The vast differences in the roll out of the Covid-19 pandemics around the world have led to markedly different effects on the markets. While in the UK, the success of the vaccine rollout has led to some cautious optimism, in areas such as India, further lockdowns are being enacted as the prospect of a third wave is causing increased volatility.

If 2020 taught us one thing, it was that predicting the markets is ultimately a fruitless endeavour. At FE Investments, we instead prefer to look at managing risk and a key component of this is to use fund manager alpha from different investment strategies to diversify our portfolios, using our ‘Approved List’ of recommended funds.

Last month we conducted the latest rebalance of the Approved List, where we added eight new funds and removed two. It was interesting to note that of the eight we added, five were concentrated in equities, which we believe are able to provide risk-adjusted returns in these volatile markets. These funds were (in no particular order), Baillie Gifford’s Global Stewardship (global equities), Baillie Gifford European (European equity), Comgest Growth Japan (Japan equity), Premier Miton European Opportunities (European equity) and Slater Growth (UK equity).

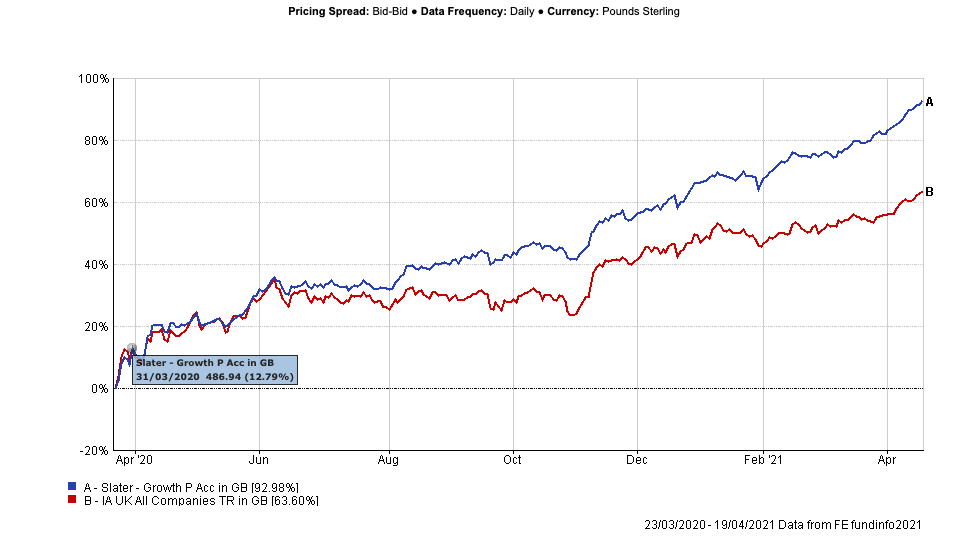

Delving into these funds’ performance, we can see their strong track record over the past year, where they were able to provide alpha over the period that the UK found itself in lockdown.

Slater Growth, which is run by FE Fundinfo Alpha Manager Mark Slater, has returned an impressive 91.45% since 23 March last year, compared to the IA UK All Companies sector, which returned 63.55%.

What is interesting about the Slater fund is that it maintains a certain allocation to cash, so it is able to take advantage of buying opportunities when the market slumps. This ultimately limits against volatility and protected the fund during the initial market sell-off early in the pandemic.

The fund also caters for those with an ESG focused mindset, in that it carefully analyses the ‘G’ in the companies it invests in and has recently added a dedicated ESG specialist to its analyst team.

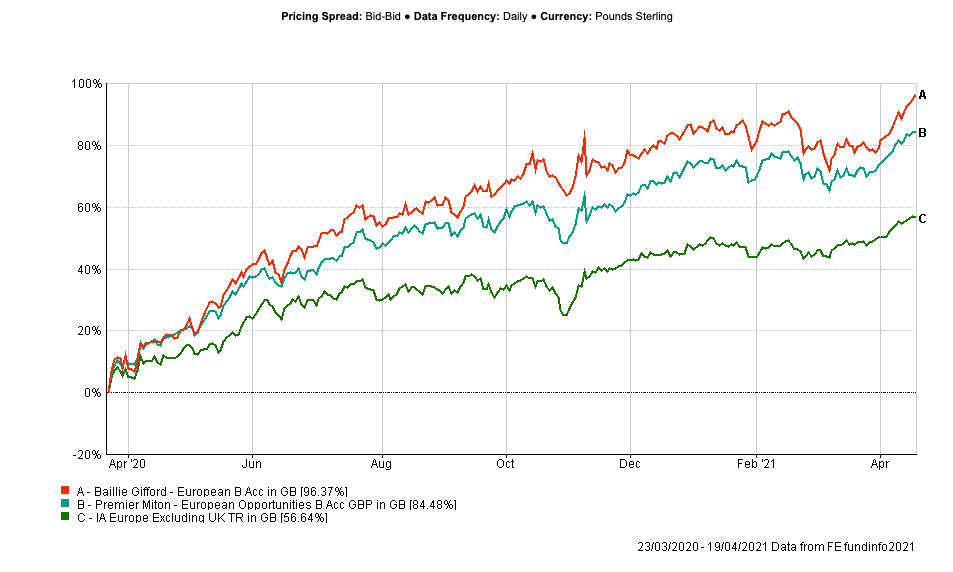

Of the other funds added, several are in the Other Developed Equity sector, where they too have been able to ride out the market volatility.

Baillie Gifford’s European fund for example prefers mid-cap stocks which makes it more sensitive to European markets, but has for the most part avoided the impacts of rising coronavirus rates in France, Germany and Italy.

Premier Miton’s European Opportunities fund too has a preference for mid-cap stocks and has been the best performer in its sector since launching in 2016. Its strategy is to operate an equally concentrated portfolio between defensive and cyclical companies; an approach which has seen it being awarded with a 5-Crown rating (the highest available) by FE fundinfo.

As the chart below shows, both funds have outperformed the IA Europe Excluding UK sector throughout the pandemic.

Our Approved List of course does not solely concentrate on equities and any portfolio must contain a variety of asset classes to maximise diversification benefits.

In the latest rebalance we also looked at a number of other funds which have positions in other areas. These are L&G Fixed Interest Trust, which invests in investment-grade corporate bonds and targets outperformance of its index of 1%, Royal London Global Bond Opportunities which adopts a flexible approach by including a large allocation to unrated corporate bonds and JPM Global Macro Sustainable, an alternative assets fund, which is constructed using sustainable securities.

Because of the nature of managing our risk and regularly optimising the diversification in portfolios, we will be rebalancing again later in the year. By then, we hope that the vaccine roll-out will have been sped up globally and more markets, asset classes and investment styles benefit from the world economy reopening. Whatever happens though, maintaining a balanced portfolio will be as important in the coming months as it has been throughout the pandemic.

Charles Younes is a research manager at FE Investments