The large majority of multi-asset funds can be found within the IA Mixed Investment, Flexible Investment and Volatility Managed sectors, with the Targeted Absolute Return sector also home to some more traditional multi-asset funds.

Unsurprisingly, all of these sectors’ assets under management (AUM) have fallen over the past 12 months, according to data from the IA to 31 August 2022. However, somewhat more surprising is that this has been felt hardest, in percentage terms, across the lower-risk sectors of 0-35%, 20-60% and Target Absolute Return.

One might have expected lower-risk funds to be more popular when markets fall in value, given their perceived defensive qualities. But somewhat unusually over the past year, the 0-35% and 20-60% sectors have also been the worst performers.

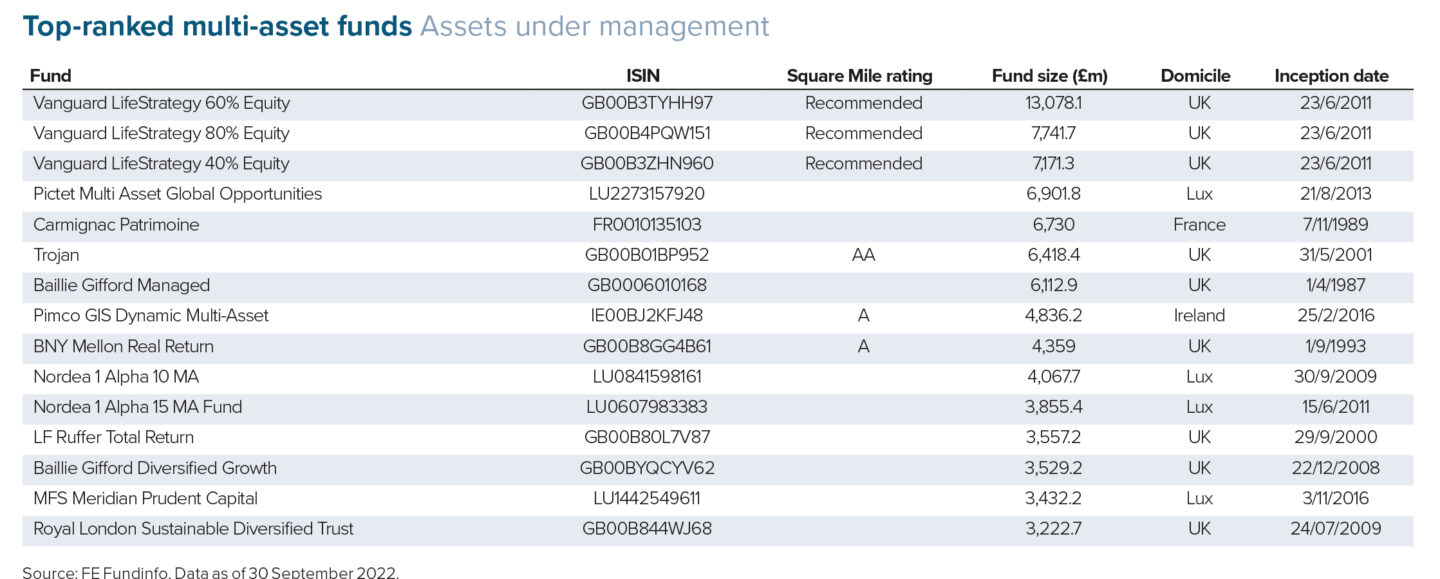

A persistent theme we continue to observe is the flow of money towards lower-cost and passive investment solutions. The largest within the multi-asset space in terms of AUM remains the Vanguard LifeStrategy fund range, which tops £36bn across the five funds, as at 28 September.

Other established players, including L&G’s Multi-Index range (AUM £6.4bn) and HSBC’s Global Strategy range (£5.6bn), also continue to grow assets but remain a long way behind Vanguard. Indeed, these three ranges have all seen positive flows in each month during the past three years.

Other providers are looking to capture a piece of this growing market by launching multi-asset solutions that have a big emphasis on low cost. One such entrant, Aviva Investors, launched its MAF Core range in November 2020. This became the lowest-cost range on the market and has grown impressively over a short period (AUM £480m).

The trend has continued as 2022 has proven to be another tough period for active managers. On the equity side, most active managers tend to be overweight mid- and small caps and, in a period where growth is expected to slow, investors tend to favour larger companies with deeper pockets.

