“I’ve just seen Prince Harry downstairs,” says Portfolio Adviser’s photographer Richie, with a beaming smile on his face as he enters the meeting room where I’m sat with Jeremy Ward. “I had to message my wife to tell her.”

While a member of the royal family would be a top celebrity sighting for most, Ward has seen numerous famous faces in the corridors of Coutts during his seven years at the firm. Coutts has a 327-year heritage as a private bank serving high-profile clients, from Charles Dickens to the current UK monarch.

Though Ward reacts casually to the reported sighting of the Duke of Sussex, he’s excited for different reasons. As the multi-asset portfolios he runs are about to hit their seventh year, he believes Coutts is on the verge of a significant profile boost, thanks to the recent appointment of Alison Rose as chief executive of parent company, Royal Bank of Scotland (RBS).

Rose, who took the top role at the UK banking giant in November, previously led the commercial and private banking business of which Coutts is a part. Ward predicts she will fly the flag for the Coutts brand, which, in turn, should gain prominence in the UK wealth management industry.

“Obviously, Coutts was previously under Rose’s wealth remit. She was very positive on the brand and now she is CEO of RBS,” says Ward. “We’ve been the centre of excellence for investment for RBS and Natwest for a while anyway.”

Winds of change

The appointment of Rose should accelerate the shift of Coutts away from private bank to wealth manager that has been under way for a while now as part of a company-wide initiative to modernise the firm. Ward agrees that the perception of the company has changed since he joined.

A big part of the transformation will hinge on how successful Coutts is in encouraging its banking clients to become investing clients, something being driven from the top.

Ward says: “We’ve seen a big focus from Peter Flavel, our CEO, who is saying, ‘If we’ve got clients that are banking with us, we need to see why they’re not investing with us’. We’re definitely very focused on that investment proposition.”

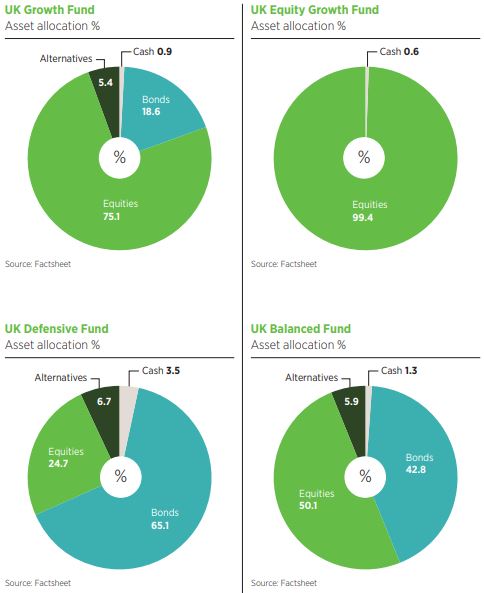

For Ward, the start of this transition dates to when he made the leap into wealth management with Coutts seven years ago. The range comprises: defensive (75% fixed income, 25% equity); balanced (50% fixed income, 50% equity); growth (25% fixed income, 75% equity); and equity growth (100% equity) options.

Ward joined Coutts from Newton Investment Management where he was an assistant fund manager on direct global equity portfolios. Prior to that, he was in a back-office role, handling foreign exchange and currency hedging for Newton parent company BNY Mellon Investment Management.

The focus at Coutts had been on running discretionary portfolios for individual clients. That changed in 2012 with the launch of the four UK-biased portfolios run out of London and three global funds managed in Switzerland by a separate team. The management of the global funds was transferred to London in 2015 after RBS sold Coutts’ international business to Swiss bank Union Bancaire Privée.

Passive range with active allocation

In April 2017, the firm launched an online portfolio service, Coutts Invest, to tap into existing Coutts, Natwest and RBS clients. The range comprises five risk-based portfolios – conservative, cautious, balanced, assertive and adventurous – available to customers with as little as £500 to invest via a general investment account, Sipp or Isa.

Ward describes the service as “a passive fund range with active asset allocation”, meaning the team applies the house view via a purely tracking approach.

“When we have regional allocations – for example, we’re underweight Japan at the moment – we’ll do that in the Coutts multi-asset funds and in the discretionary and passive fund ranges,” he explains.

As one might expect from a passive product, it has a low tracking error and does not take as much risk away from the benchmark as the actively managed portfolios.

Ward says the range is “growing nicely” – attracting £450m so far – after getting off to a slow start due to issues on the RBS side rolling out the technology online. “We are looking to do a campaign next year as this is a good product and we want people to invest their savings that are just sitting in an account and not getting anything on cash.”

