Tumultuous markets have resulted in a shake-up of the bestselling UK fund groups in the second quarter, as investors scanned for alternatives to risk assets.

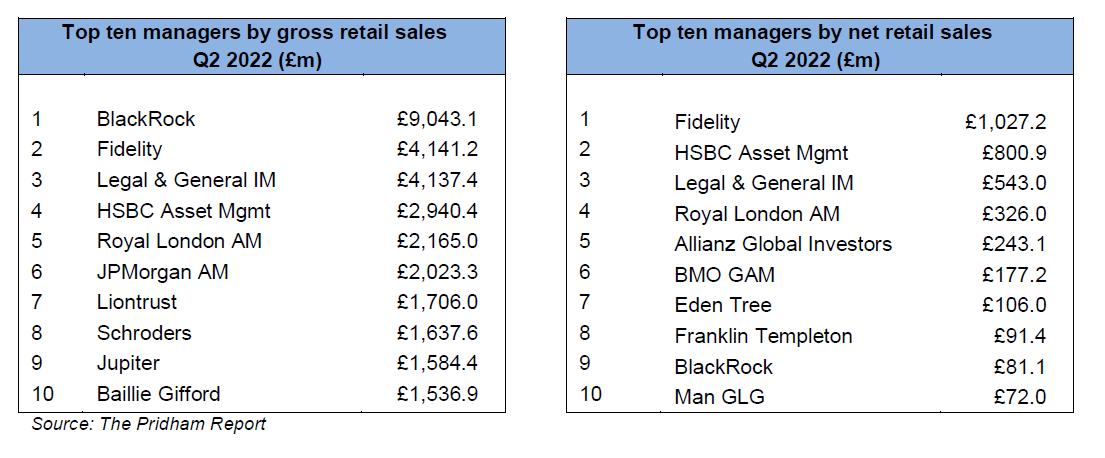

Allianz Global Investors, Edentree, Franklin Templeton and Man GLG jumped onto the table of highest net sellers, while Jupiter re-entered the top 10 gross sellers, according to the latest Pridham Report.

Across both metrics firms specialising in passive funds, such as Legal & General Investment Management and HSBC Asset Management, continued to dominate.

While Blackrock raked in the highest gross sales at £9bn, it was second from the bottom in terms of net sales with just £81.1m.

Investors turn to bonds and equity income

Healthy flows into fixed income products drove the uptick in sales for several firms; including AllianzGI which attracted £243.1m in client money, putting it fifth on the list.

Edentree’s Responsible and Sustainable Short Duration Bond fund, managed by David Katimbo Mugwanya, was also a hit with investors looking to decrease their interest rate exposure, helping the specialist boutique bag £106m in net flows.

Ariel Bezalel’s Jupiter Strategic Bond fund also attracted decent flows during quarter, the report noted, helping the FTSE 250 group to ascend to ninth place in the top gross sellers table.

Demand for income funds also helped steady sales during a volatile three-month period for the industry, with Jason Pidcock’s Jupiter Asian Income fund and Henry Dixon’s Man GLG Income fund both flagged as bestsellers at their respective firms.

Franklin Templeton’s ClearBridge Global Infrastructure Income fund helped boost total sales to £91.4m, its strongest quarter on record.

Anna Pridham, co-editor of The Pridham Report, said: “The many headwinds facing financial markets weighed heavily on investor sentiment this quarter. However, with valuations of risk assets now at more attractive levels, many investors continue to put their faith in funds for their long-term savings.”

Fidelity continues to dominate

However, it was Fidelity that took the crown for highest net sales in Q2, taking in an impressive £1bn, well ahead of the next best seller HSBC AM with £800m.

This is now the second time in a row Fidelity has been top of the net sales table, following a record performance in Q1 in which it brought in £1.5bn.

Once again, demand for its Global Dividend funds proved strong heading into the second quarter, while the Fidelity Index World fund was another standout.