The day before the US election took place, the LGIM multi-index team was “cautiously optimistic”, and increased its equity exposure at the margin in its higher-risk portfolios. “We expected most outcomes to be either neutral or positive for risk assets,” says fund manager Andrzej Pioch. By 5 November, the team was confident the ballot count was edging towards Joe Biden taking the presidency.

The S&P 500 rallied 7.3% over the course of election week, while the tech-heavy Nasdaq was up 9.4% and in the UK the FTSE 100 was up 6%.

Another factor for the team’s optimism had been the imminent arrival of Covid-19 vaccines. On 9 November, global markets got another boost, when positive vaccine trial results from Pfizer and BioNTech signalled light at the end of the tunnel for the pandemic. A week later, Moderna would solidify the market rally with another dose of positive vaccine news.

Navigating equity exposure after the Biontech vaccine news

A 36-strong team of economists, strategists and fund managers sit behind Legal & General Investment Management’s £4.6bn multi-index range. Pioch joined in 2014, a year after the range launched with just £5m, reuniting with his former Aviva Investors colleague Justin Onuekwusi.

“The economists will be responsible for building the macro picture and strategists will then take on these views to figure out what it means for individual asset classes,” Pioch says of the team structure.

“Once they come up with their recommendations, it’s our responsibility as fund managers to make sure the right recommendations are reflected in the portfolios, given their objective, horizon and the existing risks that we’d already taken in these funds.”

The funds are managed to stay within the Distribution Technology data’s risk targets, with five focused on growth, three on income and two in the Future World series, which take an ESG approach. A third Future World product is in the pipeline.

Vaccine market jubilance meant equity weights drifted higher in the LGIM portfolios so the team rebalanced positioning back to reflect its medium-term view. This was across most regional exposures as most moved above their targets, Pioch explains.

“A 90% vaccine efficacy rate is clearly much higher than many expected,” he says, speaking in November just after the Pfizer/Biotech results had come through, although the team expects it will take at least six months to vaccinate the most at-risk parts of the population. While he says US cases may get worse before they get better, market sensitivity to poor macro data, if it is virus related, will be smaller than before.

Although the US election is largely done and dusted, with a Biden presidency and split Congress, there is still a pathway for the Democrats to secure control of the Senate, thanks to a Georgia run-off election for two seats in early January. But Pioch believes the odds are in the Republicans’ favour.

“That means a continuation of the status quo, no corporate tax hikes and no large green fiscal package. For the tech sector, and to a lesser degree banks, some sensitivity remains regardless of the Georgia results, as potential regulation would rely more on personnel appointments rather than legislation in Congress.”

Tech started to behave defensively in March

The LGIM team has been cautious on mega-cap tech stocks throughout 2020, which Pioch admits was a headwind to performance until recently. He was concerned by the concentration of companies like Apple, Amazon and Facebook in US indices going into 2020. That was only exacerbated as the lockdown buoyed them further.

“What happened in March was quite unprecedented, because the part of the universe that traditionally would be described as higher beta, US tech, suddenly behaved defensively, as these were suddenly the only companies investors believed could still generate earnings, even when we’re all stuck at home.”

The North American weighting in the team’s equity bucket has remained fairly constant, and underweight, at around a third throughout the year.

Exposure is split between the LGIM US Index Fund, Nasdaq Future and Russell 2000 Future, and partially through the L&G AI ETF, which provides diversified exposure to tech.

Throughout the year, as mega-cap tech climbed higher, the team has been adding to what Pioch describes as equity laggards, such as the futures in MSCI Europe Value, Stoxx 600 Autos and Stoxx 600 Telcos.

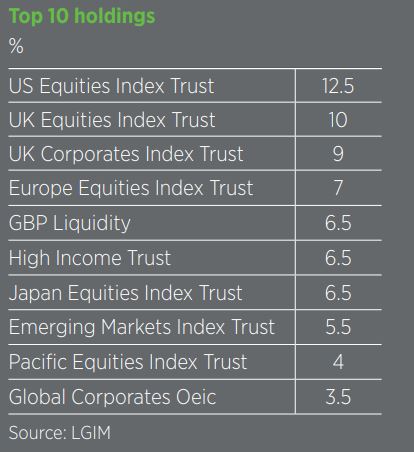

As a fettered fund of funds, LGIM products account for the bulk of positions in the multi-index range, with 75% having to go into collectives.

“We can populate our asset allocation with those internal building blocks and still offer these funds below 40 basis points for the I share class,” he says.

A handful of iShares dividend products used in the income funds are the only third-party funds in the range. A fettered approach is particularly useful for transparency in the Future World range, Pioch says.

“We really want to be the front runner when it comes to transparency in ESG, so we can explain what the metrics are that we use, how they’re applied, what sort of exposure you can expect from these funds and so on.”

2020 highlighted the limit to monetary policy

Within fixed income, Pioch expects to be in the “lower for longer” environment for years to come, although he does say that the effective lower bound for rates has been reached.

“The European Central Bank’s inaction during 2020 to lower rates, in the face of what really was the biggest economic shock in a generation, shows there is a limit to monetary policy. A fiscal policy response needs to accompany what central banks are doing, and all central banks are now very vocal about this.”

Pioch names two ways the LGIM multi-index team is preserving the role of fixed income as traditional bond markets in the US, Europe and UK fail to provide much in the way of enhanced returns or risk mitigation. The first is diversification.

“We need to look further for markets that provide higher yields and steeper yield curves. Markets like South Korea or Australia. We also want to be more nimble in our bond allocation. So if we see opportunity, like we did earlier this year with New Zealand bonds, we add that to the mix.”

The directly held position in a 2029 New Zealand bond was taken out of the portfolio in August, but they still hold the Australian and South Korean 10-year bond futures.

The second is looking for fixed income substitutes, such as bond proxies, to provide stable yield. In 2018, the team worked with LGIM’s product division to help create the Legal & General Global Infrastructure Index Fund.

“Before that, we would use derivatives. So, we would invest in utility futures, which often behave with similar risk-return characteristics to infrastructure, but it only captures a single sector.”

Currencies are another way Pioch and the team manage risk. “We want the flexibility to manage currency exposure independently of underlying assets,” he says. “We’ll build our asset allocation, see what all those exposures mean for our sterling, dollar, euro, and then we can use currency futures and forwards to adjust that.”

With medium-term investment horizon in mind, the team is negative on Japanese yen but positive on Norwegian krone, Swedish krona and Russian ruble.

This article originally appeared in the December 2020 issue of Portfolio Adviser