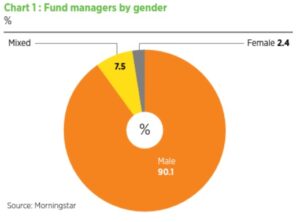

Of all the funds available to investors in the UK, just 214 are run by women. That equates to 2.4%, according to data from Morningstar.

Funds whose co-managers are male and female account for 7.5%, meaning 90.1% are run by men.

Dissertations could be written on why women remain so under-represented in fund management and across financial services more generally, and you would be hard pressed to find someone in the industry who would not acknowledge there is a gender imbalance. But the reality is that not everyone views it as a problem.

A survey by our in-house research team Bonhill Intelligence found 12% of UK fund buyers felt there were enough women in the industry. For context, 19% of respondents were female.

When asked about their selection process, 7% said they used an entirely male team every time they chose a fund. A fifth (22%) used an entirely male team most of the time. Just over half (54%) said they had never bought a fund run entirely by women.

Gender agenda

We asked fund buyers for more detail about how gender factors into their selection process, which resulted in the following responses:

“I select only on merit. Anything else would let my clients down.”

“I don’t care how the team is made up, as long as they are producing good performance. I believe in the best person for the job regardless of gender, sexual orientation, religion, nationality or any other measure. I do not like people being given jobs merely to ensure a box is ticked.”

“We are gender ambivalent. We judge each team, process and performance on its merit, without any discrimination.”

“I have never come across a female only team.”

“There is poor diversity in this industry.”

“It’s what’s available.”

It’s hard to argue with the perception that female fund managers are difficult to find when only 2.4% of funds in the UK are managed solely by women. But what about merit, which seems to be the other key determining factor?

In one sense, performance is a straightforward concept where a fund is measured against its benchmark.

But to compare female fund managers with their male peers is incredibly complicated, not least because of the difference in the size of the groups. Men outnumber women by a considerable margin.

Even though we have identified 214 funds run by women, some manage multiple strategies, further shrinking the pool. If broken down by asset class, it becomes even more convoluted, so making a meaningful comparison becomes yet more difficult.

Even though we have identified 214 funds run by women, some manage multiple strategies, further shrinking the pool. If broken down by asset class, it becomes even more convoluted, so making a meaningful comparison becomes yet more difficult.

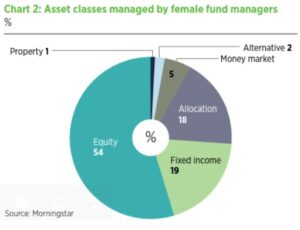

Most female fund managers (54%) run equity strategies, with 19% fixed income, 18% allocation (multi-asset funds where the asset allocation is worked out to match the risk tolerances of different types of investor), 5% money market funds, 2% alternatives and 1% property (see chart 2).

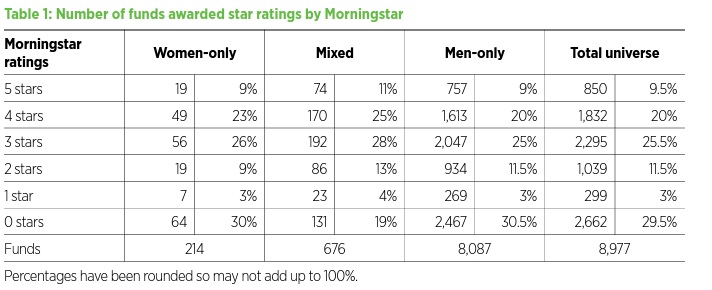

The table below shows a breakdown of the number of funds awarded star ratings by Morningstar.

Taken at face value, female- run funds have, proportionally, been awarded the same level of 5-star ratings and slightly more 4-star and 3-star ratings than those managed by their male peers.

Comparable results

Again, the varying group sizes make it difficult to draw fixed conclusions. What we can reasonably determine is that, looking at the Morningstar ratings, the performance of female fund managers is comparable to that of their peers. Additionally, and perhaps most interestingly, the best performers are where there are male and female co-leads.

