Even before the full extent of the Covid-19 outbreak was realised, property as an asset class had been creating a lot of discussion among investors. Towards the end of 2019, the gating of several groups’ funds based on liquidity issues was brought to a head following the suspension of M&G’s Property Portfolio, following “unusually high and sustained outflows”.

One might expect then that those funds with prior structural deficiencies and liquidity issues would be particularly vulnerable in a crisis as deep as the one in which we currently find ourselves. What we have seen however is a much more diverse picture. It is in this diversity where property as an asset class presents opportunity.

> See also: ACDs update investors locked out of open-ended property funds

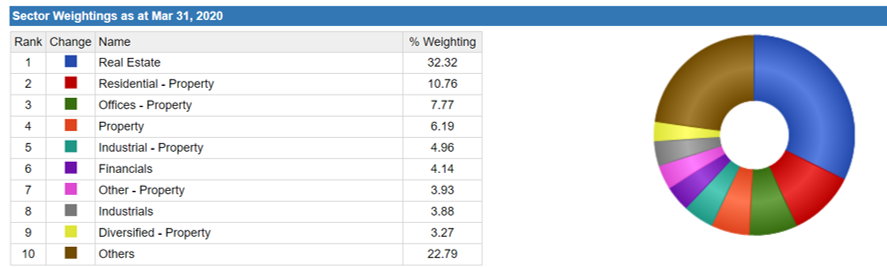

If you are to take the IA Property Other sector as a whole, you will immediately find it is extremely broad and covers a wide range of industries and funds. As such, the measures that we have seen governments around the world introduce in recent months have impacted these industries very differently.

At the sharp end, the collapse in global travel has had a severe impact on property within the leisure industry. Hotels and resorts remain empty while airports have shut many of their runways. Alongside this, retail has been hit particularly hard as non-essential shops have closed and many have made the move to buy as much as possible online. The residential area meanwhile has also been affected, though it is hoped not as drastically in the UK given the furlough scheme will support rent payments.

At the other end of the scale, the office sector has held up surprisingly well, despite the move to homeworking. A lot of companies are already set-up to work remotely but will continue to pay their office rent regardless, given the ‘knowledge’ economy is likely to be able to survive a lockdown better than ‘physical’ business models.

Industrial and logistics areas have done much better too as transport, e-commerce and other essential services continue to function and with increased importance. Finally, an interesting area of property is that of data centres which stand to benefit from the increased social distancing measures, where consumers are increasingly turning to streaming and gaming services and living more of their lives online.

How direct property funds have fared in previous market crises

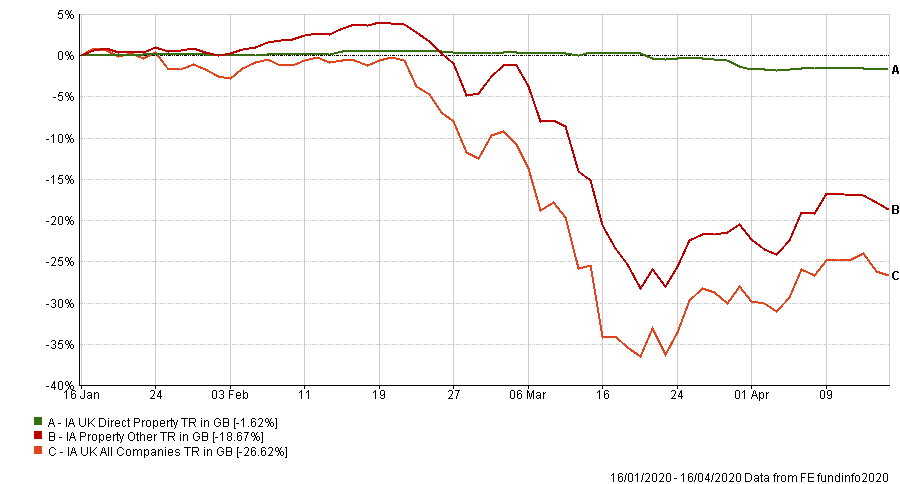

If we turn to the IA UK Direct Property sector, we see from the chart below that over the past few months, it appears as though it has weathered the storm better than the IA Property Other and particularly equities with the IA UK All Companies sector.

While initially this looks to be a positive affair, if we are to compare this with previous sell-offs in 2008 and then in the aftermath of the Brexit referendum, where direct property funds were gated, a common theme is that their performance lags. At the beginning, the funds didn’t fall that much, but this is because they are invested in non-publicly traded assets and the price discovery is delayed. The inevitable downturn in these funds, as rent reductions and tenants going through CVA kick in, is yet to be realised. We can reasonably expect this to be felt within the next 6 to 12 months.

At FE Investments, we have taken the decision to invest only in listed real estate. While it is more volatile, it doesn’t have the liquidity issues of physical property. As such, the listed property market has recently been offering attractive yields without needing to take the illiquidity risk.

At fund level in the listed real estate space, there are quite a few bright spots. One example is Schroder Global Cities Real Estate fund which was launched in 2014 and has been a stand-out performer, compared to the global benchmark. At the outset the fund managers, Hugo Machin and Tom Walker, were focused on key global urbanisation trends, so they were already allocated in areas such as data centres, logistics and e-commerce, which have subsequently come to the fore throughout the coronavirus pandemic.

> See also: REITs face same uncertainty that prompted raft of property funds suspensions

Many of the trends that were already in process are being accelerated by this latest crisis and funds invested in these areas will benefit. Indeed, some of the issues that were highlighted as an issue after the Brexit referendum might actually play in some of the direct property funds’ favour when they re-open. High cash levels will mean they can meet redemptions without being forced sellers – or better yet still have firepower to buy cheap quality assets. What all of this shows is that even in a crisis, there is still opportunity to be found within property.

Louis Tambe is a fund analyst at FE Fundinfo