Baillie Gifford’s big bet on Moderna has proved difficult this month, as the Covid vaccine maker has seen weaker sales momentum and competition from Covid pill makers, but could the arrival of the Omicron strain signal better times ahead?

The Edinburgh manager is currently the largest institutional shareholder in the biotech firm, owning over 42 million shares or a 10.5% stake at the end of September.

Currently eight of its funds and trusts hold Moderna in their top 10 holdings, according to FE Fundinfo.

Baillie Gifford funds with the highest weighting to Moderna

| Keystone Positive Change Investment Trust | 11.6% |

| Scottish Mortgage | 9.2% |

| Baillie Gifford Health Innovation | 7.9% |

| Baillie Gifford Positive Change | 7.8% |

| Baillie Gifford American | 6.5% |

| Baillie Gifford US Growth Trust | 5.1% |

| Baillie Gifford Long Term Global Growth Investment | 5.1% |

| Baillie Gifford Managed | 1.3% |

Source: FE Fundinfo

Moderna, which develops mRNA medicines to treat infectious diseases, had been the Edinburgh manager’s MVP during a year in which its funds have been battered by the cyclical recovery from the Covid crisis and the Chinese regulatory crackdown.

Earlier this year Moderna’s share price was red hot, jumping 330% from $112 at the start of the year to $485 in early August.

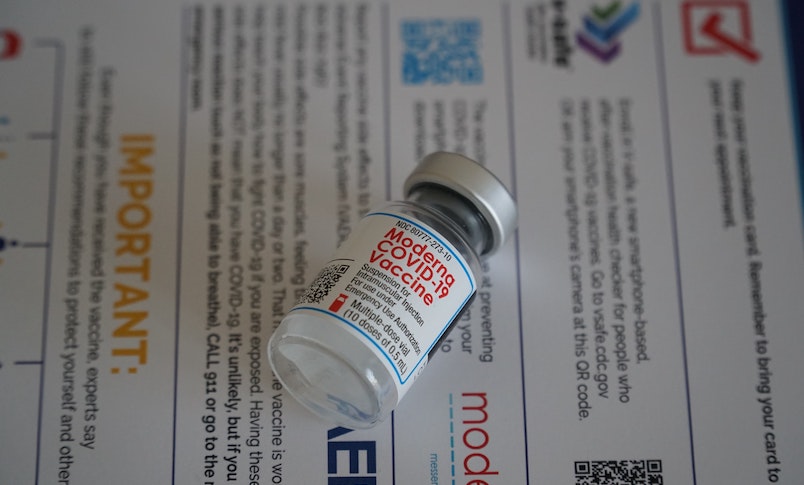

However, in early November it saw a third of its value wiped after revealing 2021 sales of its Covid-19 vaccine, known as Spikevax, would be around $3bn-$5bn lower than the $20bn previously forecast. Days before, rival Pfizer had lifted its revenue guidance for its Covid vaccine to $36bn for the year and forecast another $29bn in sales thanks to its booster shots.

With the emergence of the new Omicron Covid-19 strain last week, Moderna has recouped most of its losses from earlier in the month with shares up 26% last week at $330.

Baillie Gifford dumps 2 million shares in Moderna in Q3

Baillie Gifford’s Positive Change, American and Health Innovation funds were early backers of Moderna, investing in the stock at IPO in 2018, over which time its shares have shot up over 1,792%.

But it wasn’t until Q4 2020 that Baillie Gifford began meaningfully adding to its position, data from Bloomberg seen by Portfolio Adviser shows, with the fund group aggressively buying up shares in the first quarter of 2021. However, in Q3 it dumped around 2 million shares in the mRNA vaccine maker.

Baillie Gifford declined to comment on Moderna’s recent share price swings or the reason for the recent divestment. A spokesperson for the company said it still has conviction in the biotech stock, pointing to recent statements from Scottish Mortgage’s James Anderson and Tom Slater.

