On 25 January billions of people around the world celebrated Chinese New Year, to mark the start of Spring. The most important date within the Chinese calendar, the festival is associated with new beginnings and, as is tradition, throughout China red envelopes containing money are exchanged, to transfer good fortune from one generation to another.

The passing of Chinese New Year has sparked some conversations within the investment community about China as an investment prospect. For investors with red envelopes of their own, there is no doubt that Chinese markets offer interesting, if perhaps daunting opportunities to explore in 2020.

At first glance, it would seem that there is much to be cautious about when it comes to investing in Chinese markets. Much of the last year was dominated by the threat of a trade war between the US and China, while further back, US Senator Mark Rubio criticised the MSCI index’s decision to include Chinese A-shares within its benchmarks, citing concerns over corporate governance and transparency in reporting.

Additionally, the large presence of state-owned enterprises and the risks of VIE structures, have all been cited as reasons for not investing in Chinese markets. Lack of clarity and quality of reporting, particularly in China A-shares have also put off some fund managers as well.

China defies US trade war fears

Nonetheless, China’s growth has been impossible to ignore and the MSCI decision has enabled foreign investment to pour into the Chinese equity markets. As a sign of its importance, MSCI has been increasing its weighting, particularly in its Emerging Markets index. Several managers have already found opportunities in China A-shares and have subsequently increased allocations. Most have increased their research capabilities to include Chinese A-shares at the very least.

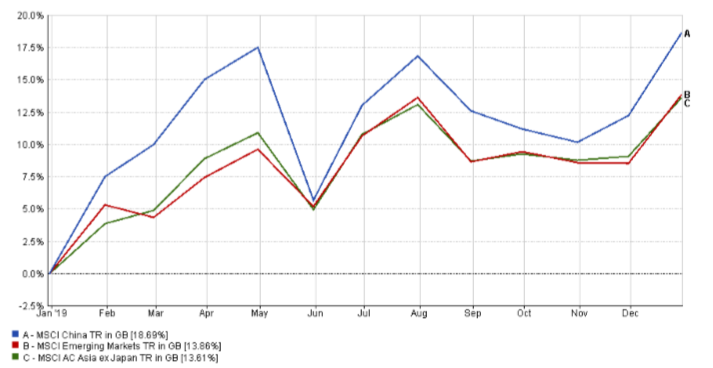

So how have the Chinese markets performed?

Quite simply, they have done well. Over the past year the IA China/Greater China sector has outperformed those other sectors concentrated within the Asia/Pacific region, or the IA Global Emerging Markets sector. China outperformed most countries within the emerging market region in 2019.

It may seem ironic that in a year when trade tensions were running high, China – which has been central to the whole storm, actually outperformed its competitors. Sentiment has swung significantly in and out of favour based on Trump’s tweets, but China has implemented various measures aimed at reviving its slowing economy. This includes lowering interest rates on several occasions and the larger than expected cut to value-added-tax.

The recovery in the last quarter drove some outperformance as US President Trump pared back his trade rhetoric. US tariffs on China were scheduled to increase on 15 December but a phase-one trade deal provided significant relief for markets. In China, this was evident in the consumer discretionary names, which includes many of the large index constituent Chinese internet companies.

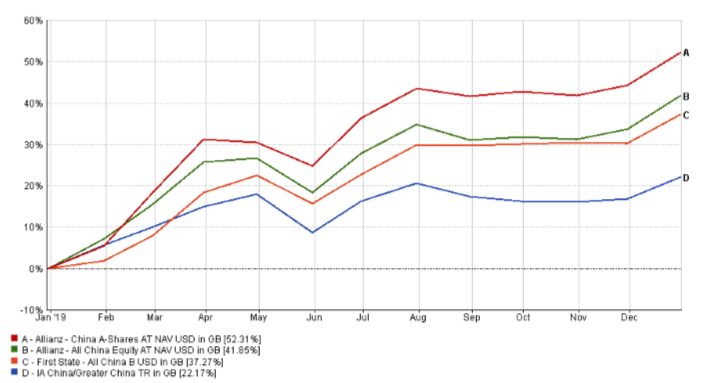

Top China fund nears 60% returns

At fund level the IA China/Greater China sector has seen some very strong returns.

The sector’s top five performers (Allianz China A-Shares; Allianz All China Equity; First State All China; JPM Greater China and NB China Equity) would all top these other sectors within their own right. Interestingly – and despite the growing importance of the MSCI index as a benchmark for passives – the sector’s top performer, Allianz China A-Shares, is an active fund managed by Hong-Kong based Anthony Wong, who has seen a 58.43% return based on fairly balanced concentrations within consumer products, financials, industrials and telecoms, media and technology.

MSCI China / MSCI Emerging Markets/ MSCI Asia ex Japan – one year performance

Source: FE Fundinfo/31 December 2018 to 31 December 2019

It is a similar story within the IA Global Emerging Markets sector, with funds concentrating in China seeing strong returns over the past year. The sector leaders during this time (Pictet Emerging Markets; Lazard Global Active Developing Markets Equity and Robecco Emerging Markets Equities) maintain concentrated holdings within the Asia Pacific Region and in Chinese companies such as Alibaba.

Top performers within the IA China/Greater China sector over the past year

Source: FE Fundinfo/31 December 2018 to 31 December 2019

Past performance is of course no guide to future behaviour and this is particularly the case in emerging markets like China where the risk of greater volatility is substantial. While growth has been impressive, the concerns raised relating to corporate governance and transparency within the Chinese economy are very valid. So, it would be self-assured investor that would overlook these entirely and store all their red envelopes in one place.

Tanvi Kandlur is senior fund analyst at FE Fundinfo