If there was ever a time for absolute return funds to prove their worth and show they can deliver positive returns as markets crash, now, during the coronavirus meltdown, would be it.

On average, funds in the Investment Association Targeted Absolute Return (TAR) sector have outperformed their pure equity counterparts. From the beginning of the year to 19 March, the sector was down by 3.7%, compared with IA UK All Companies and IA UK Equity Income, both down a sobering 25.2%.

The only asset classes to deliver positive returns during the period, unsurprisingly, were fixed income-based, with UK Gilts leading the charge, up by 9.8%.

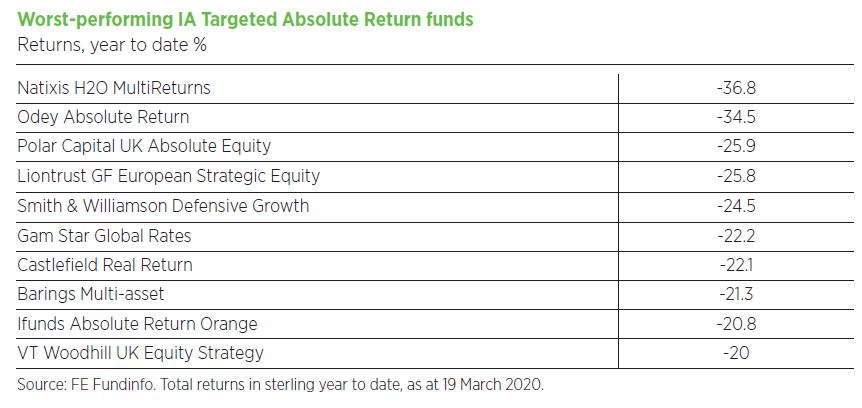

AJ Bell head of active portfolios Ryan Hughes says looking at the sector average is not helpful in this case, due to the wide range of strategies that come under the IA TAR umbrella. There’s a “huge dispersion” between the best and worst funds, Hughes says. The top-performing fund in the sector, the Argonaut Absolute Return Fund, was up by 24.3% year to 19 March, while the worst performer, Natixis H2O Multireturns, was down 36.8%.

Myth busters

During the biggest drawdown period for the FTSE 100, from 21 February to 19 March at the time of writing, only eight out of 119 funds in the IA TAR sector achieved a positive return. Invesco Global Targeted Returns, currently the largest fund in the sector at £9.1bn, was down 2.8%, while the £5.7bn BNY Mellon Real Return Fund was flat.

Aberdeen Standard Investments’ Global Absolute Return Strategies Fund (Gars), which had enjoyed a recent pick-up in performance, was down 5.9%, and Aviva Investors Multi-Strategy, set up by the brains behind Gars, Euan Munro, delivered comparable losses.

The Natixis H2O Multireturns Fund, which returned -37.6% over the period, did worse than half the 393 funds in the IA UK All Companies, UK Equity Income and UK Smaller Companies sectors.

“You can see the notion that absolute return funds perform in all market circumstances is a myth,” says Peter Sleep, senior portfolio manager at Seven Investment Management.

“Most of the sector is not fit for purpose,” according to Square Mile portfolio manager Charles Hovenden. “Certainly, when the market is up 20% you are not expecting them to be up very much. What they have to do is protect capital during the downfalls.”

One of the problems is that many funds in the sector run “fairly static” net long equity positions of 25%, meaning when markets tumble they also take a sizeable hit, according to Hovenden. “In a relentlessly rising market, the temptation to ride that beta is high, which we saw in February,” he says.

Argonaut Absolute Return dominates during Covid-19 drawdown

However, absolute return fund losses in general have been far less severe than UK equity funds during the worst of the drawdown. The best UK equity fund, Ardevora UK Equity, was down 22.7%, while the best absolute return fund, Argonaut Absolute Return, was up by 10.4%.

The Argonaut Absolute Return Fund has a net equity exposure of 26%. But Morningstar investment research analyst Fatima Khizou says the alpha generated from its short book would have been enough to offset losses from the long book. Manager Barry Norris’ (pictured) big winners in February were shorts against smartphone chip supplier AMS and NMC Health, which saw its shares plunge 33% after rumours ramped up about Ponzi scheme irregularities at the Arabian hospital.

