For the past decade, Bonhill Intelligence has tracked the forward-looking buying intention of UK investors. Last month we discussed the shift in macroeconomic outlook of our UK respondents and their attitudes to risk. However, there have also been some interesting shifts in asset class appetite.

Top of the pops

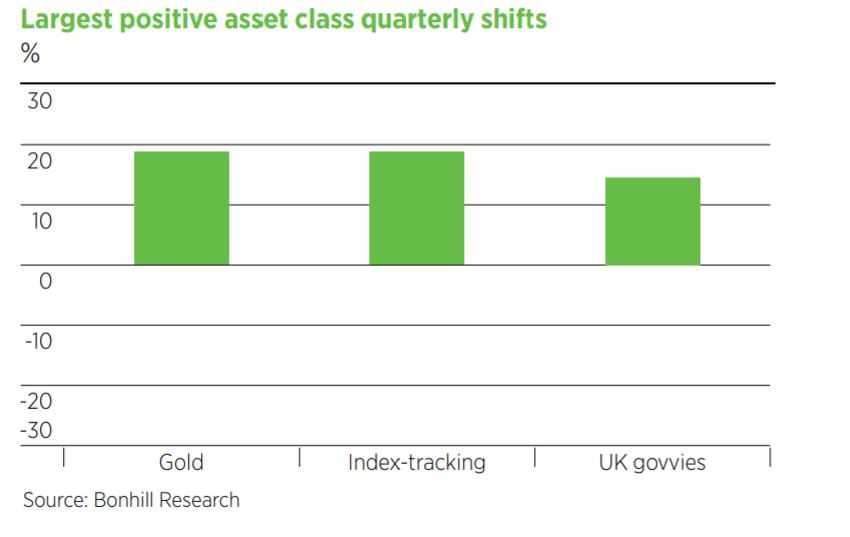

In October 2021, it was gold that saw the largest quarterly shift. For those of you who are subscribed to our quarterly report this will come as little surprise.

Although one-in-five UK-based investors are planning on increasing their allocation to gold, there has been a sharp drop in the number of sellers for the second quarter in a row.

Equally, index tracking has seen an increase in demand this quarter. Again, like gold, only around one-in-five investors are looking to increase their holding in the coming 12 months, with the majority intending to hold. However, there has been a sharp decrease in sellers throughout 2021 with hardly any seller in sight as of October 2021.

In third place we have UK government bonds. This is where it gets interesting. Those who have been following our quarterly asset class reports will know that developed market bonds have been out of favour for the past few years. This is still the case, with almost half of UK investors looking to decrease their current allocations, but there has been an upward shift this quarter for UK government bonds.

Overall, however, this asset class is still firmly in the red, with less than one-in-20 looking to buy UK govvies in the coming 12 months.

Stuck in the red

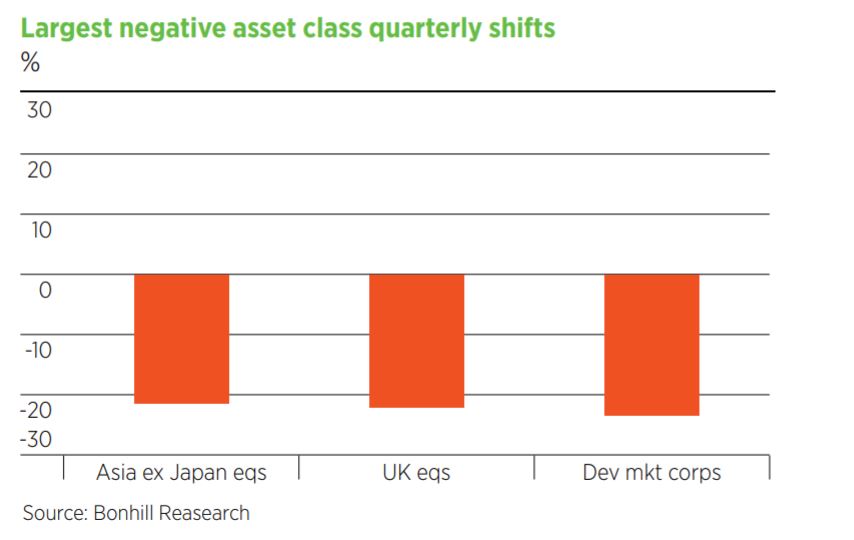

As well as tracking the upward quarterly shifts, Bonhill Intelligence follows the downward quarterly shifts. It will come as little surprise that developed market corporate bonds have seen the largest downward shift. As mentioned earlier, for the past few years developed market bonds have been unloved among not only UK fund buyers but all the regions we cover.

What is interesting is that buying intentions for UK equities has dropped considerably. While in Q2 2021 nearly half of UK investors were looking to increase their allocation to this asset class, now just one in four intend to buy in the coming year.

But it’s not all negative news. Looking at the respondent breakdown, most UK investors are happy with their current allocation to UK equities and although they may not be looking to buy anytime soon, they also don’t intend to sell out just yet.

Finally, we turn to Asia ex Japan equities. For much of 2020 this asset class, along with global emerging market equities, was a fi rm favourite, not just in the UK but Europe, too. However, throughout 2021 demand has been steadily declining, and this quarter the amount of sellers finally outnumbered buyers. Again, it is not all bad news, as the majority of our respondents are happy to maintain their current allocation to Asian equities (57%).

Although there have been some interesting quarterly shifts, it is clear there is still plenty of good news about. As we mentioned last month, UK investors are feeling positive as we enter the final months of 2021, and looking to put their cash to work.

If you would like to discuss this data or subscribe to our quarterly report, please contact lottie.mcgurk@bonhillplc.com