Each quarter, Last Word Research carries out an asset class research survey, talking to a wide range of UK fund selectors and analysing their forward-looking investment intentions.

Our latest report, published in January, revealed some massive shifts in fund buyer sentiment. Last month, we saw an increase in the number of investors ready to take more risk and move away from cash and money market funds, but where are fund selectors now planning to invest?

UK equities

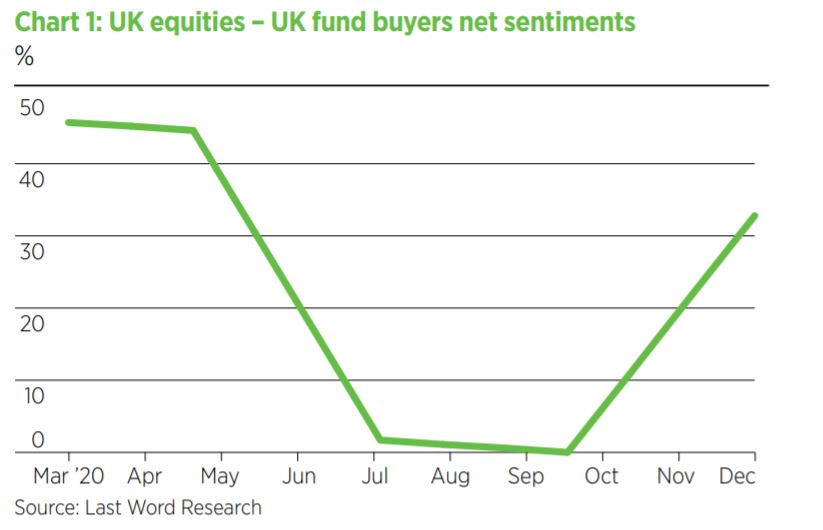

For much of the latter half of 2020, UK equities were stuck in the doldrums, with scant interest from UK investors and a steady net outflow since June 2020. However, there has been a sharp uptick in appetite for this asset class in 2021. In fact, nearly half of our respondents say they are planning to increase their allocation (see chart 1).

Compared with September’s data, there has been a 33% increase for UK equities, representing the largest quarterly shift we have seen this year, and moving this asset class firmly into the green.

It is not just Last Word Research’s data that points to an increase in demand for UK equities.

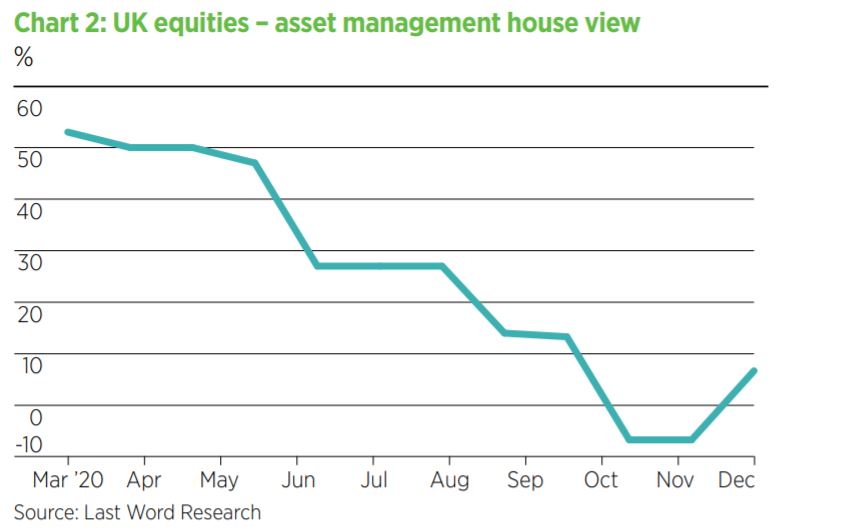

Old Mutual Wealth conducts a monthly review of 20 of the biggest global asset managers to find out their house view across asset classes. We turn that into an aggregate number to represent what the fund management industry thinks will happen next. Chart 2 shows the sentiment towards UK equities for the past year.

At the start of 2020, most fund managers expected UK equities to go up. That optimism waned throughout the year, turning negative in October. But it’s now bounced back. Our best bet is that we’ve hit an inflection point.

All the bad news is priced in, and so we think it most likely there will be a continued upturn in demand for UK equities in 2021 and net flows will turn positive.

