Allianz Global Investors global strategist and portfolio manager, Neil Dwane, said a lack of global synchronisation across central bank policy will see the end of the Goldilocks scenario that allowed all asset classes to perform well in 2017.

“Investors got paid for taking risk in 2017,” he said. “In 2018, we are conscious the world is beginning to change. For the first time in 10 years central banks are pulling in different directions.”

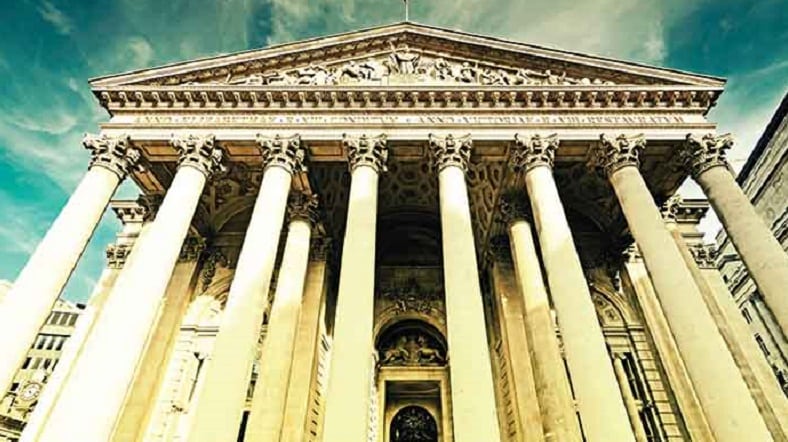

The US Federal Reserve is reducing its balance sheet and raising rates and last month the Bank of England hiked rates for the first time in a decade. Elsewhere, the Bank of Japan and the European Central Bank are slowly reducing their asset purchase programmes.

Dwane said while he anticipates the scale of central bank support will diminish in 2018, the overall shift is expected to be slow and the precise actions will vary from one central bank to the next.

As a result of this move, he foresees a continuation of low volatility, albeit with the potential to spike, as well as the possibility of a liquidity shortfall and rising inflation, which could be disruptive to markets.

Asset allocation

Dwane said investors therefore need to think more carefully about asset allocation to find opportunities, manage risk and protect purchasing power amid rising inflation.

He believes there will be a trend away from exchange traded funds and passive investing towards active management.

“Clients have to think more carefully from an asset allocation perspective,” he added. “Beta returns are so low, you have to be active.”

In terms of investment ideas in 2018, Allianz highlighted oil, European equities, emerging market debt, US banks, and Asian tech and infrastructure.

Importance of signalling

Salman Ahmed, chief investment strategist at Lombard Odier Investment Managers, also believes central banks will take centre stage in 2018.

He said: “Despite the excitement around disruptive technologies, the rise of crypto currencies, artificial intelligence and robotics, we expect good old central banks with their printing presses to remain the most important determinant of key risk asset prices next year.

“As the era of quantitative easing by central banks gradually draws to a close in the current business cycle, the impact of tightening/less accommodative monetary policy will depend on what made QE work in the first place.”

Ahmed said arguably the most important channel at the disposal of central bankers is how they manage communication to the outside world, known as ‘signalling’.

“It does seem that central banks are becoming more adept communicators. In 2017 – in contrast with 2013’s taper tantrum – both the Fed and the ECB managed the communication of their monetary policy plans well in advance of any policy moves and with increased transparency, which helped reduce the risk of a knee-jerk market reaction.

“However, this juggling act is far from over and 2018 may be a tougher test for central banks, especially if inflation starts to kick-in as global capacity further erodes.”