When Standard Life Aberdeen, one of the UK’s largest money managers, announced late last year it was making a larger proportion of its product range passive, it was a big endorsement of index funds as the future. But the emergence of the reopening trade has made some managers think now is actually the time for active management to shine.

Much has been made of the growth of passives as large asset managers including Vanguard, Blackrock and State Street have flooded the market with cheap index funds and exchange-traded funds (ETFs). The fact that Stephen Bird, chief executive of Standard Life Aberdeen, or Abrdn as it is now known, wants 30% of the £512bn manager’s assets under management (AUM) to be passive, up from the current 10%, is a clear indication the firm is gunning for a larger slice of the $12trn (£8.64trn) passive pie.

“If you stay as an old traditional asset class asset manager, you will be extinct,” he told Bloomberg.

A spokesperson for Abrdn says the firm entered the ETF space a couple of years ago, acquiring a US commodity range whose AUM doubled in 2020 to $6bn. It also launched a range of sustainable index funds in November last year. “Work is underway to build upon this success, by delivering our research and analytical strengths via ETFs.”

Investors turn to large cap

Last month, the Investment Association added 530 ETFs across its sectors in a move that some argue reflects the increasingly important role indexing is playing in the UK wealth market, and piles further pressure on active funds to deliver.

These products are appealing to investors because of their low-cost nature, plus they are becoming more nuanced. Rather than simply tracking a well-established index, ETFs are increasingly offering exposure to factors such as value, growth and momentum, as well as access to on-trend sustainable options.

But according to Morningstar data, investors turned to large cap in March as the reopening trade gathered momentum. Global large-cap blend equity funds enjoyed €11.9bn (£10.4bn) of net inflows in March, with the two top sellers being sustainable index funds: HSBC Developed World Sustainable Equity Index and Blackrock ACS World ESG Equity Tracker, with €2bn and €1.7bn, respectively.

US large-cap value equity funds took in €4.8bn in March, the best month of flows on record. The most popular product was the iShares Edge MSCI USA Value Factor Ucits ETF, which attracted €1.5bn.

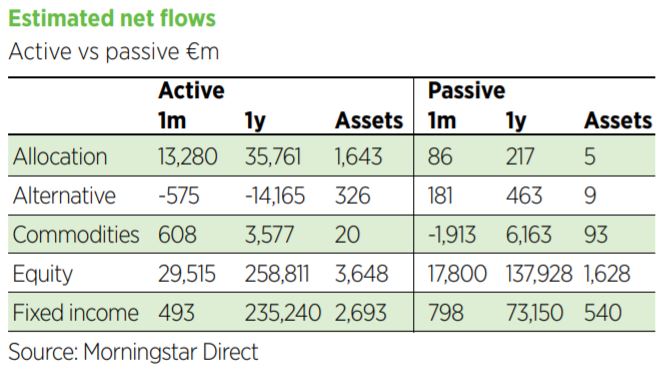

But overall, actively managed funds drew larger inflows over the month, suggesting investors are pinning their hopes on individual managers to navigate the re-opening trade. Long-term index funds gathered €16.9bn in March versus €43.3bn for active funds.

See also: Equity funds record highest month of net inflows since 2015

Proponents of ETFs have highlighted their liquidity attributes during periods of stress like last year when the Covid pandemic hit markets. Blackrock notes that investors turned to fixed-income ETFs as a tool to rebalance holdings, hedge portfolios and manage risk. Throughout February and March 2020, the iShares Ucits fixed income ETFs traded an average of $17.5bn, more than twice the 2019 weekly average of $7.8bn.

Wisdom Tree head of UK sales Ravinder Azad says during events such as the global financial crisis, Brexit and Covid-19, ETFs provided investors with liquidity and the ability to make tactical and strategic trades that many other vehicles struggled with.

“The breadth of strategies available through ETFs is vast, allowing investors to express their investment ideas in a variety of ways,” he says. “That will continue to drive growth in the years ahead.”

But while barriers to entry are low, the barriers to profitability are higher. The cost of index-tracking products has been cut to the bone as behemoth fund houses compete for a share of passive AUM. Some people have pointed out that while accessing the market is straightforward, remaining competitive in a field that contains Blackrock and Vanguard charging total expense ratios as low as 0.06% means Abrdn has its work cut out to be relevant.

Wealth portfolios will double passive in four years

However, asset managers predict further growth in the space. Blackrock thinks the current passive levels of 10-20% within the portfolios of intermediaries will double in the next four years. Research by the firm found 25% of private banks have a weighting in index funds or ETFs, compared with 20% of financial advisers and 10% of wealth managers. As a predictor of the direction of travel, it points to the 10% growth rate of robo-advisers that use solely passive products and the fact that 12% of UK wealth portfolios use purely index funds, up from zero just three years ago.

iShares head of UK wealth and retail Joe Parkin says intermediaries’ use of index strategies has evolved from simply buying US equities or the FTSE 100, to investing in fixed income, and more recently, as a means to gain exposure to different factors, markets and countries. Parkin foresees a day when wealth portfolios have half their exposure in passive strategies.

This is an approach Blackrock recently implemented with Pacific Asset Management on a range of model portfolios split 50/50 between an “efficient” half made up of iShares index strategies and half a “dynamic” actively managed tactical overlay run by PAM.

