The Allianz Technology Trust has appointed a tech entrepreneur to its board as it reveals share price gains of 34.9% in H1 2019.

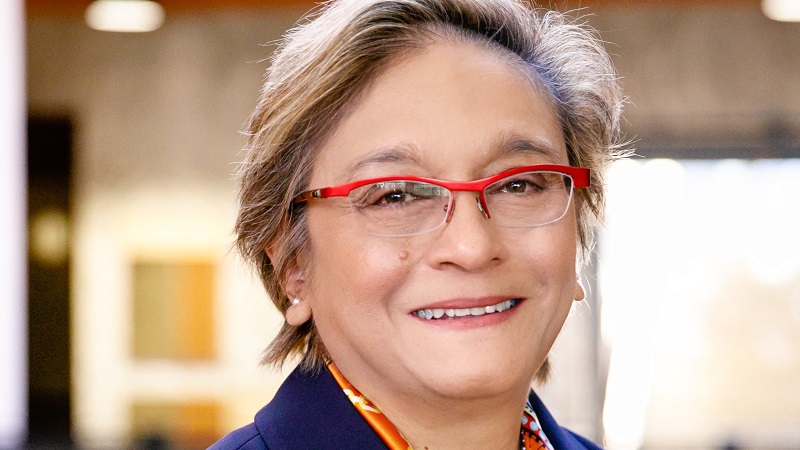

Neeta Patel will be a member of the audit and management engagement and nomination committees when she joins at the start of September.

In 1996, Patel launched the first personal finance website in Europe for Legal & General. She is now CEO of the Centre for Entrepreneurs, a board advisor for Tech London Advocates and an entrepreneur mentor-in-residence at London Business School.

Almost triple the gains of the FTSE All Share

Her appointment was revealed in the H1 2019 results for the £580.4m investment trust, which reported its 5% discount shifted to a modest premium over the reporting period.

Net asset value gains were 27.3% compared to 22.9% gains in the Dow Jones World Technology Index. Over the same period, the FTSE All Share rose 13%.

It is currently trading at a 1.5% premium with no gearing.

‘All sectoral performance tends to be cyclical’

The board acknowledged the potential for a correction of the technology sector “even though it has continued to defy predictions”, said chairman Robert Jeens.

“The company is investing in a buoyant sector with strong long term secular growth characteristics but is well aware that all sectoral performance also tends to be cyclical,” Jeens said.

The US/China trade war has significant implications for US companies doing business in China as well as wider global growth ramifications, he said.

US/China trade war hits semiconductors and hardware

But portfolio manager Walter Price said management teams are stating digital transformation will be the last budget to cut within IT if there is an economic slowdown.

“This transition is a multi-year process, and we believe we are still in the fairly early stages,” Price said. “For the semiconductors and hardware segments, we expect the environment to remain mixed as companies work through production and inventory adjustments amid the trade conflict between the US and China.”

However, he expected growth to reaccelerate in 2020.

Highly-valued growth companies

Price acknowledged valuations are high for some growth companies, but said he was still finding attractively valued opportunities.

Price said: “In particular, certain technology incumbents are making compelling progress on their ‘as-a-service’ offerings.

“Artificial Intelligence (AI) is also becoming a significant trend. From consumer goods, such as the Amazon Echo, to autonomous driving, practical applications of AI are emerging.”