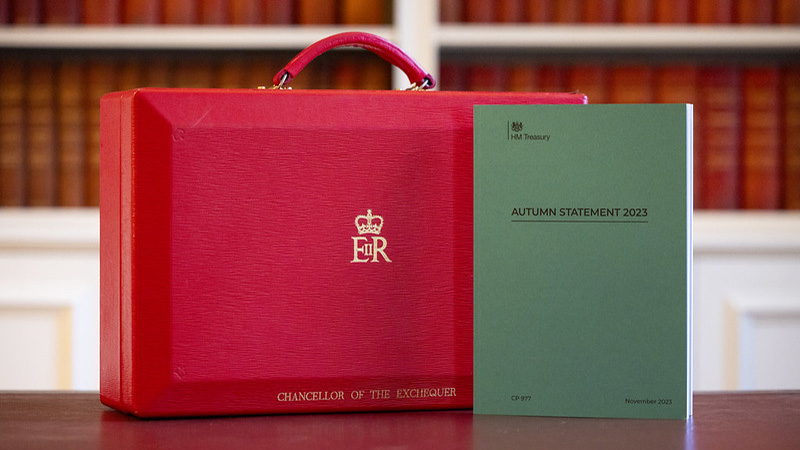

The UK’s rate of inflation is expected to fall to 2.8% by the end of next year, according to figures from the Office for Budget Responsibility (OBR), read by Chancellor of the Exchequer Jeremy Hunt in this year’s Autumn Statement.

According to the OBR, inflation will continue to fall to the 2% target by the end of 2025. The latest CPI figures for the month of October reside at 4.6% – a fall from a peak of 11.1%, according to Hunt.

Addressing the House of Commons as part of this year’s Autumn Statement, the Chancellor said: “Our plan for the British economy is working, but the work is not done.

“[In todays Statement] we reduce debt, cut taxes and reward work. We deliver world class education… and we back British business, with 110 growth measures.

“The OBR says our combined measures will raise business investment, get more people into work, reduce inflation for next year and improve GDP.”

Elsewhere, Universal Credit payouts will increase by 6.7% next year, in line with September’s inflation figures. State pensions will increase by either inflation, wages or 2.5%, depending on which figure is highest.

Growth and borrowing

OBR figures show that, since before the pandemic, the UK has grown by 1.8% and by 0.5% so far this year. While 2023’s growth forecast has increased to 0.6% compared to an anticipated fall of 0.2% forecast in March, figures between 2024 and 2026 have all been revised downwards.

In 2024, growth is expected to hit 0.7%, compared to March’s forecast of 1.8%. Growth in 2025 is predicted to reach 1.4% compared to the Spring Budget estimate of 2.5%; and 2026 growth is now projected to reach 1.9% as opposed to 2.1%.

Hunt said that, in order to boost growth, higher productivity in the UK is necessary. As such, he will be rolling out 110 measures to bolster business investment by £20bn per year.

In terms of the deficit, borrowing forecasts have fallen since the Spring budget and will be hitting the mandated 3% debt-to-economy proportion during most of the next five years.

For the 2023/24 fiscal year, debt is forecast to hit 4.5% of GDP. In 2024/25, it will reach 3.2% of GDP; 2.7% of GDP in 2025/26; 2.3% in 2026/27; 1.6% in 2027/28; and 1.1% in 2027/28.