Sir John Beckwith appears to have a knack for building fast-growing asset management businesses. The Pacific Investment Group, the private family office he established in 1993, has helped develop Liontrust, Thames River and River & Mercantile. Pacific Asset Management (PAM) is the latest addition to this impressive list.

The group takes a slightly different approach to asset managers that have gone before it, with two strands to its business. The multi-asset side offers risk-managed multi-asset funds for advisers. The group also has its ‘craft businesses’ – single manager strategies that can’t be industrialised by passive funds. These are focused on segments of the market where passive is unlikely to add value. At the moment, this holds an emerging market value and G10 macro funds, but there are plans to add new strategies later in the year.

See also: Pacific Asset Management challenges traditional DFMs with Blackrock collaboration

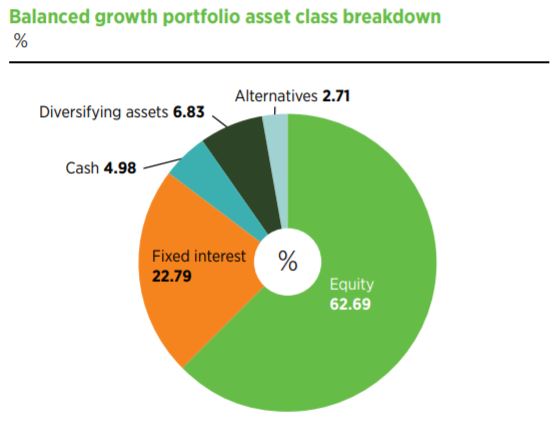

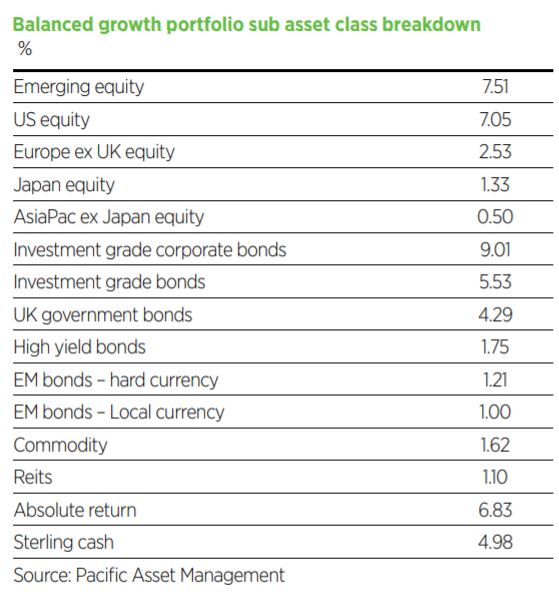

The multi-asset funds aim to combine two engines within a single portfolio. Half is in a static asset allocation portfolio, using a series of passive funds from Blackrock. PAM chief investment officer Will Bartleet says: “This is a blend of tracker funds for which we provide the allocation. We draw on a lot of intellectual property in this allocation – we look at historical correlation data, currencies, diversification. It is designed to deliver exposure to a specific risk profile in the most efficient way possible.”

It also helps keeps costs very low. “To our mind, advisers haven’t gone as far as they could in embracing passive. It’s a chance for advisers to reduce costs for end clients,” Bartleet adds.

The asset allocation for the remainder of the portfolio is managed dynamically. Bartleet says: “This part of the portfolio is forward-looking, more diversified and much more actively managed. It will use active tilts and a broader range of asset classes. We try to think about how the future might look.”

In building the portfolio this way, they can accommodate significant structural changes in the economy and markets. “A straight multi-asset passive fund with a static asset allocation has worked very well in recent years and if the world stays as it has been for the last 20 years – with bonds and equities uncorrelated, bonds an incredible investment and a complement to equities – this will continue to do well,” says Bartleet.

“But what do you do if the world changes? Investors need a dynamic element to their portfolio that will do well in a changing world.”

As many levers to pull as possible

Bartleet’s background was in asset allocation at HSBC, so he has a long history of thinking about regional asset allocation, the appropriate split between bonds, equities and alternatives, and large structural themes.