European equities

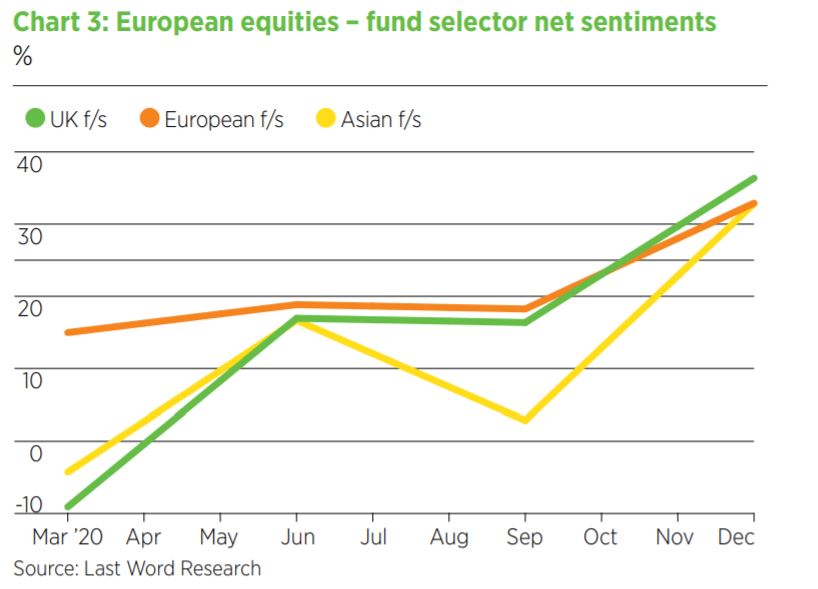

A 20% quarterly shift means there has also been a nice uptick in appetite for European equities this quarter, although not to the same extent as UK equities.

That shift up in interest for the asset class is also present among European and Asian fund selectors, and chart 3 shows all three geographies. Remember, this is all forward-looking investment intentions.

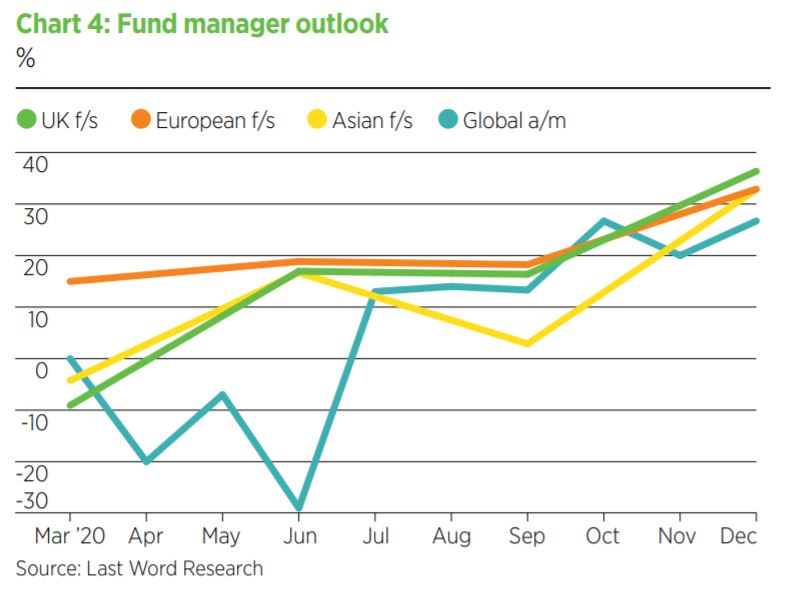

In chart 4 we have overlaid the fund manager outlook on the asset class and, as you can see, everyone agrees European equities are the way forward for 2021.

Property

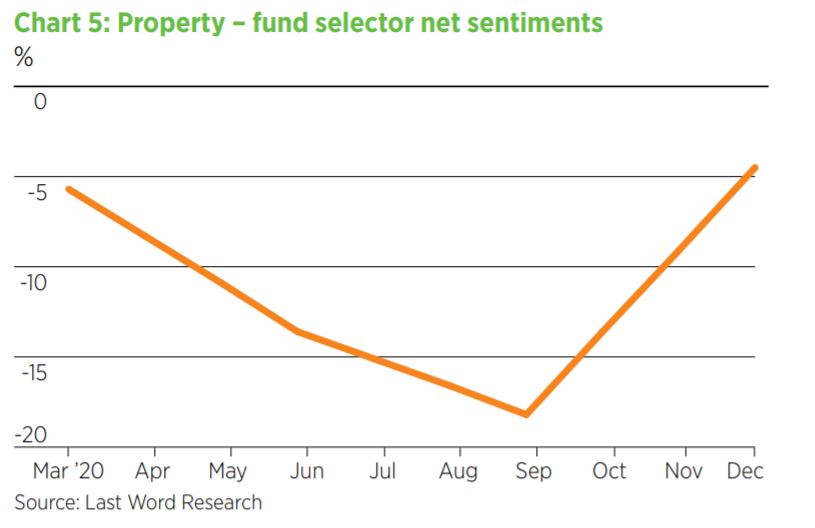

Finally – perhaps unexpectedly – there has been an uptick in fund buyer sentiment for property after a year of sinking interest (chart 5). With a rise of 13%, this asset class has moved from firmly in the red to slightly negative, although there are still more sellers than buyers about.

However, against a backdrop of open-ended fund suspensions during the pandemic, this change in attitude is interesting, and something Last Word Research will continue to track over the coming months.

Ready to take a risk…

Overall, it is clear that at the top of 2021, UK investors are ready to start taking more risk and are looking much more favourably on asset classes that had been neglected throughout 2020.

If you would like to get involved with Last Word Research’s quarterly Asset Class Research Survey, or want to discuss this article please feel free to contact Lottie.mcgurk@ lastwordmedia.com

This article first appeared in the February 2021 issue of Portfolio Adviser magazine. Read more here.