The final valuation of the Woodford Equity Income fund has revealed the magnitude of the biggest ever maximum drawdown in Neil Woodford’s career with investors who invested £1,000 at the fund’s peak losing almost half their money so far with further writedowns expected to come.

The Financial Conduct Authority granted permission for the fund’s wind-up to begin on 18 January with investors due to get their first distribution payment on 30 January. The final valuation of the fund on 17 January cemented Woodford’s most significant and prolonged maximum drawdown highlighting how far the star fund manager has fallen since his Invesco days.

Woodford (pictured) was dubbed the UK’s answer to Warren Buffett when he stepped out on his own to open his boutique fund business and was lauded in the press as the man who could turn a £1000 investment into £25,000. In fact, the figure was actually higher for any investor that timed their entry and exit to the fund correctly.

The man who turned £1,000 into £583

But for investors who bought Woodford Equity Income at launch and stuck with the fund all the way until the suspension Woodford will be remembered as the man who turned £1,000 into £794, thanks to the 20.6% losses in the fund between launch in June 2014 and Woodford handing over the reins this month. The IA UK All Companies sector has returned 44.1% over the same period, while the FTSE All Share has risen 43.2%.

The losses are twice as high for investors who bought Woodford Equity Income at its peak.

Punters who backed the fund in June 2017 and failed to sell out before its suspension are currently sitting on a 41.7% loss compared with the FTSE All Share’s gain of 14.1%, Morningstar data shows. That follows a £150m writedown at the fund’s final valuation on 17 January, which delivered a further 5% hit to investors.

Rather than growing these investors’ saving pots, Woodford would have turned a £1,000 investment into £583 with further blows expected to come as the fund winds down.

‘We are right in the midst of the biggest drawdown period’

“Sadly, we are right in the midst of the biggest drawdown period,” notes AJ Bell head of active portfolios Ryan Hughes, who points to the further writedowns to come as Blackrock and PJT Partners sell off the less liquid and unquoted parts of the portfolio.

Hughes says “it is a reminder that no manager has the recipe to outperform the market forever and that skills are not always transferable into different parts of the market”.

Woodford Equity Income vs FTSE All Share during its worst drawdown period

FE Investments fund analyst Amy Kennedy notes the fund outperformed the FTSE All Share “by a solid margin” until November 2017 at which point “the tide turned in a pretty substantial way”. Those investors who stuck their money in at launch and were lucky enough to pull out when the fund reached peak value would have seen their investment grow by 38.5%, outperforming the FTSE All Share’s gains of 25.4%.

Woodford Equity Income return on £1000

| Return | |

| Maximum drawdown period (June 2017-present) | £583 |

| Maximum gain (June 2014-June 2017) | £1385 |

| Since launch | £794 |

Source: Calculations based on total return in sterling from Morningstar

Woodford’s underperformance worse now than during financial crisis

Woodford’s losing streak at his fund boutique is considerably worse than his longest drawdown periods at Invesco.

