Bank of America’s global research team has said ESG is an opportunity for asset managers to create “tens of trillions of dollars over time” as it pointed to firms it believes are best positioned in the US and Europe

In the note ESG is transforming Asset Management, authored by research analysts Michael Carrier, Hubert Lam, Shaun Cainan and Gayathri Ramkrishnan, it said sustainable or ESG investing had become an “increasing area of focus for corporates and investors in recent years” and is “likely to be another differentiator” between the most successful and unsuccessful firms.

“In our view, the ESG opportunity is significant for the industry, and for firms that have a real strategy, the outlook can be attractive, and for those firms that lack a strategy, it could be another headwind in separating out the winners and losers in the asset management sector,” the note said.

The ESG opportunity

There are many drivers that are encouraging asset managers into ESG. The Bank of America (BofA) note said “client demand, alpha potential and risk mitigation” are the main factors, while incorporating ESG into their strategies also aligns with their fiduciary duties.

The majority of asset managers surveyed by Cerulli cited in the note indicate they have an ESG integration approach – some 89% indicated this, while 72% said they followed an active ownership approach.

Three quarters of the asset management firms questioned by Cerulli cited risk mitigation and client demand as their top reasons for using ESG criteria, but more than 66% said it was also to improve alpha or excess returns.

“Several managers believe that taking ESG consideration into account delivers long-term investor value and drives positive change in the companies in which they are invested,” the note said.

The research team found that European companies with a higher overall ESG score outperformed those with lower ESG scores during its backtesting period between December 2007 and August 2019. On average they provided 4% annualised returns.

Additionally, ESG is the best measure for signalling future earnings risk, the team found.

“We view the ESG market opportunity as significant, particularly given increasing investor demand and different strategies,” the note said.

Data and definition challenges

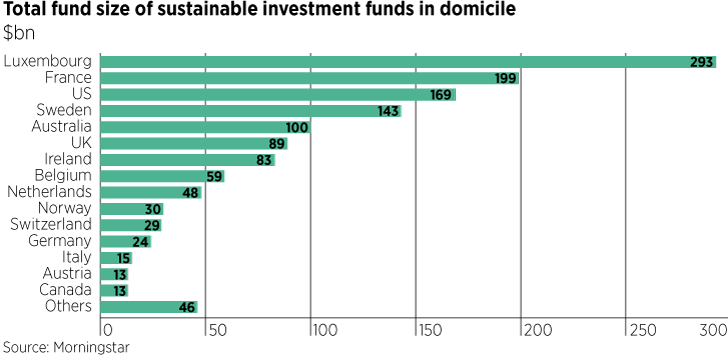

Because of the different definitions surrounding responsible investing, BofA said it can be difficult to size up the industry.

The note explained: “While very specific sustainable investing strategies only amount to the hundreds of billions of dollars in assets today, the broader definition has tipped into the trillions.”

Highlighting again the opportunity this holds for groups developing their sustainability status, the note added: “Over time, we expect the majority of investment strategies to incorporate some form of ESG process, which could create an opportunity set in the tens of trillions of dollars over time, which is a significant opportunity for asset managers, or a significant risk if firms aren’t focused on this area.”

As growth and demand soar in ESG strategies, the industry is still relatively young and faces some hurdles as investors get to grips with a sustainable way of investing.

BofA identified the biggest impediments for asset managers as “data quality” and, as highlighted already, “defining the style of ESG investing”.

“A majority of asset managers we surveyed suggested that data – availability, consistency, reliability, subjectivity, and comparability was their biggest challenge,” the note said.

These were broken down into the following:

• Not all companies disclosed ESG data and there was limited standardization in reporting.

• Even when data was available from third party providers it wasn’t always sufficient or comparable across providers.

• ESG meant different things to different groups, resulting in subjectivity that made comparability harder.

Who are the best?

Challenges aside, BofA identified a number of asset managers it said were set to be the ESG winners.

Upon evaluating a number of quantitative and qualitative factors such as AUM covered by ESG, variety of ESG products and strategies deployed, ESG investment process and engagement models, thought leadership and advocacy, it judged the following as best in class.

| Best positioned US groups | Best positioned European groups |

| Blackrock | Amundi |

| Eaton Vance | DWS |

| Federated Hermes | Schroders |

| T Rowe Price | Standard Life Aberdeen |

Source: BofA Global Research

“While most asset managers have an ESG strategy, there are some firms that are further ahead than others.

“Blackrock, Eaton Vance, Federated Hermes, and T Rowe are best positioned in the US, and Amundi, DWS, Schroders and Standard Life Aberdeen are best positioned in Europe,” the note said.

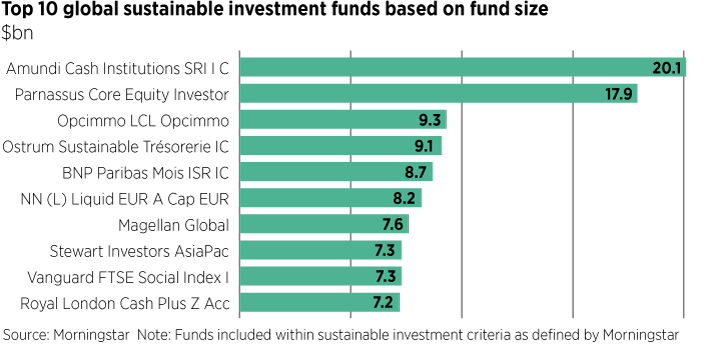

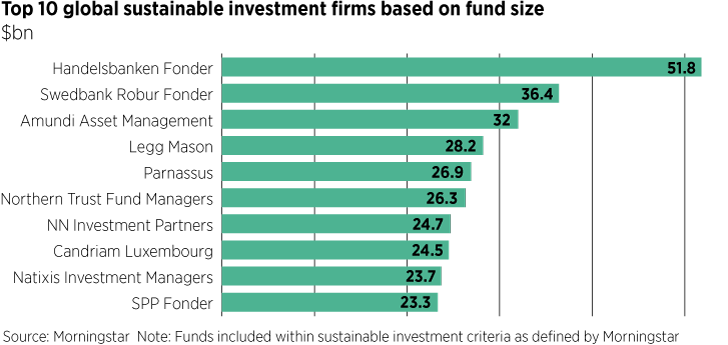

Additionally, BofA created charts based on the top 10 sustainable investment funds by fund size and top 10 sustainable investment firms by fund size.

For more insight on responsible investment, please click on www.esgclarity.com