By Matt Girard, Precious Metals Dealer at Ravenscroft Group

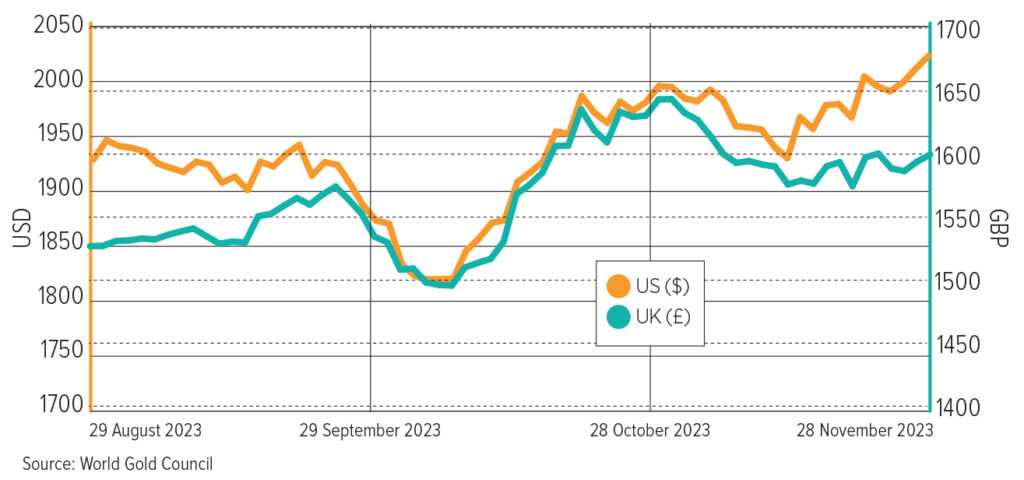

The sterling spot price often gets overlooked as, for the most part, gold is thought of as a USD asset, so you’d be forgiven for thinking maybe that the all-time GBP spot price high of £1,658 reached during October isn’t as significant as it sounds. However, when you look at the USD spot price and realise we’re back in $2,000 per ounce territory, this can’t be dismissed.

Without focusing too much on all the negative situations we are currently facing, we also cannot ignore that they are happening. The conflict in the Middle East seems to have completely overshadowed the ongoing war between Ukraine and Russia, with neither having a resolution in sight. There have been several natural disasters, with Morocco being hit with its worst earthquake in 60 years and, closer to home, the UK and Channel Islands doing their best to cope with the aftermath of Storm Ciarán.

Anyone who has loosely paid attention to the gold price over the years will know that in times of geopolitical uncertainty, retail investors, central banks, and everyone in between tend to flock to safe-haven assets to preserve wealth, with gold normally at the top of the list. During the first nine months of 2023, central bank purchases were up 14% year-on-year. This has provided stability to the gold market in a time where USD strength and high interest rates have been pushing in the other direction. As a non-yielding asset, rising interest rates will clearly have a negative impact on gold’s appeal but change might be just around the corner as rate cuts are being predicted from May 2024 according to the CMEFedWatch tool.

Consumer demand drives precious metals rally

While investors are beginning to drive precious metal prices upwards, major consumers such as China and India are also contributing to prices due to demand in these counties. Following an 11-month buying streak, the People’s Bank of China has increased its gold reserves by 181 tonnes during 2023. This means that gold now accounts for 4% of its total reserves and is thought to be a strategic move to reduce their dependence on the US dollar as financial ties with Russia strengthen.

Retail investors in China followed suit with an increase in jewellery consumption of 8% year-to-date. This comes as somewhat of a surprise considering the renminbi gold price is near all-time high. However, the ongoing trouble in the housing market is leaving investors searching for investment alternatives. Property sales have slumped with an oversupply of homes and low confidence from potential homeowners.

See also: “FundCalibre’s McDermott: Why gold could get its shine back in 2024“

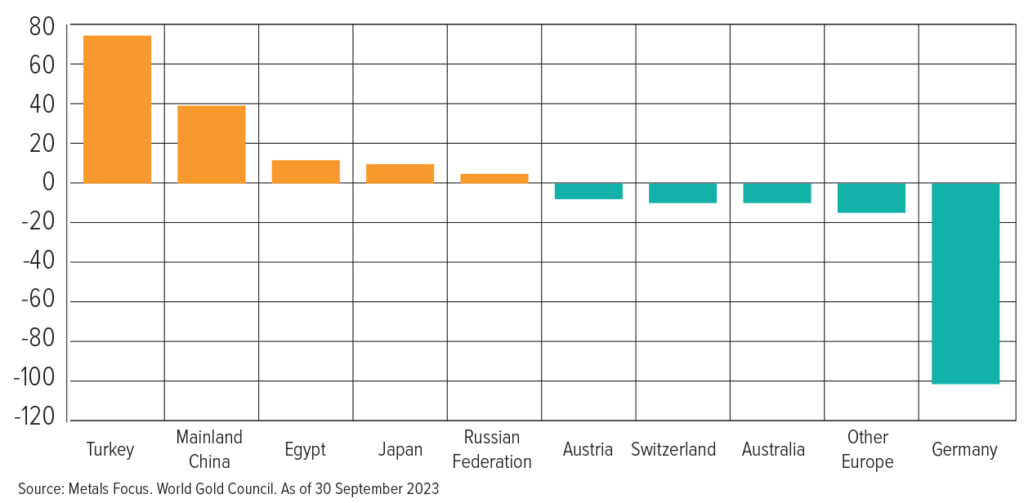

Historically Q4 is a strong time for gold sales in China, with it being the busiest season for weddings, and although unlikely to reach pre-pandemic levels of buying, there are good signs for gold. The same is anticipated for India as festive season runs from November through to February. The yellow metal is deeply rooted in Indian culture and is highly sought after in the lead up to traditional celebrations such as Diwali. Demand rose 7% in Q3 despite high local premiums deterring some retail investors and this is expected to continue into 2024 as, like China, the end of the year is a particularly popular time for weddings. in contrast, demand in Europe is struggling due to changes in regulation that have impacted the market considerably.

Germany is expected to have its worst year in the bar and coin market for over a decade, with demand for silver expected to decline by as much as 70-80% year-on-year. This is largely due to legislative changes with VAT being raised from around 7% to 19% on silver coins. Further changes by Germany’s heavily environment-focused government include private homeowners being forced to make energy-efficient renovations that could cost up to €200,000 per home, meaning investor savings are tied up elsewhere. Despite a bleak outlook for Germany, the opposite has been seen in Turkey during the last few months, with bar and coin demand in Q3 40% higher than its five-year average. This is due to seemingly uncontrollable inflation and a continually weakening lira.

Healthy figures from both retail and institutional investors throughout 2023 have provided a solid foundation for the gold price following a relatively turbulent 2021/22. With geopolitical tensions rising and potential interest rate cuts on the horizon the environment looks promising for gold heading into 2024.