Referring back to Bonhill Intelligence’s fund buyer survey, we asked respondents for suggestions as to how the industry could encourage greater equality in the sector. Some indicated little interest in making wholesales changes, perhaps reflecting their earlier response that diversity was not an issue.

The more proactive suggestions centred on themes such as early education, mentoring, recruiting from less-traditional pathways, reducing nepotism and elevating voices already in the industry.

Beyond the numbers is the lived experience, so Portfolio Adviser reached out to female fund managers to find out more about their experiences and views, which you can read about below.

‘We need cognitive diversity in all areas of decision making’

Kate Morrissey, head of world selection funds at HSBC Asset Management, was one of just six women when she joined the firm’s investment banking graduate programme in 2000.

“There were around 60 graduates that year,” she says. She later joined HSBC AM’s discretionary wealth management team as a trainee portfolio manager on the fixed income team, going on to run it from 2007 until she joined the institutional global bonds business four years later.

“In 2019, I moved across to multi asset to lead the team that manages HSBC AM’s flagship wealth products, World Selection and Global Strategy.” Morrissey’s name appears an impressive six times on our list of five-star Morningstar-rated funds managed by women, but she is quick to credit the success to “the broader multi-asset platform”.

“I think, broadly across the industry, the star manager culture is declining and this is intrinsically linked to the increasing recognition that a team-based, collaborative approach leads to better outcomes.”

Diversity drive

When asked if her gender plays a role in attracting interest in the strategies she manages, Morrissey says, “first and foremost, interest in our multi-asset solutions stems from investors acknowledging our ability to delivery strong returns in a risk-aware way, our best in-class processes and that our flagship solutions benefit from a very strong performance track record versus peers”.

But she acknowledges that “in recent years, and particularly since the discussion paper on diversity and inclusion in the financial sector was published last year, we are seeing increasing requests from clients to detail the diversity data of the firm”.

When it comes to whether men and women manage funds differently, Morrissey believes it is more to do with the characteristics of the individuals, rather than their gender. “I enjoy working in a mixed team. Mixed fund management teams have been determined to generate better performance and do so across different market regimes.

“This reconciles with my own observations, and it is important as it disproves the myths around women and risks.” It’s also more about inclusivity than gender, she says.

“It is important to me I have a strong connection with my team. We have a very open continuous dialogue and I do my best to lift them up as much as possible.”

Pinch point

Everyone’s professional journey is marked with challenges, and for Morrissey it was early motherhood, something to which many women can relate. “This remains a pinch point in many women’s careers and that will continue until we see greater balance with childcare and in the home.

“It was also an enormous help that I was able to work a four-day week throughout my children’s early years. I am grateful to HSBC AM for providing such flexibility.”

Asked if she has ever felt the need to change or adopt any traits to be more successful, Morrissey says she has always tried to be authentic in the workplace.

“We all amplify or diminish different parts of ourselves depending on the circumstances, but that is something quite different from feeling you need to adopt a specific trait to progress.”

This is where workplaces can ensure employees are provided with the “psychological safety to bring their true selves to work”, she adds.

Visibility and role models

When it comes to encouraging more women into the industry, Morrissey points to the visibility of female role models, which she says “cannot be underestimated”.

“I recall reading profiles of Helena Morrissey and Nicola Horlick when I was early in my career and found that hugely encouraging. And, of course, within HSBC AM I am following in the footsteps of many great women: Joanna Munro, global CEO of our alternatives business is a great inspiration, as are the other eight female CEOs within our business.”

She adds: “As a sector, we do still need to work on improving the retention of women in the workforce and increasing representation of women at more senior levels. The reality is that the allyship of senior men remains very important to foster change.

“We are fortunate within HSBC AM that our global CIO Xavier Baraton and Stuart White, our global head of strategy and UK and international CEO, are both powerful forces in the diversity, equity and inclusion space. It has also been very encouraging to see awareness increase and how generational transition naturally fosters more open-mindedness and thoughtfulness.

“With such progress, I feel our industry is getting in front of the agenda and that we are closer to the point where it is conventional wisdom that we need cognitive diversity in all areas of decision making.”

