Jupiter hires Latam analyst in fixed income push

Investors have been increasingly weary of emerging market debt this year amid a stronger dollar and rising rates

Investors have been increasingly weary of emerging market debt this year amid a stronger dollar and rising rates

To navigate the hazards of the bond markets, one fund manager looks to US and emerging market debt for value while a fund selector finds opportunity in alternative fixed income.

Rob Drijkoningen took his whole team with him from ING Investment Management to Neuberger five years ago and he still finds the entrepreneurial culture of his employers to be empowering.

Liontrust’s John Husselbee believes that the majority of active emerging market debt funds are too immature to invest in now, but hinted he will switch from passive to active funds in the sector at some point.

BNY Mellon Investment Management (IM) has launched an emerging market debt total return fund in response to the “demand for a long-only EM debt strategy”.

Schroders’ is set to lose the head of its emerging market debt absolute return and commodities group, Geoff Blanning, who will retire in April 2018.

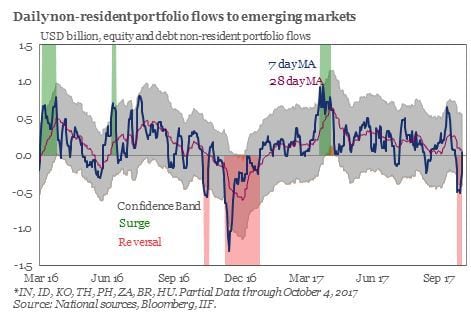

Emerging market debt has been the best-selling asset class with European investors this year, but flows turned negative in late September against a backdrop of a hawkish Fed and a strengthening dollar.

The global bond ETF industry garnered almost twice the amount of capital from investors in the second quarter of 2017 as it did the year prior, thanks to sustained demand for EM debt passive products.

Recent divergence between eurozone sovereign bond yields may be based more on perception than reality and offer opportunities for investors, according to M&G Investments.

Invesco Perpetual’s new Global Emerging Markets Bond Fund seems to be well timed to take advantage of investors’ broad structural underweight to the asset class.

It’s still relatively early days for the IA Global Emerging Market Bond sector, and funds could be facing their biggest test yet, says the editor of FE Trustnet.

General risks for investors in emerging-market debt are ebbing, which is why global institutional investors are likely to continue to add exposure, said Michael Ganske, portfolio manager at Axa Investment Managers.