House view

The starting point for Coutts’ asset allocation is a top-down quant process run by a team of two. Quant is used as an indicator of where to allocate but everything that comes through this filter is then viewed through a qualitative lens, which involves research, meeting managers and conducting due diligence. “That starting point gives us an edge,” says Ward.

Ward works closely with the seven-strong manager research team. “They do all the hard work of the initial search and we get involved later on in the process after it’s been narrowed down.”

The house view is determined by the tactical asset allocation forum made up of four senior individuals who are ultimately responsible for performance. The group comprises Alan Higgins, chief investment officer, UK, Sven Balzer, executive director of investment strategy, Vinod Nehra, head of systematic investments, and Lilian Chovin, multi-asset strategist.

As well as the underweight Japan position, Ward says Coutts has opened a contrarian overweight to Europe at a time when the continent is largely unloved by investors. This is because the team has studied Chinese leading indicators and their expected effect on European companies.

Ward says: “China is the EU’s biggest source of imports and its second-biggest export market. OECD composite leading indicators show a stabilisation in Chinese economic activity which, in line with the historical relationship, is starting to positively impact EU economic activity and company earnings.”

To express this, the portfolios have passive exposure to a Europe ex UK ex Switzerland exchange-traded product, the UBS ETF – MSCI EMU Ucits ETF, which is GBP hedged to increase sterling exposure.

“The nature of the trade is to try and get unloved, cyclical companies,” says Ward. “The Swiss markets contain the Nestlés of this world and pharmas on high multiples. We’re not trying to get those companies.”

Another play on Europe across some of the multi-asset funds is a specialist structured note that seeks to exploit the wide dispersion levels in European stocks by going long single-stock volatility and short index volatility.

“When you get a lot of single-stock volatility, for example, the Volkswagen ‘dieselgate’ scandal, and the rest of the index is relatively flat, it makes money on that dispersion.”

Amid the Brexit malaise the team has looked closely at sterling exposure and concluded it is very cheap. In order to play this theme, some of the portfolios hold Investec Special Situations, run by Alastair Mundy, which is a domestic deep-value-focused fund.

“You’re talking about banks, housebuilders, the sorts of names that are very beaten-up and unloved. These assets are just too cheap, regardless of the outcome of Brexit.”

For similar reasons the team has also bought the Merian UK Mid Cap Fund, managed by Richard Watts.

Another position Ward highlights is a US treasury steepener as an alternative to gilts. The two to 10-year US treasury yield spread is widely considered a bellwether of the US economy, with 10-year bonds typically yielding more than the shorter-maturity issues.

However, during periods of market stress, nervous investors sell off two-year treasuries, driving up the yields, while buying 10- year treasuries, resulting in lower yields on these bonds.

Contrarian view

“It has been documented that when 10-year yields drop below two-year yields, it is an indicator of a recession,” he says. “Taking a contrarian view, it is our belief that the yield curve will steepen again, and this trade puts us in a position to capitalise on that.”

Another contrarian move the team has taken recently is to reduce its exposure to alternatives, particularly absolute return products, as it is less positive about the value they play in the portfolio.

“Some of the supposedly market-neutral funds have underperformed substantially, so we’ve reduced that part of the portfolio. Multi-factor long/short strategies didn’t do very well, as traditional correlations that have worked since ’08 have broken down, causing some underperformance.”

In terms of fixed income, the team aims to be widely diversified rather than hold big blocks of government bonds and credit. The portfolios are exposed to government debt and contain a substantial part in investment grade.

To mix things up, however, short-duration emerging market debt is accessed through the Colchester Emerging Markets Bond Fund and there is some financial credit exposure through contingent convertibles.

In terms of illiquid assets, the team recently reduced its UK commercial property exposure, but this was to take profits after a good run rather than any fears over liquidity or Brexit, says Ward. The portfolios still hold the Legal & General UK Property Fund and the M&G Property Portfolio in this space.

Coutts’ portfolio range asset allocation

Given recent liquidity issues flagged by the demise of the Woodford Equity Income Fund, has Coutts seen fit to scrutinise portfolio liquidity in more detail?

Ward says: “We did we look at our portfolios to scrutinise the liquidity factor more intensely than we have in the past. But we haven’t made any changes on the back of that.

“A lot of our portfolios are very liquid anyway. When we go into any new investment, as part of our normal due diligence process we do a screen to find out the liquidity of the underlying manager.”