‘Study what you like and retrain’

The Quilter Cheviot Climate Assets Fund, run by Claudia Quiroz and deputy manager Caroline Langley, is the only strategy on the list of 214 funds run by women that has been awarded Morningstar five-star and ‘High’ ESG ratings.

“We have also had five crowns from Financial Express for the past eight years,” adds head of sustainable investment Quiroz.

Neither she nor investment director Langley had a traditional route into fund management.

In her native Argentina, Quiroz’s first degree was in chemical engineering. After working in the industry for a couple of years, she moved to the UK to study for an MBA at Cass Business School. It was while looking at how to invest commission, earned from her role in an M&A brokerage house in London, that she came across a fund run by Henderson, which she would later join.

“I got interested in the philosophy of investing in companies that are providing solutions to improve productivity, tackle environmental issues and improve access to water and medicine.”

She started at Henderson as a research analyst before progressing to fund manager. In 2009, Quiroz joined Cheviot to develop its sustainable investment strategy, where she met Langley, who has been with the company since 2006.

Langley’s interest in financial services started early, after her stockbroker father bought her a few shares when Andrew Lloyd Webber’s Really Useful Group listed. But it was human sciences she studied at Oxford, before joining PwC’s graduate training scheme.

She started as a chartered accountant in the financial services division, before her interest in biology, demography and social sciences saw Langley transfer to PwC’s sustainable business solutions group.

But Langley got “fed up with just writing about” trust and reputation in financial services “and not doing it”. She joined JO Hambro Investment Management (now Waverton) where she trained to become an investment manager.

She moved to Cheviot when it was “an embryonic business”, which spoke to her entrepreneurial streak. “I enjoyed being involved at a very early stage, setting the tone for a whole new business.”

Throughout her career, Langley has been involved in looking after private clients, but has always been interested in the ethical/sustainable side, which she has tried to incorporate where possible. Quiroz says the pair has “an unusual expertise, in that we know how to manage private money and are also fund managers”.

‘Female flavour’

Langley describes the statistic that 2.4% of funds available to UK investors are run by women as “disappointing”, adding “it’s shocking there aren’t more female teams like us”.

She credits Quilter Cheviot with providing a space where they could flourish and grow their strategy but adds both women “are ambitious and determined”.

Quiroz has been asked by younger colleagues about tips for career progression and says she offers the following advice: “For me, it’s like a marriage. You need to choose who you’re married to because that person needs to support your career. And choosing who you work for is as important.”

Her second tip is to make sure, whatever career you choose, that you have a passion for it. As Quiroz puts it: “I didn’t find mine until my second career. Or, I should say, my passion found me. I was just trying to invest my money like anybody else, but I found this product I really liked, and I joined that company.”

Running the Climate Assets Fund revolves around three critical elements. First is a repeatable investment process, then discipline and, finally, as Quiroz describes it, “the female flavour comes in”.

“We are never shy about putting our hands up, say we got something wrong and make the correction that is needed.”

Despite alluding to a “female flavour”, Quiroz says what attracts investors to the fund is not that she and Langley are women. “People come to us because they like the investment proposition. When they realise it’s run by two females, that puts a smile on their face. It’s a ‘nice to have’ but not what investors are basing their decisions on.”

Langley adds: “It has to stack up in terms of performance and that’s what people look at first. I think many would not even realise who was running it.”

It does attract a lot of female clients and investors, Langley says, which she attributes to how women think about family. “As soon as you think about the financial future of your family, it gets tied up with what kind of world they will grow up in.”

A different view

When it comes to getting more women and diversity into the industry, Langley points to the recruitment process. “There is a tendency for companies to look at economic and business-type degrees and, I’m generalising but, women aged 18 are not necessarily thinking about a tactical degree subject.

“But I think the breadth of that broader education is incredibly valuable for looking at investments and seeing the world from different views.”

The industry is so regulated that people need to do a whole set of exams when you enter it, “so your degree doesn’t really matter that much”, Quiroz says. “Study what you like and then retrain.” Quiroz adds that people often don’t realise how flexible the industry can be when it comes to working hours.