“We take a tactical view of why the world would be different to the long-term allocation. Then we think about how best to allocate to all the different asset classes.”

The team is agnostic on how it accesses those opportunities. They will use exchange-traded funds (ETFs) where appropriate, plus active funds where they believe active management can add value. They will also select direct securities where appropriate, some ‘factor’ exposure, as well as some uncorrelated risk premia strategies. This may include exposure to the other craft businesses within the PAM stable.

“We want to have as many levers to pull as possible. There are some years in the equity market when it’s all about being in the right region. The US has driven the recovery over the last decade, so regional positioning can be very important. Other times, it’s much more about the style or sector view. Today, for example, we think it’s time for value. We’ve been allocating through active funds and we’ve got factor exposure to value as well,” says Bartleet.

The group sees it as a centralised investment proposition ‘in a box’, designed to help advisers manage the increasingly difficult process of delivering advisory models in-house, which are subject to significant regulatory costs, administration, rebalancing and platform complexities. PAM supplies the investment expertise, but also has a whole digital proposition that runs alongside it. This should help with everything advisers struggle to do in-house.

Bartleet adds: “One of the problems advisers face is the information gap between the people running the portfolio and the end client. This is a particular problem at times of market stress and we want to make sure advisers are very well-informed. They can look at the portal and see exactly what we’re doing in real time.”

This has been important in 2020 and the group has been careful to provide communication during the crisis, updating investors on the latest actions of central banks and governments as well as moves in the markets.

This multi-asset engine powers three ranges; the model portfolio solutions (MPS); multi-asset sustainable; and multi-asset accumulator ranges. Within each range are options mapped to different client risk profiles, with 12 portfolios in the MPS range, four in the sustainable range and another four in the accumulator range.

Themes for the future

In the dynamic segment of the portfolio, in addition to the tilt to value, the group also aims to think about long-term themes that are likely to be in place for decades. At the moment, the first of theme is water scarcity.

Bartleet says: “On current trends, by 2025, two-thirds of the world will be under water stress and up to 10% of the world will be living in regions with absolute water scarcity.”

The second area of focus is demographics. According to Bartleet, sustainable investing tends to focus on environmental factors but social change is also extremely important. “Demographics is one of the huge shifts we are certain to see in the next 50 years – and it is unstoppable.”

The water scarcity theme is played through an ETF, but the group will invest in demographics and social change through an active fund. Dani Saurymper, a healthcare and longevity portfolio manager from Axa Investment Managers, will join later in the summer.

At each point the group is looking for themes with longevity, but where there isn’t too much expectation built into the share prices: “Some of the hot themes are undoubtedly growing very quickly, but the valuations reflect that. They’ve become popular places for retail investors to get involved and valuations have been pushed to extremes.

“Clean tech was a huge theme in 2007. It then collapsed for two years before the Nasdaq went sideways for 10 years. It never stopped being an important theme, but the prices weren’t right.”

Balancing inflation

Bartleet is relatively untroubled by the central theme of today: inflation. “The figures were always likely to look elevated compared to history, partly because we are comparing to a very deflationary period a year ago,” he says. “There are also rising commodity prices, prompted by supply bottlenecks from areas such as steel, lumber, cotton and also semiconductors. We’ve also got the opening up of the economy, plus stimulus packages and high consumer spending. All this is going to cause a pickup of inflation in the short term.”

That said, Bartleet believes this needs to be balanced with some major deflationary forces, such as high debt and demographics. The mix is reflected in this portfolio: “We have gold in the portfolio, which has a very strong track record when inflation rises. We also have a lower dependency on government bonds, focusing on other diversifying assets that will do well.”

The unique structure of the portfolios allows them to be tilted to accommodate these shifts in the global economic landscape, while also keeping costs low. Like many of its stable-mates, Pacific Asset Management may become a force to be reckoned with on the UK asset management scene.

This interview is taken from the June 2021 issue of Portfolio Adviser. Read more here.