By Holly Downes, reporter at PA Future

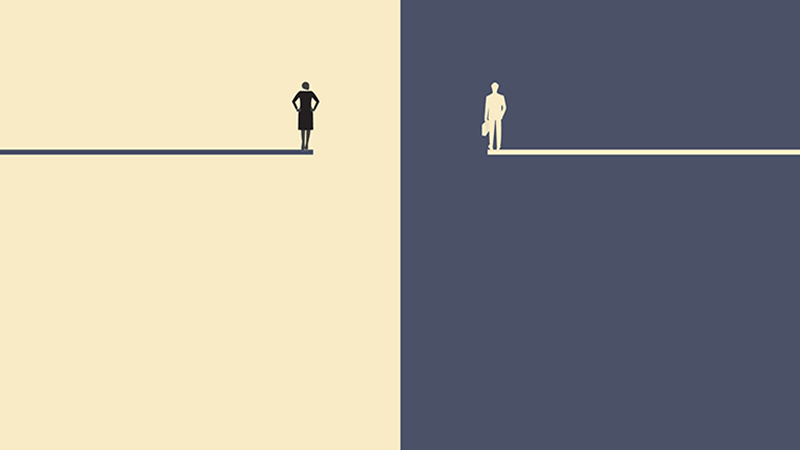

The Gender Investment Gap in the UK rose by £54bn to £567bn between January 2023 and January 2024, research by Boring Money has revealed.

The gap has risen because more men between 25 and 44 are becoming first-time investors compared to women in the same age group, as well as women reporting they are more risk averse about investing.

Of the 6,500 adults surveyed by Boring Money, data showed the gap was most pronounced among 18 to 24-year-olds. Only 9% of women invest compared to 22% of men in this age bracket, a trend that continues among the 25-44-year-olds where 28% more men said they were investing in January 2024 than women.

The study also found women started their investment journey later due to limited awareness of investment brands, while the gender pay gap and differing parental responsibilities were also a big factor.

Alongside this, women have a lower risk appetite than men – only 18% of women would pick a ‘higher’ risk pension, compared to 33% of men – and 4% more female investors keep their assets in cash, limiting their opportunity for growth.

Boring Money’s chief executive, Holly Mackay, said: “The Gender Investment Gap remains stubbornly high and has got worse in 2024. Fewer than half the number of young women under 24 choose to invest compared to men. This gender gap comes into play at an early age, even before the typical culprits of childcare and pay gaps appear.

“Our research has found that with this younger group, this is all about confidence, brand awareness, social norms and expectations of what an investor looks like.”

This article was originally posted on our sister title, PA Future