Billions in new short positions levelled against UK names

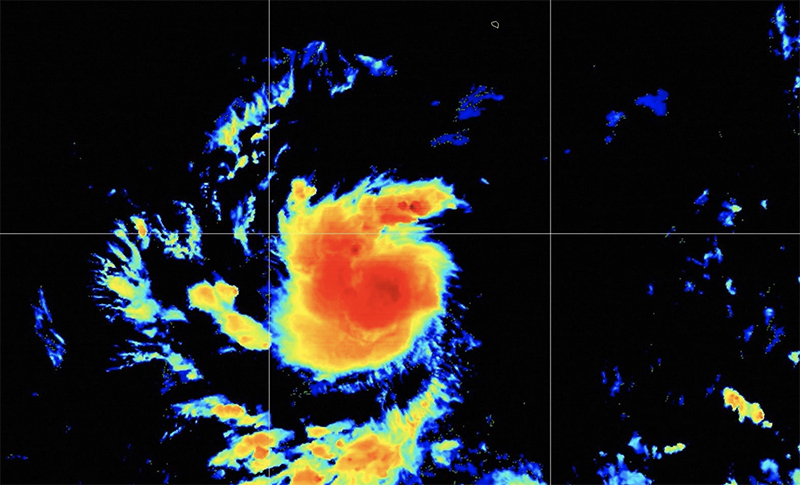

Uncompromising macroeconomic environment has started to expose unsustainable valuations

Uncompromising macroeconomic environment has started to expose unsustainable valuations

Many traditionally defensive assets have not lived up to their reputations

Unlisted holdings have not been written down to the same extent as listed stocks, giving rise to concerns of a disconnect

Bonds may be on the brink but it’s a different story for equities

But the sharp drop in valuations is also giving firms pause for thought

Severe share price slumps and outflows widespread across the asset and wealth management sector though there are a few anomalies

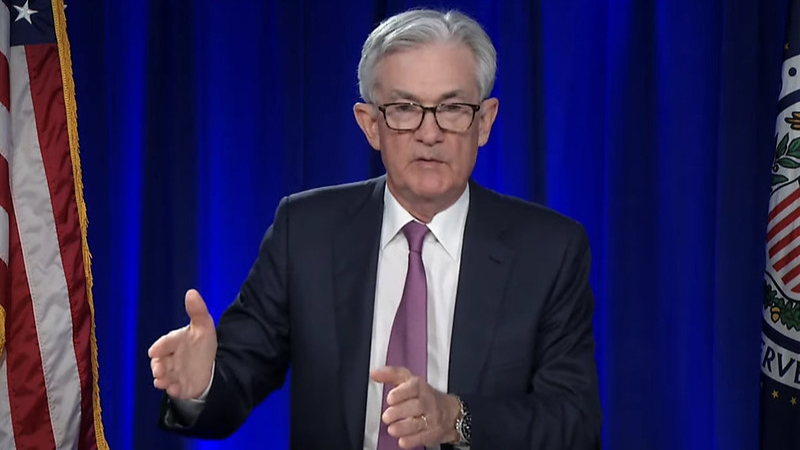

April US CPI drop was ‘never going to be the start of it freefalling to more palatable levels’

Static allocations to long-dated government bonds have hampered returns

Lingering supply chain issues have caused headaches for an industry that is a key indicator of the health of the economy

With some price hikes already built in – newer investors in certain sectors might just have missed the boat

The over-valued tech stocks struggle to offer any benefits for investors less willing to pay their premium

Fund managers are putting pressure on holdings to reveal mitigation strategies but good data remains hard to come by