is a cultural change. You cannot compare the new Fidelity launch to Schroders Private Wealth, which for me is a pretty standard bancassurer offering with a traditional salesforce to take on SJP.

“Fidelity are certainly serious, with two significant acquisitions [L&G’s personal investing business and Cavendish Online] in 2020. But can they change UK culture? What sort of people will approach them? Or will they be proactive and approach clients? I am looking for firms who can challenge SJP, who dominate direct sales (and are still a broker) and Hargreaves who dominate so-called direct. I am not sure Fidelity are it.”

See also: Will other fund houses follow M&G wealth management push?