The dividends paid to shareholders by UK companies fell 3.7% to £90.5bn in 2023 as businesses scaled back on special pay-outs, according to new research from Computershare.

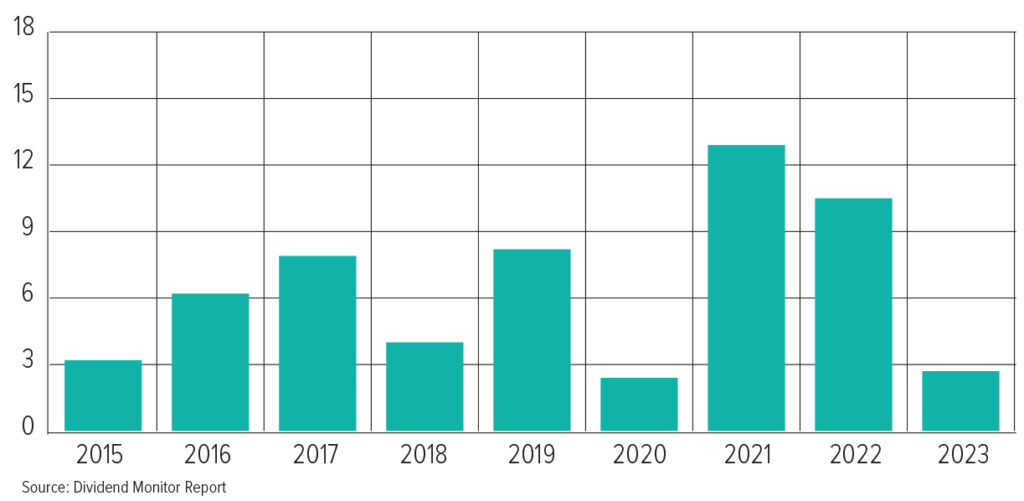

Businesses paid £2bn in special one-off dividends last year, which was 79% lower than what they issued in 2022.

Mark Cleland, CEO of governance services at Computershare, said: “We had anticipated a big decline in 2023 but it was even larger than our expectations.”

Special dividends since 2015

Most of this £7.4bn drop came from UK-listed mining companies, which reduced special pay-outs by 28.4% after two years of heightened dividends.

They paid £16bn during the commodities super cycle of 2022 when mining companies were thriving, but dropped dividends to £11.5bn last year as the rally dwindled.

Nevertheless, mining companies were still the third highest paying sector in 2023, accounting for £1 in every £8 distributed by UK companies. It was succeeded by oil and gas companies (£11.6bn) and the banking sector (£13.8bn), which “more than offset cuts from miners,” according to Cleland.

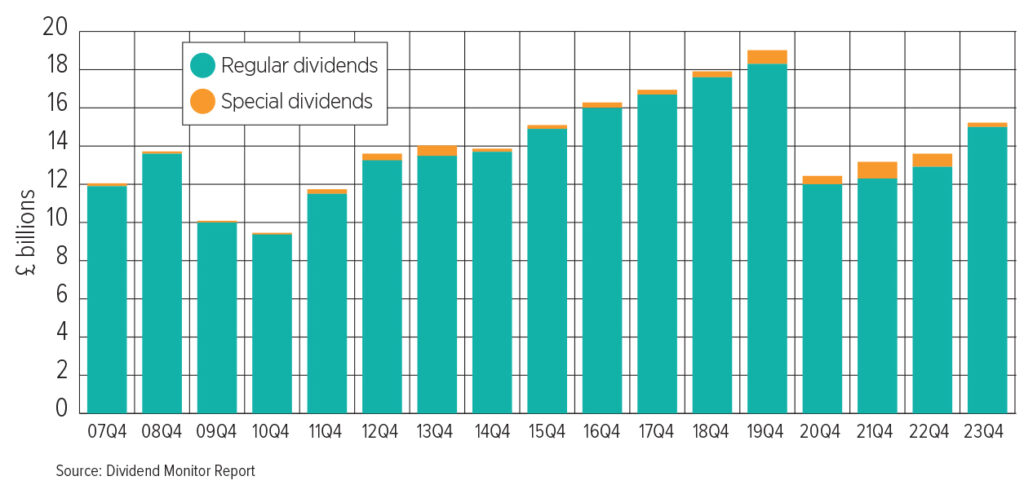

Banks upped their dividends by 30% in 2023 to the highest level since the global financial crisis in 2008.

“The aftermath of the financial crisis led to the ultra-low interest-rates and money-supply policies that in turn crimped bank profits for years, even after credit conditions had returned to normal,” Cleland explained. “The return of high interest rates has meant wider margins for the banks and therefore higher dividends.”

Indeed, HSBC became the highest paying company in 2023, pushing miner Rio Tinto – which was top dog in the previous two years – to the fifth spot. The bank accounted for £4bn of the £4.8bn increase in dividends paid by its sector in 2023.

UK companies may have cut special dividends by more than three quarters in 2023, but underlying pay-outs were up 5.4% to £88.5bn. Cleland said these were more preferable than the “very volatile and unpredictable” nature of special dividends.

“Regular dividends are best thought of as a distribution of recent profits, allowing for the fact that companies will typically smooth out short-term profit volatility when setting their dividend policy,” he added.

“Most companies only declare special dividends, however, when a major corporate event takes place, such as a disposal or a merger, or when they wish to restructure the balance sheet to reduce surplus capital.”

UK dividends since 2007

Looking ahead, Computershare forecasts that underlying dividends will grow 2% to £89.8bn this year. While some may celebrate this anticipated increase, Cleland reminded investors that this is a slowdown from last year.

“The outlook for 2024 is dogged by uncertainty,” he said. “The lagged effect of higher interest rates has yet to be felt in full and geopolitical factors are weighing on sentiment.”

However, investors can expect a 3.7% recovery in special dividends this year after a poor 2023, which would bring headline dividends in the UK to £93.9bn.

See more: Value funds overtake growth in FE Fundinfo Crown rebalance