She joined Cheviot when her son was very young. “I was given the opportunity to choose the days I wanted to work and how many hours. That took me from being a working mum to a full-time employee and then being the lead for a very successful strategy.”

‘Different mindsets challenge your way of thinking’

‘You’re going to have to be five times better than the men to succeed in this business,’ was the advice BambuBlack founder Jane Andrews received from a boss early in her career.

The matter-of-fact statement came from someone she describes as being “very pro-female fund managers”.

Andrews spent 23 years working at Smith & Williamson before setting up her own firm in 2019. Having been a partner for “many, many years,” she reached a point “when I wanted to do something more entrepreneurial.”

She was introduced to Craig Bingham, CEO of Bennelong Funds Management, known as Bennbridge outside of Australia, which partners with boutique asset managers around the world. “They provide the infrastructure, along with the compliance, operations, sales and marketing functions. Everything we need to run and help grow our business.”

It has been “very hard work, but very rewarding”, she smiles. “It has stretched me, personally, and I’m very pleased that I have done it.”

When BambuBlack was founded, Andrews brought her two Asia-focused funds along with her. “Smith & Williamson were keen that clients come first and, in their view, when a manager leaves, funds tend to lose quite a lot of support. They felt it was in the clients’ best interests to have that continuity.”

It was difficult to leave the business after so many years, but she says that Smith & Williamson “have been very supportive”.

She credits her former employer with “always being keen to promote women and find new graduates to join the industry”.

More than a tick-box exercise

Andrews got into financial services “by accident”, adding “it has been an amazing journey and I wouldn’t have wanted to have done anything else”.

When it comes to women in the industry, Andrews says, when she started on her career path, “my perception was that there were potentially more women in the Asian space”. She has seen the evolution of China, which Andrews first visited in the early 1990s, and the “wonderful” transformation of the region, where “you get quite a few women, within senior positions, running companies”.

The exception, she notes, is Japan, where women still have a tendency to leave the workforce after having children. “When I talk to companies there, they want to have more female representation on their boards but it’s hard to find that experience because many women have taken time out to look after children, which leaves a big career gap.”

Being a female entrepreneur in this industry comes with some additional attention, but “you also potentially stand out because of that”. One thing that is important to Andrews is for the team to be judged on their merits and not be selected to fulfil a diversity tick-box exercise. “I wouldn’t want someone to invest in our funds just because we’ve got female representation.”

World view

When building her team, Andrews’ goal was to focus on complementary skillsets and ensure “we don’t all think alike”.

Portfolio manager Linda Wang Saitowitz is from mainland China. Given BambuBlack’s Asia focus, it was important for Andrews “to have someone who couldn’t just speak Mandarin but who also understood both mainland Chinese and western culture”.

They are joined by analyst James Measures. “We are all different ages, so we bring different perspectives.”

She adds: “When you’ve got people who think differently or come at something from a different mindset, that challenges your way of thinking. Change is important otherwise we just stagnate.”

Andrews identifies confidence as one of the barriers discouraging women from pursuing careers in fund management. “In some ways, men find it easier to communicate their story,” she says.

“Women maybe tend to overthink things and second-guess ourselves. But one thing I’ve always tried to be is true to myself and not compromise who I am as a female and as a fund manager.” She says it is important for men to also play a role in championing women. Where the industry could better attract more female applicants is with people like Andrews talking to school and university students “about our experiences of being a fund manager and being in the industry”.

“Also, by telling our stories and mentoring younger female analysts and managers, explaining that it has been a great, great career.”

Realising potential

Andrews references “an intuition” as one of the qualities many women possess. “That’s a strength. We can pick up on things when we meet companies and investors,” she explains. “You absolutely have to put in all the hard work, but women also tend to have an ‘intuitiveness’ – and when you combine the two, I think that can be very compelling.”

Her route to entrepreneurship is something she says should be more widely available and accessible to women.

When it comes to encouraging greater female participation in fund management, “it is not about setting the bar lower”, Andrews says. “It’s more about helping people to reach their potential.”

This article first appeared in the March edition of Portfolio Adviser magazine