By Jeff Schulze, head of economic and market strategy at Clearbridge Investments

Investing and mountain climbing are both judged by the ability to move higher. The journey higher is never smooth, and experienced climbers understand that heightened concentration is paramount once the crux, the toughest part of a route where the hardest moves and challenges are concentrated, is reached.

The crux for investors lies in the coming quarters, as fiscal stimulus and consumer resilience fade while the lagged effects of monetary tightening take hold. We worry that many investors have fully embraced the soft-landing narrative and are facing potentially the most dangerous part of this cycle’s climb with their guard down.

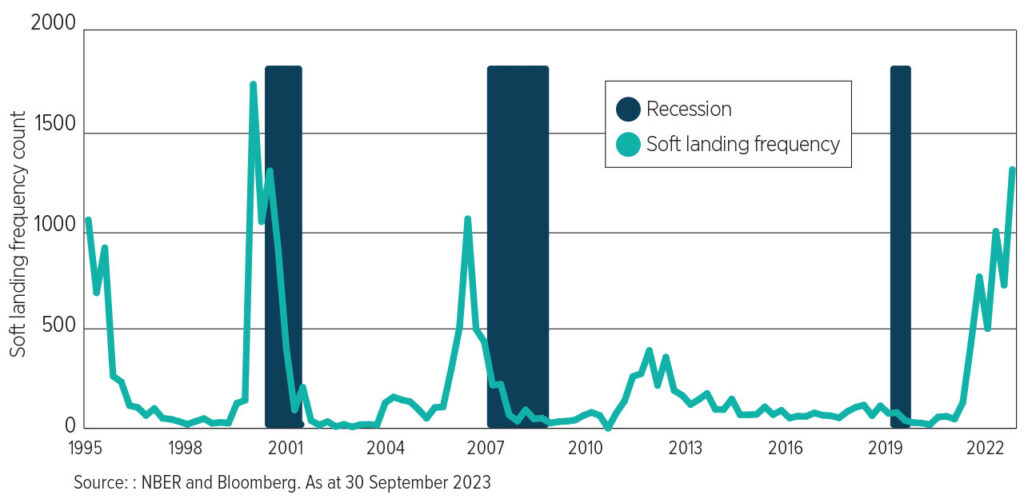

US economic data has held up better than we expected coming into 2023, driving many investors to abandon their calls for the “most anticipated recession ever.” However, history shows that hopes of a soft landing often take hold before the economy hits the skids and investors would be best served by remaining sceptical that the economy is out of the danger zone.

Soft landing ‘frequency of mentions’ in company filings since Q3 1995

Over the last year, the timing of a possible recession has drifted later and later and, with the benefit of hindsight, investors likely underappreciated the recent surge in fiscal spending.

Looking ahead into 2024, the fiscal stimulus appears likely to be smaller. The debt ceiling deal reached earlier this year included agreements to cap spending in 2024 and 2025, which is projected to shrink the deficit by $170.8 billion. While the size of the fiscal 2024 federal budget remains to be seen, we believe that the change in spending is more important to near-term economic growth than the size of the deficit itself. Additional spending above prior levels creates higher economic activity, so the recent spending binge is unlikely to be a tailwind for economic growth in the new year.

Another surprise has been the resilience of the US consumer as the labour market cools and excess savings dwindle, resulting in less consumption growth. With borrowing metrics also normalising, consumers’ ability to spend diminishes.

A final explanation for the economy’s surprising strength may be the recognition that the period of truly restrictive monetary policy has lasted less than a year. Although the Fed began hiking 18 months ago, policy only entered “restrictive” territory around year-end 2022. Given the traditional six to 18-month lag associated with monetary policy, the economy will likely face restrictive headwinds through mid-2024 as we move through the cycle’s crux.

As supportive macro tailwinds fade, cracks in the economy appear. Consumer balance sheets show increasing signs of strain, with delinquency rates for credit card, auto and other loans on the rise. An economic bull would note that these rates may be normalising from very low levels, while a pessimist would point out that auto and credit card delinquency rates are already above the peaks seen during the last economic expansion.

Another crack is evident in the labour market itself. While the economy continues to add jobs, every payroll release this year has been lower, and the preliminary benchmark revision last month reduced the March baseline by a further -306,000 jobs. This data should not set off an immediate recession alarm, but rather is a sign that the labour market may be weaker than perceived.

The path of the labour market will determine whether the economy continues along the soft landing path or slips into recession. Payroll gains have normalised to an average of 204,000 over the last three months and while this has been a positive development, the slowdown in job creation will need to stop rapidly. If not, the soft landing will have just been a stop along the path to recession.

Labour to stabilise or continue lower?

Despite headwinds gathering, the Fed appears firmly committed to a higher for longer policy path. Generationally high inflation and a tight labour market leave the Fed hamstrung and likely slower to react to unfavourable data and more targeted when it does. A frozen Fed presents a significant risk to economic growth, elevates the chances of a recession, and could even allow what might have otherwise been a mild recession to metastasize into something worse.

The market backdrop has largely mirrored the economic one this year, with a surprisingly strong surge concealing weakness beneath the surface. With fewer stocks participating in the market’s move higher, this is a troublesome sign for the health of the fledgling bull.

Another dent comes from small caps, which have been lacklustre since the lows. This is their worst stretch at the start of a new bull market in 40+ years and since small cap earnings are generally more U.S.-centric than large cap earnings, this may indicate pessimism about the sustainability of the current expansion.

In summary, widening cracks across the economy and capital markets could short circuit the current rally. That path should become clearer in the coming quarters as we move through the crux. In the meantime, we continue to adopt a growth and defensive positioning until more clarity emerges on the economic path forwards.