Khizou says having a skilled management team, strong investment process and appropriate risk controls in place are all things that would help absolute return funds navigate choppy markets. And as with any type of portfolio, diversification is key, she adds.

Having too many closely correlated positions has been the main problem for one of the biggest flops in the sector, the Jupiter Absolute Return Fund. Though manager James Clunie has around 83 long positions and 113 short holdings, most of his bets are big macro calls on similar themes of growth versus value and US versus UK equities.

“Whether you have 20, 50, 100 or 500 stocks, if they are all exposed to the same theme or factors, then your diversification benefit is much reduced,” explains AJ Bell’s Hughes.

“Jupiter Absolute Return has a lot of short positions in very similar companies, essentially highly valued growth stocks, and therefore while benefiting from diversifying individual stock risk, the fund isn’t really gaining any benefit at a sector or theme level.”

Clunie was “absolutely crucified” in January when the dispersion between value and growth was its highest since the height of the dotcom bubble in June 2000, Hovenden notes. Clunie’s bets against electric car maker Tesla, and one of its biggest backers Scottish Mortgage trust, run by James Anderson, have come back to bite him with the fund down 14% year to date after Tesla’s share price tripled.

Performance has picked up slightly during the worst of the coronavirus sell-off , with the fund finishing 22 out of 199 funds in the IA TAR sector between 21 February and the time of writing.

The fund’s shortcomings ultimately boil down to an issue of risk management, says Hovenden. “When you’re getting it wrong, what you do is control the risk. Managers shrink their growth exposure, they stop digging, take money off the table and re-evaluate.

“The mistake in the Jupiter fund is the more it went against him, the more he kept digging. I suppose he got stubborn.”

Chain reaction

Funds across the sector have been losing assets. Clients pulled around £14.5bn from absolute return funds, according to Morningstar flows data, taking total assets to £53.5bn. ASI Gars has continually been the biggest source of outflows, leaking £7.3bn last year. Once the biggest fund in the sector, at £12.6bn at the start of 2019, it now sits at £4.6bn.

Invesco Global Targeted Return saw redemptions of £2.6bn, followed by BNY Mellon Real Return at £1.9bn and Aviva Investors Multi Strategy Target Return at £1.1bn.

Sleep thinks the “maximum disillusionment” with absolute return funds set in when equity markets were soaring. Gars, for instance, did not do that badly in 2015/16 when redemptions started picking up, it is just that it was down fractionally when equity markets were doing well .

“Some people thought funds like Gars were an easy alternative to equity that would go up with equity markets and still go up when equities went down,” says Sleep. “I think this is a misunderstanding of absolute return. They should be seen as an investment that makes money from something other than the equity and bond markets, and as such will diversify your portfolio at all times – when equity and bonds are not doing well and when they are.”

Breached defences

Clunie’s fund lost a third of its assets over February alone, as clients withdrew £267m. Chelsea Financial Services was among the fund selectors to give Clunie’s fund the heave-ho, selling out five to six weeks ago. The fund had been in its portfolios since launch.

“We expected it to be a cushion or a hedge,” the firm’s managing director Darius McDermott, explains. “When markets were going down, we believed it was positioned to defend us. And unfortunately, for a long period of time it didn’t.”

McDermott has previously relinquished positions in Merian Global Equity Absolute Return and the BMO Global Equity Market Neutral Fund for similar reasons. Merian Gear lost 5.4% during the worst of the coronavirus drawdown. Meanwhile, BMO announced in early March it would be winding up its absolute return fund after investors rushed to withdraw money as the fund slumped by 25% in the last year. During that time the fund has shrivelled from £621m at the start of 2019 to £4.8m.

Also burned by the BMO Global Equity Market Neutral Fund was 7IM, but Sleep says the firm does have several alternative funds that are doing well at present, such as the AQR Managed Future Fund.

Hovenden’s favourite fund in the space is Blackrock European Alpha, while McDermott likes the UK version of the Blackrock Absolute Return Fund as well as Janus Henderson UK Absolute Return and Man GLG UK Absolute Value, which he says have “defended admirably on the downside” amid the coronavirus sell-off .

“I don’t think anybody could have predicted the global pandemic was going to be what shook markets,” says McDermott. “When you’re running portfolios you do want a bit of ballast, and the things that have held up the best have been our absolute return funds.” On 18 March, these funds were down by 2-5%, “which when markets are down 30%, means it’s done its job”.