“Efficient, core building blocks should form the basis of portfolios,” says Parkin. “It’s a great way to get beta at a low cost, and access to thousands of securities, equities and bonds to really anchor the portfolio.”

Look under the bonnet of thematic funds

The fact that two of the best-selling index strategies in March were sustainable products is noteworthy, says Parkin. “Flows into thematic and sustainable products have been enormous, and that train has not stopped; it has continued to grow.”

According to Morningstar, ETFs designed to tap into a specific theme such as robotics, artificial intelligence (AI), clean energy or logistics, raked in €9.5bn in 2020, taking overall AUM in these strategies to €22.7bn. One-third (€3.1bn) of thematic ETF net inflows went into energy transition-themed funds last year. During 2020, a record 17 thematic ETFs were launched and by the end of the year, passive funds accounted for 22.5% of the European sustainable fund market, up from 18% three years ago.

While thematic ETFs are popular among wealth and intermediary investors, Azad cautions that with so many on offer, it is imperative investors look under the hood of these strategies to make sure they are getting the exposure they claim to provide.

“It’s not just about buying into a specific theme,” he says. “You really need to understand an ETF’s approach to stock selection, its methodology and objectives. These are some of the clear differentiating factors investors should be looking for within an increasingly crowded space.”

He says cloud computing, AI and cybersecurity have proven particularly popular among wealth managers and intermediaries over the past 12 months, along with gold, especially low-cost and sterling-hedged exposures.

According to AJ Bell financial analyst Laith Khalaf, investing in these more specialist ETFs is in reality more active than passive, because thematic funds carry higher charges than plain vanilla ETFs.

“Investors also need to pay attention to the construction of the underlying index to make sure it fits their expectations,” he says. “Every investor knows what the FTSE 100 is, but once you start moving away from the big market indices, you need to have a closer look under the bonnet of the ETF you’re considering.”

AJ Bell Investments runs several ranges, including passive, active, ‘pactive’ (blend of active and passive), responsible and income, so the passive exposure varies from 100% down to about 20%. AJ Bell head of passive portfolios Matt Brennan estimates at least two-thirds of overall assets are in passive, with the majority of these in ETFs. Using passive helps keep costs low, which Brennan thinks explains the high level of growth in adviser and retail clients.

“Even in our active portfolios, the lower-risk portfolios with high bond exposure invest most of this passively, and can be up to 50% passive,” he says.

Active opportunity

Psigma Investment Management head of investment strategy Rory McPherson believes the passive boom is related to the increasing number of retail investors who dabbled in markets during the pandemic. However, from Psigma’s perspective, he thinks now is a fantastic time for active managers and the group has a higher weighting to these strategies than ever before.

“The active opportunities are very compelling and active fees have come down significantly,” says McPherson.

A Psigma balanced strategy has about 8.5% allocated to passive, 3.75% in cash and the rest in actives. A couple of years ago, Psigma had almost double the passive exposure, at around 15%.

For AJ Bell, the only asset classes the team has struggled to invest in passively over the long term have been alternatives and income, even in passive portfolios.

“These will at least in the short term likely remain in the realms of active managers,” says Brennan. “However, the passive alternative and income products have massively improved over the past few years, so this will not always be the case.”

Psigma uses passive strategies in UK equity and gold mining shares. “For the miners, we want cheap exposure to that trade and for the UK, we want exposure to the more ‘value’ parts of the UK market. Until recently these were heavily under-owned by the actives,” says McPherson.

“Generally, we think active managers have listened and responded very well,” he says. “Fees have come down considerably and we have been able to get some cracking active fee deals for our clients.

“Furthermore, stock dispersion is elevated, and has been since the outbreak of the pandemic. This has meant good managers can add excellent value – something our clients have been able to benefit from.”

Brennan agrees the growth in passives has allowed AJ Bell’s active team to drive the costs down of many active funds, given the availability of a low-cost passive alternative in almost every asset class.

“It is not necessarily true to say our active team will go more passive in the future. But there is a continued drive to deliver value for money, so this is either going to be more passive or better value active funds.”

HFMC Wealth runs a passive range of five risk-rated portfolios as part of a suite that also includes flexible/active, positive impact and off-shore portfolios. Investment director James Tuson explains how the team is happy to hold index-trackers in the active portfolios as a low-cost way of adding market risk around core active fund selections. The passive element has increased slightly during the past 12 months.

However, aside from the purely passive range, he does not envisage adding further index-tracking options to the model portfolios. “In fact, I wouldn’t be surprising to see this fall back slightly,” he says.

HFMC Wealth uses traditional index trackers, rather than smart-beta options, typically on the major US and UK equity indices, such as the S&P 500 or FTSE 100. “We are less keen on index trackers in the fixed-income world but have held the Legal & General Short-Dated Corporate Bond Index for some years. This is a low-cost way of buying short-dated investment-grade credit with a relatively low sensitivity to interest rate risk.”

There is no doubt the passive wave continues to gather momentum as these strategies evolve to offer access to esoteric asset classes at low cost. But with high levels of stock dispersion since the outbreak of the pandemic and the re-opening trade taking hold, good managers continue to add value.

This article first appeared in the May 2021 issue of Portfolio Adviser. Read more here.