ESG morphs into glorified box-ticking exercise

Impact investing is being touted as an alternative to environmental, social and governance (ESG) strategies failing to live up to their ethical hype.

Impact investing is being touted as an alternative to environmental, social and governance (ESG) strategies failing to live up to their ethical hype.

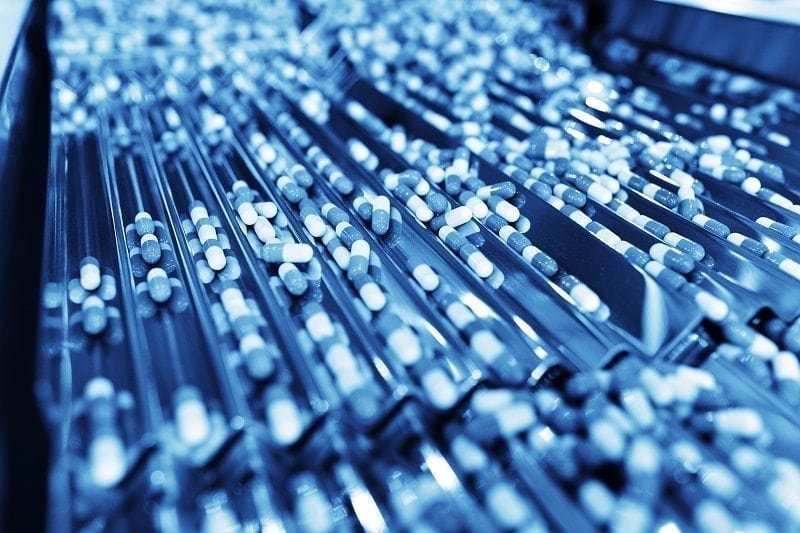

The biotech sector is going through a renaissance as innovation takes off according to one successful fund manager, but data shows that performance over the last three years has been far less than stellar.

The inclusion of 230-odd China A-shares was a hugely symbolic moment for investors in the region but the fund industry has failed to get ahead of the curve with most firms lacking dedicated teams of analysts or products to invest in the asset class.

Italian expansionary fiscal policy is more likely to inform European Central Bank policy than political threats to financial stability, with some investors raising concerns the central bank could soon switch to a more hawkish tone.

When pension freedom was introduced by the government three years ago soundbites flew around about individuals splurging their lifetime savings on flash sports cars or buying second homes to fund their twilight years.

Environmental funds are blaming poor data on holding companies for their inability to report on environmental impact as the industry’s methodology for measuring green credentials throws up mixed results.

The opening of the China A-shares market to foreign investors provides a window for China-focused funds to push ESG criteria into greater prominence in the world’s second largest economy.

To navigate the hazards of the bond markets, one fund manager looks to US and emerging market debt for value while a fund selector finds opportunity in alternative fixed income.

Investment managers are positioned for long-term weakness in the US dollar, sticking by emerging markets, despite recent strength in the currency.

UK equities could be a beneficiary of Spanish and Italian political turmoil, despite investors playing down existential risk to the European Union from the peripheral economies.

Financial Conduct Authority (FCA) changes that allow asset managers to more easily switch investors between share classes could still see a minority of investors refusing to budge.

The chairman of Invesco Perpetual Enhanced Income has said the investment trust is facing a “self-interested onslaught” from Invesco Perpetual and has called for the asset management giant to drop its actions to oust him.