Over the last year, a trio of ETF providers have jumped on the so-called “smart cities” trend where previously just a couple of longstanding active funds offered exposure to the theme.

By 2050, two-thirds of the global population will be living in urban areas, according to the United Nations. Smart city technologies seek to tap into that trend by using technology to combat some of the most pressing challenges of urbanisation, such as sustainability and efficiency.

In March, Blackrock described its new iShares Smart City Infrastructure Ucits ETF (CITY), which tracks the Stoxx Global Smart City Infrastructure index and has a total expense ratio of 0.4%, as a thematic fund to tap into the “global migration from the countryside to cities”.

The Lyxor MSCI Smart Cities ESG Filtered (DR) Ucits ETF, which has a TER of 0.15%, also launched in March with the aim of profiting off “smart connectivity (IoT), smart buildings, smart homes, smart safety and security, smart mobility, smart waste and water management, and smart energy and grids”.

When Amundi sought to tap into the mega trend, with the launch of the Smart City ETF in October, it identified over 200 stocks from six sectors to underpin its strategy: public infrastructure, smart homes, e-commerce, healthcare, entertainment, and technology. It tracks a Solactive index and charges 0.35%.

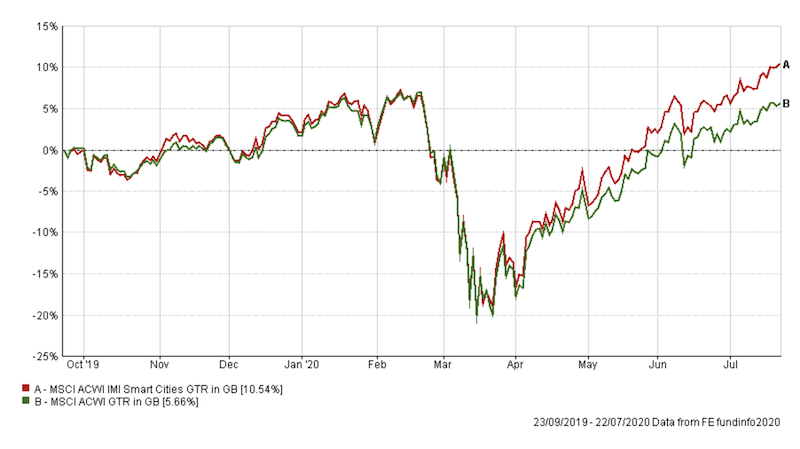

Performance of the MSCI ACWI IMI Smart Cities index over five years

Source: FE Fundinfo

How smart city funds with long track records have performed

While there has been a flurry of activity in the ETF space, Ostrum Asset Management and Pictet Asset Management both offer European-domiciled funds with long track records.

The Ostrum Euro Smart Cities fund, launched in 2008 and revamped in November 2019, achieved -0.67% from March to end of May. It outperformed its benchmark, the MSCI EMU Index which returned -7.67% over the same period.

The thematic equity fund, with €25.1m of assets under management, invests in innovative companies which develop the cities of tomorrow and are related to the mega trend ‘urbanisation’.

Kenneth Lamont, senior analyst, manager research for passive strategies at Morningstar, said: “The Ostrum Euro Smart Cities fund has been the best performing of these [smart city funds] year-to-date. Although it has been comfortably beaten over three, five and 10 years by the Pictet fund.”

Pictet Smartcity fund performance

| 6m | 1yr | 3yr | 5yr | 10yr | |

| Pictet Smartcity | 2.97 | 6.49 | 27.54 | 71.50 | 134.51 |

| IA Global sector | 1.05 | 6.00 | 24.60 | 65.10 | 159.63 |

| MSCI ACWI index | 0.52 | 5.48 | 26.21 | 76.09 | 186.59 |

Source: FE Fundinfo

Pictet Smartcity launched in 2010 but dwarves the Ostrum fund in size with £1.2bn AUM, according to its latest factsheet. Its largest holdings currently range from German real estate business Vonovia (5.08%) to payment businesses like Paypal (3.78%) to US natural gas company Atmos Energy (3.56%).

Lamont recommends, however, to not compare funds with each other, as the Ostrum fund invests in Eurozone stocks while the others hold global stocks. The Pictet Smartcity fund uses the MSCI AC World as its reference index.

“Versus the MSCI EMU benchmark, the Ostrum fund has been overweight tech (+4%), real estate (+16%) and industrials (+23%) since the beginning of the year.

“But it is stock selection within these categories that has driven relative returns. For example, an overweight to Dutch electronic payment firm Adyen, which has benefited from the surge in online payment over the Covid period, has paid off for the fund,” he explains.

Covid-19 provides some benefits for the smart city trend

Florent Eyroulet, portfolio manager at Ostrum Asset Management, told Portfolio Adviser sister publication Expert Investor that he increased small and mid caps and other stocks, for example, INWIT (Italian Wireless Infrastructures), a telco infrastructure business, which benefits from 5G development.

“This crisis is pushing for more digitalisation; it’s one driver of the fund,” says Eyroulet, while emphasising that digitalisation is not exclusively offered by tech stocks.

The fund has also outperformed because of other criteria, such as its systematic environmental, social and governance (ESG) approach and its growth and quality stocks, he adds.

“By quality we mean quality of the franchise, quality of the management, a solid balance sheet. It’s a high conviction portfolio, with only 35 stocks,” he notes.

Most recently, the fund has seen support from national recovery plans, which target energy efficiency, digitalisation and smart mobility, Eyroulet explains.

Building resilience against future crises is a priority for the EU, and Lukas Neckermann, managing director of Neckermann Strategic Advisors, expects that this will lead to related public investments in the mid term.

He says: “Three smart city areas that should see increased attention and investments are:

- Smart building and infrastructure (including crowd thermal monitoring and touchless entry systems),

- Connectivity (including 5G and network roll-outs); and

- Smart mobility (making public transport palatable once again, facilitating bicycles and micro-mobility, and accelerating electrification).

“This includes surveillance and quick-response measures for acute health emergencies, but also for our longer-term struggle with climate change,” Neckermann adds.

For more insight on continental European investment, please click on www.expertinvestoreurope.com