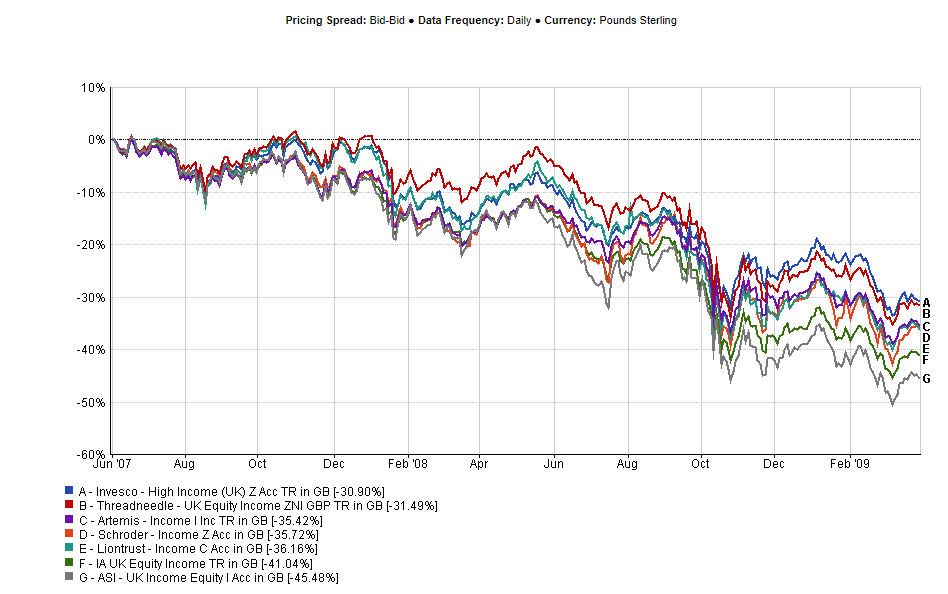

Invesco High Income, which he ran from launch in 1988 until he left to set up Woodford Investment Management, saw its worst period of underperformance between 01 June 2007 and 31 March 2009, smack dab in the middle of the global financial crisis.

Investors lost 30.5% over the period but Woodford’s decision to ditch his UK bank holdings before the crisis hit, one of the calls that would cement his reputation as a star stock picker, helped his fund hold up better than other equity income giants.

Invesco High Income was the third strongest performer in the IA UK Equity Income sector during its worst drawdown period, data from FE Fundinfo shows, coming in ahead of Threadneedle UK Equity Income (-31.5%), as well as Adrian Frost’s Artemis Income fund and the Schroder Income fund, now headed up by Kevin Murphy and Nick Kirrage (both down -35%).

Woodford’s second fund Invesco Income saw its worst drawdown period around a similar time frame (01 November 2007 and 31 March 2009), losing investors 31.3%.

Woodford then vs Woodford now is apples and pears comparison

Hughes says comparing Woodford’s performance at Invesco versus at his investment boutique is like comparing apples with pears given his significant style drift over the period.

“Neil Woodford’s performance at Invesco was very strong, delivering huge outperformance of the FTSE All Share Index and garnering his reputation as a star fund manager,” Hughes says. “While we all now know how this has ended, it will go down as a fascinating case study in how a manager changed his investment approach from a successful formula focusing predominantly on large caps to one focused on small and unquoted companies.”

Investors who backed his Invesco High Income fund at launch in 1988 and stuck with him over the 26 years he ran the fund saw returns surge by over 2,935%, according to Morningstar data.

Invesco Income, which Woodford took over for Martin Rasch from 1990 until he left Invesco in February 2014, produced similarly stellar returns over the period during which he ran the fund of 2,084%.

Willis Owen head of personal investing Adrian Lowcock adds that the lax risk and governance controls at Woodford’s boutique compared with Invesco makes Woodford Equity Income a different beast from Invesco High Income.

“The long term track record of Woodford got lost in the subsequent collapse of his funds,” says Lowcock. “While it is important to remember that contrarian fund managers do have periods where they are out of favour with the market there was more to the situation than a blip in the funds performance.”

Useless to speculate on eventual losses

On top of the 43% they’ve lost already Woodford Equity Income investors will likely face additional losses as the fund’s illiquid assets are sold down.

Unquoted stocks made up a third of the portfolio, by the end of April 2019. A report commissioned by the fund’s authorised corporate director Link has previously forecast losses at the end of the wind-up could be between 32.5% in a base case scenario or as high as 42.6%.

Portfolio Adviser understands these figures were part of an analysis carried out while considering an offer from a third party for the entire portfolio which Link rejected.

Blackrock has so far realised £1.9bn from selling off 90% of the listed portfolio, which makes up 63% of the value of the fund.

Figuring out what price PJT will be able to sell the illiquid holdings at is like “pinning jelly to the wall,” says Peter Sleep, senior manager at Seven Investment Management.

Sleep points out that immunotherapy start-up Autolus saw its shares fall 20% last Thursday after issuing new shares, meaning Link’s 14% share which was worth £70m is now worth closer to £50m.

“It is pretty useless to speculate on the eventual losses,” he says. “Prices for biotech companies are depressed because buyers know Link is desperate to sell Woodford’s illiquid to anyone who will take it.”