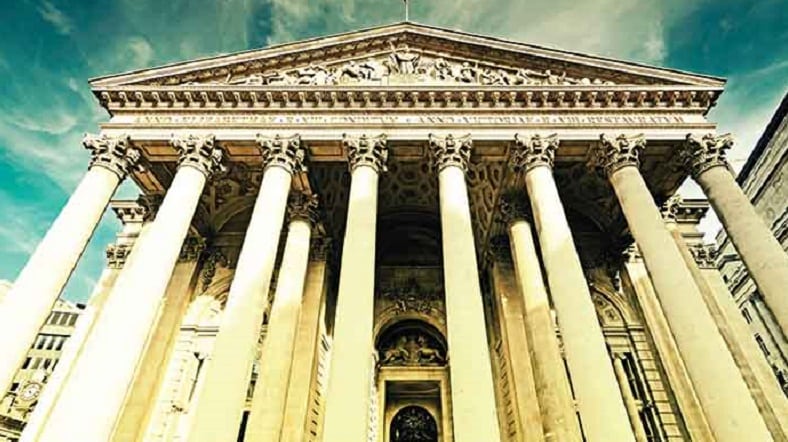

Bank of England stresses market making risk to bond funds

The Bank of England has raised concerns about liquidity mismatch in open-ended corporate bond funds as market makers retreat from the asset class.

The Bank of England has raised concerns about liquidity mismatch in open-ended corporate bond funds as market makers retreat from the asset class.

Schroders is the latest manager to report a hit to total assets over the first quarter as fund groups cope with higher volatility.

Aberdeen Standard Investments has joined Royal London Asset Management (RLAM) in voting against Persimmon’s remuneration package, which it said threatens the firm’s reputation.

Unicorn Asset Management’s Simon Moon and Fraser Mackersie have apologised to investors in the Acorn Income fund for holding Coviviality as it went under.

Seven Investment Management (7IM) has received approval from the Jersey Financial Services Commission (JFSC) to open an office on the island.

Lloyds’ share price remained depressed, despite delivering a good set of first quarter figures, containing higher profits as Payment Protection Insurance (PPI) costs fall.

Credit Suisse has reported its adjusted pre-tax profits were up 36% at CHF1.2bn for the first quarter, thanks to inflows into its wealth management division.

Advisers continue to favour Vanguard Lifestrategy for multi-asset exposure, despite concerns the range’s high duration leaves investors exposed to rising interest rates.

Aviva has been forced to issue another apology to advisers after they were wrongly sent a notification that the value of their clients’ portfolios had dropped by more than 10%.

Royal London Asset Management is one of the few asset managers that has confirmed it will vote against sky-high executive pay packages at Persimmon’s AGM on Wednesday, as the housebuilder comes under fire for failing to meet the living wage for its lowest-paid workers.

Active UK equity managers last year failed to outperform their benchmark due to under exposure to small cap companies post Brexit, research from Lyxor Asset Management shows.

Neil Woodford has highlighted his track record for backing biotech winners in his Patient Capital Trust annual review, just one day after Prothena’s share price blow-up.