Despite that, multi-manager flows have not been disastrous, though momentum is firmly with lower-cost solutions. Conversely, the £95bn MPS market, which is largely run on a multi-manager model, remains popular. This highlights that it is not multi-manager as a proposition investors are moving away from but rather the high costs they carry.

Responsible investing and ESG integration have shifted from an evangelical pursuit to a mainstream factor within most managers’ investment approach – and this is no different across the multi-asset universe. An advantage any new market entrants have versus the current incumbents is they can ensure responsible investment is firmly embedded within their investment methodology, rather than having to change their process.

Aside from engagement at the corporate level this is not something the other established solutions can easily do. Indeed, Vanguard, HSBC and L&G have all either launched or added new funds to an existing responsible range over the past 12 months. Most new funds now integrate ESG within their investment process as a minimum, while others define both financial and non-financial objectives.

There is currently a broad spectrum of responsible approaches to choose from in the multi-asset universe, which includes exclusionary-based solutions, as well as those targeting companies providing positive solutions for the environment and society. But compared with other sectors and the expected demand for these solutions from investors, the available options remain limited.

The bigger picture

We are seeing some extraordinary market movements. Some of the ‘safe-haven’ fixed-income assets have underperformed equities this year, and managers who follow a valuation-driven approach look likely to generate higher returns than those focused on growth for two calendar years in a row. The last time this happened was in 2003 and 2004.

The events of this year are leading some analysts to believe there is a paradigm shift underway and that the drivers of markets over the next decade will be different from those of the previous one.

Many domestic multi-asset funds have a large overweight to UK equities compared with a global index.

Despite a strong start to the year for the UK market, which has been driven by its high energy weight, at time of writing it is currently lagging behind its global counterpart.

UK underperformance versus the global index has been a persistent trend in recent years, and you would have to look to 2013 for the last time it outperformed on a calendar year basis. This trend has been a significant headwind for funds that allocate a large portion of their equity portfolio to the UK.

Many investors and policymakers suspected the inflationary pressures felt last year would be transitory, though this hasn’t been the case. As a result, central banks have been rapidly raising interest rates in an attempt to combat it, leading to a sharp rise in government bond yields. US 10-year yields have risen exponentially from their 12-month lows of 1.35% in December 2021 to 3.8% in October 2022.

UK gilt markets have also had a tumultuous time, stemming from the pressures around sterling, and exacerbated by Liz Truss and Kwasi Kwarteng’s proposed tax cuts in the ‘mini-budget’. The yield on the 10-year UK gilt rose from a 12-month low of 0.7% in December 2021 to 4.2% in October 2022. For multi-asset fund managers this has hurt the performance of those portfolios with index-like duration, and for gilts constitutes a loss of around 23% over the past 12-months.

Even managers who have avoided government bonds for many years, opting for alternative forms of protection, have been surprised at the speed and scale of these market moves.

Performance review

The IA categorisation of multi-asset funds is driven by the amount of equity exposure they have, which helps set an expectation of how much risk is likely to be taken. Sectors with high levels of equity exposure are expected to contain the most volatile funds.

It may be a surprise then that in the falling markets so far this year, the IA Mixed Investment 0-35% Shares sector has been the worst performing of the multi-asset sectors, falling 12.9% for the year to the end of September. In addition, the other sectors, except for the IA Targeted Absolute Return, have provided a similar level of return and are down 11.2-12.5%, despite funds offering different risk profiles.

In contrast, the IA Targeted Absolute Return sector is down just 2.4% over the same period. Global markets have experienced a significant level of volatility in the past 12 months. Not only have both equities and bonds fallen in value, but so have many other alternative assets that are attractive for their low correlation with equities, including global Reits.

Unfortunately for investors there have been few hiding places within traditional sectors. The few bright spots of postive returns of the past 12 months include commodities and infrastructure.