Writing in their latest set of interim results, Anderson and Slater described Moderna, now their largest holding, as one of the businesses benefitting from the intersection of biology and the “powerful trends in computing technologies”.

Anderson and Slater said the “breadth and scalability” of Moderna’s mRNA technology platform is where its value truly lies, with the company targeting a wide range of diseases from the flu to Zika, HIV and cancer.

See also: Scottish Mortgage spikes 25% as James Anderson moves into the final lap

Consensus perception of Moderna could change if new variants pose a threat

AJ Bell investment director Russ Mould says analysts are doubtful the current momentum in sales and profits can be kept up.

“The current consensus expects earnings per share (EPS) to exceed $26 in 2021 but then retreat to just under $25 in 2022 and plunge to $11.40 in 2023 as the pandemic is beaten off, the need for vaccines declines and competitor treatments proliferate.”

However, that perception could change “were new variants to make their unwanted presence felt,” he adds.

Prior to last week’s share price recovery, Moderna was trading on a price-to-earnings ratio of less than 10, while Pfizer was on 12-13x earnings and Astrazeneca was north of 20x.

“On the face of it, the stock is not expensive, especially for a pharmaceuticals firm, with the sort of very high margins and returns on equity that can quickly compound up and generate fabulous long-term returns for shareholders – if they can be maintained. And it is that caveat that is the key,” Mould says.

Current valuations imply Moderna will take over biotech

Morningstar continues to think the stock looks overvalued. In a research note published on 19 November, it maintained its fair value estimate for Moderna at $159, around halve its current share price.

Senior sector strategist Karen Andersen told Portfolio Adviser the research house takes a long-term view on assigning valuations, modelling cash flows over 10 years.

Over this timeframe her base case is that more vulnerable populations, and possibly infants, will require annual boosters every year, not every member of the public.

Despite showing some promising data in treating other infectious diseases, Moderna has only really validated their technology for one infectious disease (Covid-19), Andersen argues.

“The market sees this technology and thinks this could basically take over biotech. We could have vaccines for every imaginable disease.

“But are they really going to be able to generate enough protein that it could be therapeutic and that we could see this replacing biologic therapies? Is it really going to work for all infectious diseases? Things like HIV have been notoriously difficult to find vaccines for using other technologies and even with mRNA, I think, experts are thinking this would be a longer road.”

See also: Healthcare fund managers caution against getting caught up in Covid-19 vaccine hype

‘Any firm making 60% plus operating margins is going to attract competition’

While Moderna’s current fortunes are tied to the success of its Covid vaccine, it also faces increasing competition from companies producing antiviral pills. There are two such drugs on the market currently – Merck’s molnupiravir, which has been approved for use in the UK, and Pfizer’s Paxlovid pill.

“Any firm making 60%-plus operating margins is going to attract competition by dint of simple economics – high returns on capital naturally attract more capital as someone decides they want a piece of the action,” Mould says.

“A desire to ‘do good’ and help to beat off the pandemic is likely to mean other firms want to be seeing to be doing their bit, too, and you would expect new, rival products to appear and offer more effective, and potentially less costly, treatment as scientists learn more about Covid-19, its origins, how it works and how to fight it.”

Pictet Biotech fund manager Marco Minonne has avoided the mRNA vaccine makers like Moderna in favour of Regeneron and Gilead, which specialise in antibody cocktails.

While he says the oral pills “are a significant threat” and will continue to be used, he believes there will still be demand for antibody treatments, which tend to provide longer immune response than orals.

“As we go to an endemic phase, we would expect that orals and antibody cocktails will remain important tools, but the rate of hospitalizations should also trend lower and more in-line with the flu,” Minonne says.

By year-end he expects 70-80% of people in most developed countries would have either contracted the virus or have been vaccinated.

“While a new powerful strain is always possible, we would think that with such high rate of vaccination and natural immunity, the chances of such an event should diminish,” Minonne says. “Also, there is some initial evidence that while the first 2 shots efficacy wanes significantly within 5 months, a booster could theoretically provide a much longer immune response (2-3yrs).”