As 2019 draws to a close we look at how the IA Global Emerging Market (EM) fund managers have performed. Before we do that we’ll quickly recap the key drivers of the markets this year.

President Donald Trump sits in the Oval office pondering his latest 280-character tweet. Time to restart a trade war with China? The tweet is sent. Phones ping across the trading floor in acknowledgement. Weary traders cut their break short and swivel back to their screens. And the markets surge again.

Loose non-fiction aside, such has been the impact of Trump’s tweets on the markets that JP Morgan created the Volfefe index to track how each tweet affects US Treasury bonds.

However, not all market movements were solely driven by Trump. Over the last few years global growth has been stagnating. The biggest contributor to world growth, China, is at a cross roads; transitioning away from an export-driven economy to a consumer consumption focused one.

Central banks have also continued to play a key role in 2019. At the start of the year the US Federal Reserve initiated a dramatic pivot after consecutive hikes last year and started lowering interest rates lifting market sentiment.

Where the Fed went most central banks followed.

A low interest rate environment has squeezed all banks’ bottom line. Rising protectionism and sluggish global growth have impacted stocks tied to health of the economy like autos and heavy machinery.

Breaking down 2019 performance in the MSCI EM index

Twenty-six developing economies make up the MSCI EM index. And each has their own idiosyncratic stories. Brazil has benefited from the Bolsonaro effect as steep pensions reform plans have improved sentiment towards the country. India’s tax cuts have renewed overseas investor appetite while Modhi’s re-election has been a positive boost for the nation. Taiwan has been one of the main beneficiaries of the trade war pocketing $4.2bn.

Nevertheless, the wider trends we’ve seen in developed economies can also be found in EM. Most of the EM economies this year where either stagnant or in contractionary mode buffeted by multiple headwinds

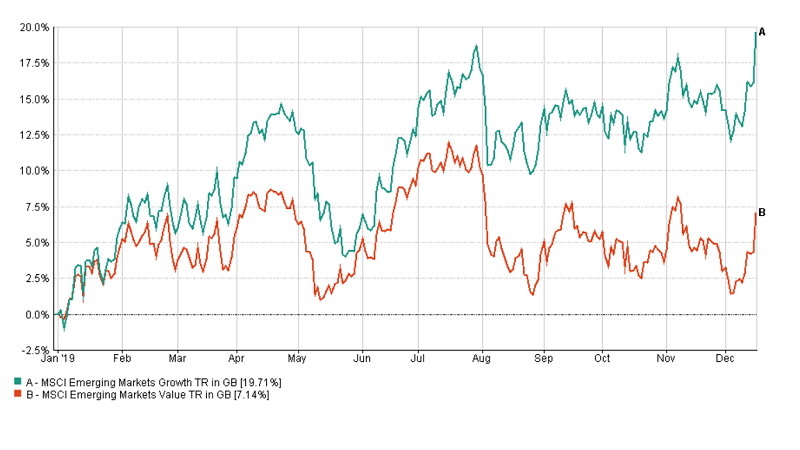

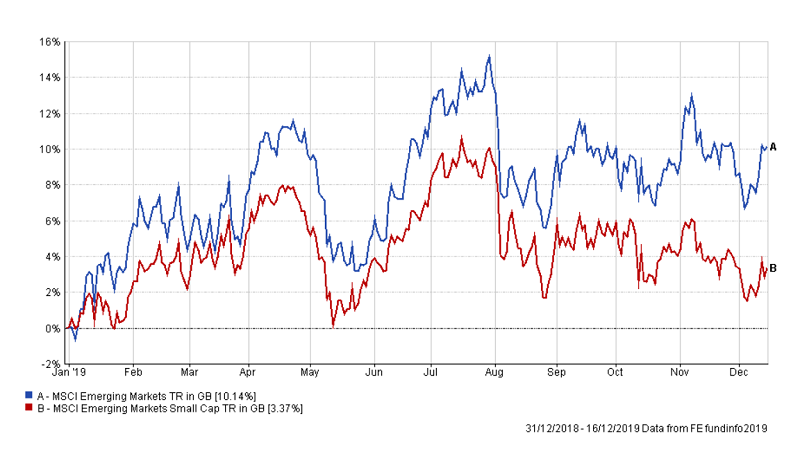

On a stock level, we’ve seen similar parallels between EM and developed markets. Growth stocks continue to outperform their value peers. And large-caps have strongly outperformed small-cap stocks.

Emerging market growth outperforms value in 2019…

…and emerging market small caps underperformed

China and India fail to drive emerging markets

So, given this brief market recap, which were the best and worst performing funds within the IA Global Emerging Markets?

Top three funds in the IA Global Emerging Markets sector

| Name | YTD Performance |

| JPM Emerging Markets | 23.9% |

| Quilter Investors Emerging Markets Equity Growth | 23.1% |

| Lazard Global Active Developing Markets Equity | 23.0% |

Figures as of 16/12/2019

EM performance this year was less driven by just the big index constituents like China and India.

Instead it was more fragmented with certain industries across different countries doing well. Apple innovation and a 5G rollout meant Taiwanese memory chip company TSMC outperformed even as overall global revenues for memory chip makers fell this year.

Consumer services, retail, semiconductors and growthier tech stocks like Alibaba and Tencent led the pack in China while autos and heavy machinery floundered. Banks which make up a strong portion of the index had mixed results but private Indian banks like HDFC and Kotak Mahindra performed well despite the recent shadow banking crackdown.

The market has rewarded the growthier tech names which make up a large portion of the index. In turn the top three funds have benefited from this alongside good stock selection.

The JPM Emerging Markets fund’s sector positioning echoed a lot of the positive drivers for EM namely its allocation to quality Indian banks, Chinese retail and services as well as its underweight to autos and industrials.

Bottom three funds in the IA Global Emerging Markets sector

| Name | YTD Performance |

| Carmignac Portfolio Emerging Discovery W GBP Acc | 2.1% |

| Templeton Emerging Markets Smaller Companies W Acc GBP | -1.3% |

| Comgest Growth Gem Promising Companies I Acc USD | -1.6% |

At the bottom of the performance table languishes the small cap funds.

Investor appetite towards riskier assets has lowered this year given the heightened volatility. In turn investors tended to allocate more towards large cap EM stocks rather than the volatile small cap which are one of the riskiest asset classes. This has been one of the key factors in its underperformance.

In contrast to the EM small cap index, the EM index tends to be more top heavy whereas the small is more diluted. Thus only a few top-heavy names within the EM index needed to outperform in order for the managers to benefit. A case which we have seen play out this year.

With trade tensions subsiding we are starting to see growth in key economies and industrial production picking up again. And both the bond and equity markets are becoming increasingly more bullish as trade and Brexit headwinds subside and expectations of quantitative easing rises. What the market will reward next year remains unclear. The jury remains out on whether value will be making a comeback. The winners of today may not be the same for next year. Check back next year to find out.

Ahmed Mohamoud is a research assistant at FE Fundinfo