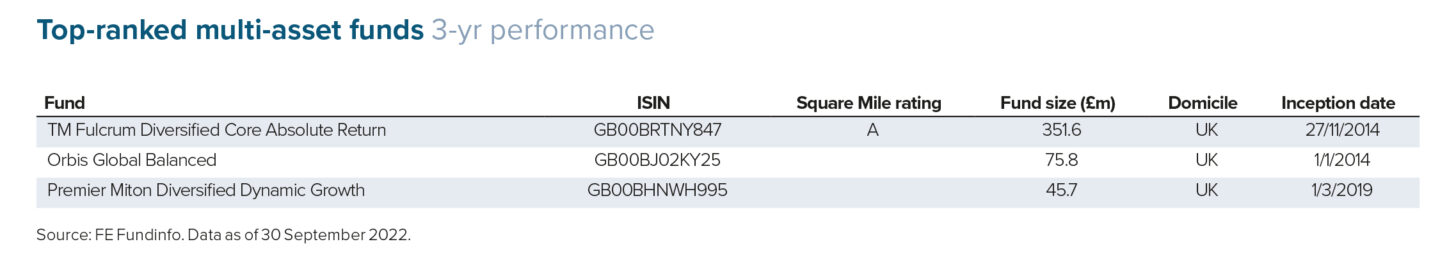

FUND TO WATCH: 3-YEAR PERFORMANCE

1. The investment team responsible for TM Fulcrum Diversified Core Absolute Return seeks to identify where we are in the business cycle and what actions policymakers are likely to take next. They build a portfolio around core macroeconomic themes, augmented with a number of ‘satellite’ ideas. The fund usually has between 20 and 30 investment positions in total, which may be directional or relative value in nature. The fund’s managers, Suhail Shaikh and Nabeel Abdoula, may use derivatives to optimise the overall risk and return characteristics of the portfolio. Such derivatives often include put options, the purpose of which is to protect capital in stock market drawdowns. Two of the big themes that have proven beneficial for returns more recently include higher inflation and higher commodity prices.

2. Orbis Global Balanced is run by Alec Cutler and Ashley Lynn. They leverage the broader resources of the country and global sector analysts at Orbis. The fund aims to provide a superior return to a 60% equity and 40% fixed-income investment portfolio. The team’s primary focus is on the intrinsic value of the company or asset and whether the market has mispriced this. They take a contrarian view and generally build portfolios from the bottom up, which look very different to the market. The fund has provided a positive return this year, which has helped its long-term return profile. Key contributors to the portfolio over this period were its energy exposure and hedged equity positions, which provided positive returns as equity markets fell. Its gold position has also been beneficial.

3. Premier Miton Diversified Dynamic Growth is managed by Premier Miton chief investment officer Neil Birrell. The fund utilises the wider Premier Miton investment team, both for investment views that drive the asset allocation, along with its investment managers, who are responsible for underlying selection. A significant proportion of the portfolio will be invested in equities, although other assets including property, alternatives and fixed income will be held to provide diversification. The fund has provided strong risk-adjusted returns over the past three years. This has been driven by the investment style of the underlying managers, which overall has a bias to growth-orientated companies, along with good asset allocation and the use of portfolio hedges that have helped limit the level drawdown.

