Though long/short equity managers are supposed to deliver performance uncorrelated to markets, the returns of long/short managers as a group have been strikingly uniform in recent years. After delivering mostly solid performance in the years up to 2016, almost all funds lost money in 2016.

The average European long/short equity fund was down 4.66% over the year, according to Financial Express data.

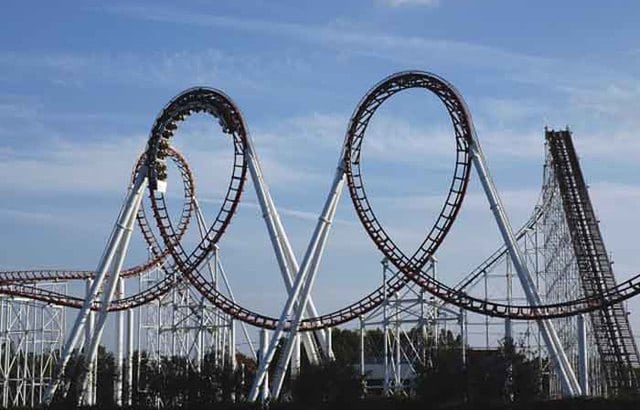

Net flows to long/short equity funds have closely followed performance in recent years. From 2015 to early 2016, when they were doing well, long/short equity managers saw a record streak of inflows (see chart below) as investors were attracted by the steady returns and the diversification benefits they delivered. But as performance started to worsen, the category suffered a 10-month period of net outflows.

L/S equity funds – rollercoaster flows

L/S equity funds – rollercoaster flows

Willi Oberbeck, a fund selector at DZ Privatbank in Luxembourg, was one of these sellers. “In 2016, long/short managers were caught by extreme sector rotations and a shift from quality to value,” he says.

Long/short equity managers were almost all long quality stocks and short value sectors such as commodities at the start of 2016, and that hurt them as value stocks embarked on a remarkable rally.

“Basically all the funds we follow lost money, and we sold the Henderson Pan European Alpha fund which suffered in 2016 (though it has since recovered all lost ground). We don’t own any pure long/short equity funds anymore,” says Oberbeck.

Steve Frost, manager of the Legg Mason Martin Currie European Absolute Alpha Fund, says he lost money last year because the good trades of 2015 turned into disastrous ones the next year.

“In 2015, the oil price was falling so we became risk-averse. We shorted oil companies and companies with exposure to the oil sector. We made good profits from these trades and by the end of the year we started covering these shorts,” he says.

But in early 2016, when oil and commodity stocks started to recover, he still had “about a third” of these short positions left. “Oil stocks are quite a big part of the market [in Europe], and because we had no exposure to the sector we weren’t catching the upside.”

Lessons learnt

What should long/short managers to differently in the future to prevent a repeat of the 2016 debacle?

They should pay more attention to valuations, believes Oberbeck. “If certain sectors, indexes or stocks approach extreme long-term valuations, mean-reversion will come into play. Managers could be more active in changing gross exposure or sector exposure when valuations become extreme,” he says.

Oberbeck is slightly disappointed with the response long/short equity managers have given so far. “The managers I follow haven’t changed their concept at all. On the hand it’s of course good that they stick to their style, but they could create overlays to protect their funds from the rotation effects that hurt them so much in 2016.”

Sébastien Saba, head of portfolio management at Meeschaert family office in Brussels, is also wary of investing in long/short equity funds again after the recent experience of 2016.

“I’m staying on the sidelines for now, and I’m not planning to engage again soon. They have to first rebuild their track record,” he says.

Article continues on the next page….