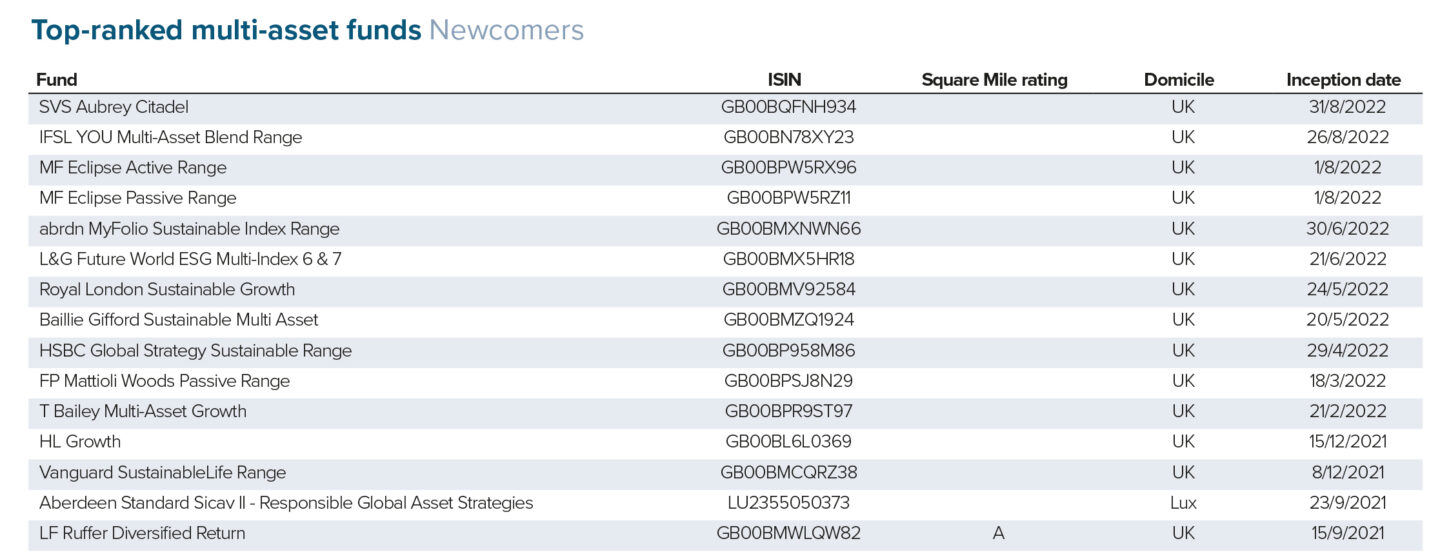

FUNDS TO WATCH: NEWCOMERS

1. The Abrdn MyFolio Sustainable Index range was launched in June 2022. It is run by the multi-manager strategies team with an unfettered fund-of-funds approach. At least 80% is invested in passively managed funds and up to 20% in active funds. The majority of funds selected will be sustainable, though there may be some exposure to funds with no specific ESG or sustainability criteria within the team’s investment objective or process.

2. The L&G Future World ESG Multi-Index 6 & 7 funds were launched in June 2022, although they are part of a wider range that was initially launched in April 2019. The funds are managed by Justin Onuekwusi, Andrzej Pioch and Francis Chua, who also manage L&G’s flagship Multi-Index range. The funds have risk targets as well as aiming to explicitly incorporate ESG considerations into the investment strategy at a portfolio and security level.

3. LF Ruffer Diversified Return was launched in September 2021 and is managed by Duncan MacInnes and Ian Rees. The fund, which sits in the IA Targeted Absolute Return sector, follows the same philosophy and investment strategy as other long-standing Ruffer funds, one that is designed to both protect and grow clients’ money over the long term. The fund will always hold a combination of growth and defensive assets, as well as at times hedging strategies to achieve its objective.

FUNDS TO WATCH: ASSETS UNDER MANAGEMENT

1. Pictet Multi Asset Global Opportunities was launched in 2013. The fund sits in the IA Flexible Investment sector and is one of the largest funds at €7.9bn (£6.9bn). Co-managers Andrea Delitala and Marco Piersimoni use a risk-managed approach to keep ex ante volatility at around 5% on an annual basis. The managers aim to provide capital growth following a flexible asset allocation strategy. The fund tilts towards ESG factors as a core element of its strategy, increasing the weight of securities with low sustainability risks and good governance practices. Despite the fund’s lower-risk approach, the sterling share class has made a loss over the past 12 months in line with many peers.

2. The well-established Baillie Gifford Managed Fund, in the IA Mixed Investment 40-85% Shares sector, has been co-managed by Iain McCombie and Steven Hay since November 2012. The portfolio is constructed from the bottom up with the help of the specialist regional equity and fixed-income teams. The fund predominantly invests in equities and, in line with the investment style of Baillie Gifford, it has a distinctive bias to growth-oriented businesses. Although the fund’s AUM has fallen significantly over the past year, investors seem to be remaining loyal to the strategy. It remains one of the largest in the sector at £6.1 bn.

3. At €5.8bn in assets, Pimco GIS Dynamic Multi-Asset is part of the IA Flexible Investment category. This is a macro-orientated, multi-asset fund that provides investors with access to Pimco’s macro and relative value ideas across the full spectrum of liquid asset classes, including equity, credit, rates, real assets and foreign exchange. Lead manager Geraldine Sundstrom seeks to achieve the fund’s objective by dynamically adapting the level of risk within the portfolio, based on the team’s outlook for asset classes and markets. The fund, along with many peers, has had a difficult 12 months where a number of its long-term structural themes, including technology, and robotics and automation, have struggled.

Alex Farlow is head of risk-based solutions research at Square Mile Investment Consulting and Research

This article first appeared in the November edition of Portfolio Adviser Magazine